Securitas AB Annual Report 2005

Securitas AB Annual Report 2005

Securitas AB Annual Report 2005

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Financial control and fi nancial objectives<br />

Financial objectives and fi nancial performance<br />

12<br />

9<br />

6<br />

3<br />

0<br />

-3<br />

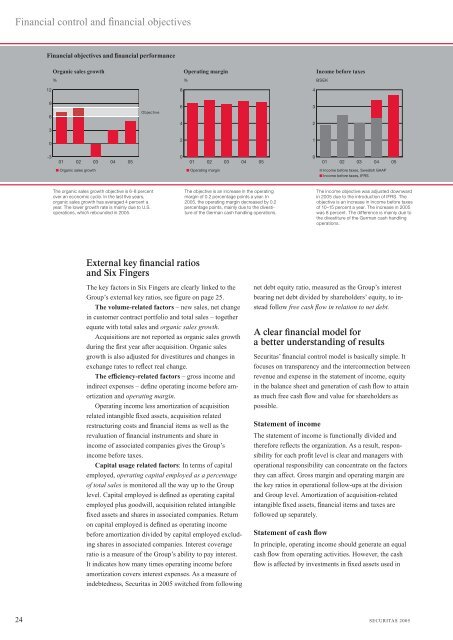

Organic sales growth<br />

%<br />

01 02 03 04 05<br />

■ Organic sales growth<br />

Objective<br />

The organic sales growth objective is 6-8 percent<br />

over an economic cycle. In the last fi ve years,<br />

organic sales growth has averaged 4 percent a<br />

year. The lower growth rate is mainly due to U.S.<br />

operations, which rebounded in <strong>2005</strong>.<br />

External key fi nancial ratios<br />

and Six Fingers<br />

The key factors in Six Fingers are clearly linked to the<br />

Group’s external key ratios, see fi gure on page 25.<br />

The volume-related factors – new sales, net change<br />

in customer contract portfolio and total sales – together<br />

equate with total sales and organic sales growth.<br />

Acquisitions are not reported as organic sales growth<br />

during the fi rst year after acquisition. Organic sales<br />

growth is also adjusted for divestitures and changes in<br />

exchange rates to refl ect real change.<br />

The effi ciency-related factors – gross income and<br />

indirect expenses – defi ne operating income before amortization<br />

and operating margin.<br />

Operating income less amortization of acquisition<br />

related intangible fi xed assets, acquisition related<br />

restructuring costs and fi nancial items as well as the<br />

revaluation of fi nancial instruments and share in<br />

income of associated companies gives the Group’s<br />

income before taxes.<br />

Capital usage related factors: In terms of capital<br />

employed, operating capital employed as a percentage<br />

of total sales is monitored all the way up to the Group<br />

level. Capital employed is defi ned as operating capital<br />

employed plus goodwill, acquisition related intangible<br />

fi xed assets and shares in associated companies. Return<br />

on capital employed is defi ned as operating income<br />

before amortization divided by capital employed excluding<br />

shares in associated companies. Interest coverage<br />

ratio is a measure of the Group’s ability to pay interest.<br />

It indicates how many times operating income before<br />

amortization covers interest expenses. As a measure of<br />

indebtedness, <strong>Securitas</strong> in <strong>2005</strong> switched from following<br />

8<br />

6<br />

4<br />

2<br />

0<br />

Operating margin<br />

%<br />

01 02 03 04 05<br />

■ Operating margin<br />

The objective is an increase in the operating<br />

margin of 0.2 percentage points a year. In<br />

<strong>2005</strong>, the operating margin decreased by 0.2<br />

percentage points, mainly due to the divestiture<br />

of the German cash handling operations.<br />

01 02 03 04 05<br />

The income objective was adjusted downward<br />

in <strong>2005</strong> due to the introduction of IFRS. The<br />

objective is an increase in income before taxes<br />

of 10–15 percent a year. The increase in <strong>2005</strong><br />

was 8 percent. The difference is mainly due to<br />

the divestiture of the German cash handling<br />

operations.<br />

net debt equity ratio, measured as the Group’s interest<br />

bearing net debt divided by shareholders’ equity, to instead<br />

follow free cash fl ow in relation to net debt.<br />

A clear fi nancial model for<br />

a better understanding of results<br />

<strong>Securitas</strong>’ fi nancial control model is basically simple. It<br />

focuses on transparency and the interconnection between<br />

revenue and expense in the statement of income, equity<br />

in the balance sheet and generation of cash fl ow to attain<br />

as much free cash fl ow and value for shareholders as<br />

possible.<br />

Statement of income<br />

The statement of income is functionally divided and<br />

therefore refl ects the organization. As a result, responsibility<br />

for each profi t level is clear and managers with<br />

operational responsibility can concentrate on the factors<br />

they can affect. Gross margin and operating margin are<br />

the key ratios in operational follow-ups at the division<br />

and Group level. Amortization of acquisition-related<br />

intangible fi xed assets, fi nancial items and taxes are<br />

followed up separately.<br />

Statement of cash fl ow<br />

In principle, operating income should generate an equal<br />

cash fl ow from operating activities. However, the cash<br />

fl ow is affected by investments in fi xed assets used in<br />

24 SECURITAS <strong>2005</strong><br />

4<br />

3<br />

2<br />

1<br />

0<br />

Income before taxes<br />

BSEK<br />

■ Income before taxes, Swedish GAAP<br />

■ Income before taxes, IFRS