Securitas AB Annual Report 2005

Securitas AB Annual Report 2005

Securitas AB Annual Report 2005

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Notes and comments to the consolidated fi nancial statements<br />

NOTE 29 CONVERTIBLE DEBENTURE LOANS<br />

Loan 2002/2007 Series 1–4<br />

The loan was issued within the framework of <strong>Securitas</strong>’ employee incentive program<br />

on May 2, 2002 to a special purpose company, <strong>Securitas</strong> Employee Convertible<br />

2002 Holding S.A. in Luxembourg, in which employees have subscribed for shares.<br />

The loan matures on May 2, 2007 and conversions may be requested no earlier than<br />

90 days before and no later than 14 days after the loan’s maturity. The loans carry<br />

a variable interest rate equivalent to 90 percent of the 3-month EURIBOR plus 0.49<br />

percentage points. Interest expense on the loan was charged against net income for<br />

the year in the amount of MSEK 77,9 (94.6 and 94.6).<br />

The reference price for the <strong>Securitas</strong> share, measured as the average closing price<br />

during the period April 24–30, 2002, was set at SEK 186.90. The EUR–SEK exchange<br />

rate was set at SEK 9.23. This produces a conversion rate of EUR 20.30<br />

(0 percent premium) on the fi rst convertible loan. The second, third and fourth<br />

series will have a conversion rate of EUR 24.30 (20 percent premium), EUR 28.40<br />

(40 percent premium) and EUR 32.40 (60 percent premium), respectively.<br />

During <strong>2005</strong> <strong>Securitas</strong> has repurchased and redeemed part of the convertible<br />

debenture loan. The redemption amounts to EUR 47,245,625 for each of the four<br />

series, in total EUR 189,982,500.Outstanding convertible debenture loan as per<br />

December 31, <strong>2005</strong> amounts to EUR 254,497,500.<br />

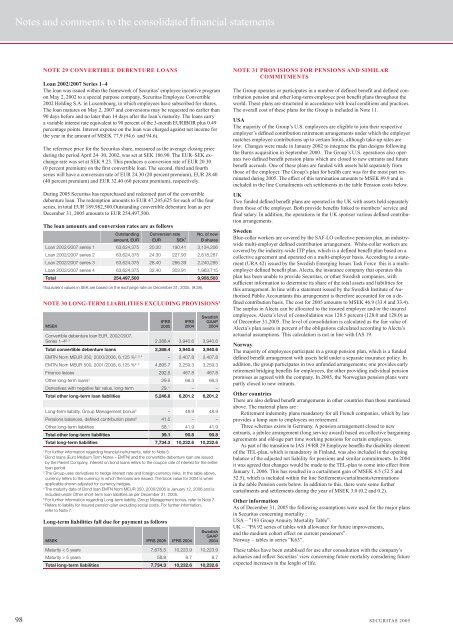

The loan amounts and conversion rates are as follows<br />

Outstanding Conversion rate No. of new<br />

amount, EUR EUR SEK 1<br />

B shares<br />

Loan 2002/2007 series 1 63,624,375 20.30 190.41 3,134,206<br />

Loan 2002/2007 series 2 63,624,375 24.30 227.93 2,618,287<br />

Loan 2002/2007 series 3 63,624,375 28.40 266.39 2,240,295<br />

Loan 2002/2007 series 4 63,624,375 32.40 303.91 1,963,715<br />

Total 254,497,500 9,956,503<br />

1 Equivalent values in SEK are based on the exchange rate on December 31, <strong>2005</strong>, (9.38).<br />

NOTE 30 LONG-TERM LI<strong>AB</strong>ILITIES EXCLUDING PROVISIONS 1<br />

MSEK<br />

IFRS<br />

<strong>2005</strong><br />

IFRS<br />

2004<br />

Swedish<br />

GAAP<br />

2004<br />

Convertible debenture loan EUR, 2002/2007,<br />

Series 1–42, 3 2,388.4 3,940.6 3,940.6<br />

Total convertible debenture loans 2,388.4 3,940.6 3,940.6<br />

EMTN Nom MEUR 350, 2000/2006, 6.125 % 2, 3, 4 – 2,407.8 2,407.8<br />

EMTN Nom MEUR 500, 2001/2008, 6.125 % 2, 3 4,895.7 3,259.3 3,259.3<br />

Finance leases 292.5 467.8 467.8<br />

Other long-term loans3 2,388.4<br />

2,388.4<br />

–<br />

4,895.7<br />

292.5<br />

29.5 66.3 66.3<br />

Derivatives with negative fair value, long-term 29.1 – –<br />

Total other long-term loan liabilities 5,246.8 6,201.2 6,201.2<br />

Long-term liability, Group Management bonus5 – 48.9 48.9<br />

Pensions balances, defi ned contribution plans6 –<br />

41.0 – –<br />

Other long-term liabilities 58.1 41.9 41.9<br />

Total other long-term liabilities 99.1 90.8 90.8<br />

Total long-term liabilities 7,734.3 10,232.6 10,232.6<br />

1 For further information regarding fi nancial instruments, refer to Note 5.<br />

2 Bond loans (Euro Medium Term Notes – EMTN) and the convertible debenture loan are issued<br />

by the Parent Company. Interest on bond loans refers to the coupon rate of interest for the entire<br />

loan period.<br />

3 The Group uses derivatives to hedge interest rate and foreign currency risks. In the table above,<br />

currency refers to the currency in which the loans are issued. The book value for 2004 is when<br />

applicable shown adjusted for currency hedges.<br />

4 The maturity date of Bond loan EMTN Nom MEUR 350, 2000/2006 is January 12, 2006 and is<br />

included under Other short-term loan liabilities as per December 31, <strong>2005</strong>.<br />

