Securitas AB Annual Report 2005

Securitas AB Annual Report 2005

Securitas AB Annual Report 2005

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

The Group – Market<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

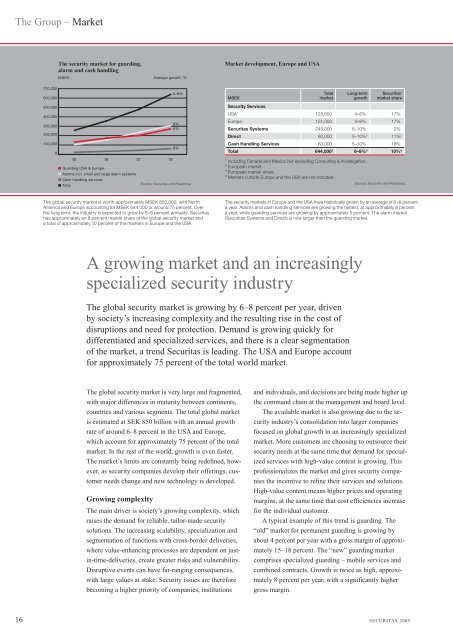

The security market for guarding,<br />

alarm and cash handling<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

Source: <strong>Securitas</strong> and Freedonia<br />

The global security market is worth approximately MSEK 850,000, with North<br />

America and Europe accounting for MSEK 644,000 or around 75 percent. Over<br />

the long term, the industry is expected to grow by 6–8 percent annually. <strong>Securitas</strong><br />

has approximately an 8 percent market share of the global security market and<br />

a total of approximately 10 percent of the markets in Europe and the USA.<br />

The security markets in Europe and the USA have historically grown by an average of 6–8 percent<br />

a year. Alarms and cash handling services are growing the fastest, at approximately 8 percent<br />

a year, while guarding services are growing by approximately 5 percent. The alarm market<br />

(<strong>Securitas</strong> Systems and Direct) is now larger than the guarding market.<br />

A growing market and an increasingly<br />

specialized security industry<br />

The global security market is growing by 6–8 percent per year, driven<br />

by society’s increasing complexity and the resulting rise in the cost of<br />

disruptions and need for protection. Demand is growing quickly for<br />

differentiated and specialized services, and there is a clear segmentation<br />

of the market, a trend <strong>Securitas</strong> is leading. The USA and Europe account<br />

for approximately 75 percent of the total world market.<br />

The global security market is very large and fragmented,<br />

with major differences in maturity between continents,<br />

countries and various segments. The total global market<br />

is estimated at SEK 850 billion with an annual growth<br />

rate of around 6–8 percent in the USA and Europe,<br />

which account for approximately 75 percent of the total<br />

market. In the rest of the world, growth is even faster.<br />

The market’s limits are constantly being redefi ned, however,<br />

as security companies develop their offerings, customer<br />

needs change and new technology is developed.<br />

Growing complexity<br />

The main driver is society’s growing complexity, which<br />

raises the demand for reliable, tailor-made security<br />

solutions. The increasing scalability, specialization and<br />

segmentation of functions with cross-border deliveries,<br />

where value-enhancing processes are dependent on justin-time-deliveries,<br />

create greater risks and vulnerability.<br />

Disruptive events can have far-ranging consequences,<br />

with large values at stake. Security issues are therefore<br />

becoming a higher priority of companies, institutions<br />

<br />

Market development, Europe and USA<br />

MSEK<br />

Total<br />

market<br />

Long-term<br />

growth<br />

<strong>Securitas</strong>’<br />

market share<br />

Security Services<br />

USA1 125,000 4–6% 17%<br />

Europe 151,000 4–6% 17%<br />

<strong>Securitas</strong> Systems 245,000 6–10% 2%<br />

Direct 60,000 5–10% 2 11% 3<br />

Cash Handling Services 63,000 5–10% 18%<br />

Total 644,0004 6–8% 4 10% 4<br />

1 Including Canada and Mexico but excluding Consulting & Investigation.<br />

2 European market.<br />

3 European market share.<br />

4 Markets outside Europe and the USA are not included.<br />

Source: <strong>Securitas</strong> and Freedonia<br />

and individuals, and decisions are being made higher up<br />

the command chain at the management and board level.<br />

The available market is also growing due to the security<br />

industry’s consolidation into larger companies<br />

focused on global growth in an increasingly specialized<br />

market. More customers are choosing to outsource their<br />

security needs at the same time that demand for specialized<br />

services with high-value content is growing. This<br />

professionalizes the market and gives security companies<br />

the incentive to refi ne their services and solutions.<br />

High-value content means higher prices and operating<br />

margins, at the same time that cost effi ciencies increase<br />

for the individual customer.<br />

A typical example of this trend is guarding. The<br />

“old” market for permanent guarding is growing by<br />

about 4 percent per year with a gross margin of approximately<br />

15–18 percent. The “new” guarding market<br />

comprises specialized guarding – mobile services and<br />

combined contracts. Growth is twice as high, approximately<br />

8 percent per year, with a signifi cantly higher<br />

gross margin.<br />

16 SECURITAS <strong>2005</strong>