5 For further information regarding Long-term liability, Group Management bonus, refer to Note 7.<br />

6 Refers to liability for insured pension plan excluding social costs. For further information,<br />

refer to Note 7.<br />

Long-term liabilities fall due for payment as follows<br />

MSEK IFRS <strong>2005</strong><br />

IFRS 2004<br />

Swedish<br />

GAAP<br />

2004<br />

Maturity < 5 years 7,675.5 10,223.9 10,223.9<br />

Maturity > 5 years 58.8 8.7 8.7<br />

Total long-term liabilities 7,734.3<br />

10,232.6 10,232.6<br />

NOTE 31 PROVISIONS FOR PENSIONS AND SIMILAR<br />

COMMITMENTS<br />

The Group operates or participates in a number of defi ned benefi t and defi ned contribution<br />

pension and other long-term employee post benefi t plans throughout the<br />

world. These plans are structured in accordance with local conditions and practices.<br />

The overall cost of these plans for the Group is included in Note 11.<br />

USA<br />

The majority of the Group’s U.S. employees are eligible to join their respective<br />

employer’s defi ned contribution retirement arrangements under which the employer<br />

matches employee contributions up to certain limits, although take-up rates are<br />

low. Changes were made in January 2002 to integrate the plan designs following<br />

the Burns acquisition in September 2000. The Group’s U.S. operations also operates<br />

two defi ned benefi t pension plans which are closed to new entrants and future<br />

benefi t accruals. One of these plans are funded with assets held separately from<br />

those of the employer. The Group’s plan for health care was for the most part terminated<br />

during <strong>2005</strong>. The effect of this termination amounts to MSEK 89.9 and is<br />

included in the line Curtailments och settlements in the table Pension costs below.<br />

UK<br />

Two funded defi ned benefi t plans are operated in the UK with assets held separately<br />

from those of the employer. Both provide benefi ts linked to members’ service and<br />

fi nal salary. In addition, the operations in the UK sponsor various defi ned contribution<br />

arrangements.<br />

Sweden<br />

Blue-collar workers are covered by the SAF-LO collective pension plan, an industrywide<br />

multi-employer defi ned contribution arrangement. White-collar workers are<br />

covered by the industry-wide ITP plan, which is a defi ned benefi t plan based on a<br />

collective agreement and operated on a multi-employer basis. According to a statement<br />

(URA 42) issued by the Swedish Emerging Issues Task Force this is a multiemployer<br />

defi ned benefi t plan. Alecta, the insurance company that operates this<br />

plan has been unable to provide <strong>Securitas</strong>, or other Swedish companies, with<br />

suffi cient information to determine its share of the total assets and liabilities for<br />

this arrangement. In line with a statement issued by the Swedish Institute of Authorised<br />

Public Accountants this arrangement is therefore accounted for on a defi<br />

ned contribution basis. The cost for <strong>2005</strong> amounts to MSEK 46.9 (33.4 and 33.4).<br />

The surplus in Alecta can be allocated to the insured employer and/or the insured<br />

employees. Alecta’s level of consolidation was 128.5 percent (128.0 and 128.0) as<br />

of December 31,<strong>2005</strong>. The level of consolidation is calculated as the fair value of<br />

Alecta’s plan assets in percent of the obligations calculated according to Alecta’s<br />

actuarial assumptions. This calculation is not in line with IAS 19.<br />

Norway<br />

The majority of employees participate in a group pension plan, which is a funded<br />

defi ned benefi t arrangement with assets held under a separate insurance policy. In<br />

addition, the group participates in two unfunded arrangements; one provides early<br />

retirement bridging benefi ts for employees, the other providing individual pension<br />

promises as agreed with the company. In <strong>2005</strong>, the Norwegian pension plans were<br />

partly closed to new entrants.<br />

Other countries<br />

There are also defi ned benefi t arrangements in other countries than those mentioned<br />

above. The material plans are :<br />

Retirement indemnity plans mandatory for all French companies, which by law<br />

provides a lump sum to employees on retirement.<br />

Three schemes exists in Germany. A pension arrangement closed to new<br />

entrants, a jubilee arrangement (long service award) based on collective bargaining<br />

agreements and old-age part time working pensions for certain employees.<br />

As part of the transition to IAS 19/RR 29 Employee benefi ts the disability element<br />

of the TEL-plan, which is mandatory in Finland, was also included in the opening<br />

balance of the adjusted net liability for pensions and similar commitments. In 2004<br />

it was agreed that changes would be made to the TEL-plan to come into effect from<br />

January 1, 2006. This has resulted in a curtailment gain of MSEK 4.5 (52.5 and<br />

52.5), which is included within the line Settlements/curtailments/terminations<br />

in the table Pension costs below. In addition to this, there were some further<br />

curtailments and settlements during the year of MSEK 3.0 (0.2 and 0.2).<br />

Other information<br />

As of December 31, <strong>2005</strong> the following assumptions were used for the major plans<br />

in <strong>Securitas</strong> concerning mortality :<br />

USA – ”193 Group Annuity Mortality Table”.<br />

UK – ”PA 92 series of tables with allowance for future improvements,<br />

and the medium cohort effect on current pensioners”.<br />

Norway – tables in series ”K63”.<br />

These tables have been establised for use after consultation with the company’s<br />

actuaries and refl ect <strong>Securitas</strong>’ view concerning future mortality considering future<br />

expected increases in the lenght of life.<br />

98 SECURITAS <strong>2005</strong>