Securitas AB Annual Report 2005

Securitas AB Annual Report 2005

Securitas AB Annual Report 2005

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

New sales of customer contracts that are added to<br />

the portfolio when the work begins.<br />

Net change in the portfolio of customer contracts,<br />

which includes new sales plus any increases in sales<br />

in existing contracts, less terminated customer contracts<br />

and reductions in sales in existing contracts.<br />

Price changes are monitored separately and added to<br />

the net change to arrive at the closing balance of the<br />

overall portfolio at the end of the period..<br />

Total sales, include contract-based sales as well as<br />

temporary assignments.<br />

Specifi cation of contract portfolio (example)<br />

Value<br />

% change in<br />

op. portfolio<br />

Opening balance 100<br />

+ New starts 15<br />

+ Increases 5<br />

– Terminations 12<br />

– Reductions 4<br />

Net change 4 +4<br />

Price change 3 +3<br />

Closing balance 107 +7<br />

Six Fingers – Effi ciency-related factors<br />

Effi ciency-related factors provide managers with instruments<br />

to monitor service effi ciency and costs. The fourth<br />

and fi fth key factors in Six Fingers are:<br />

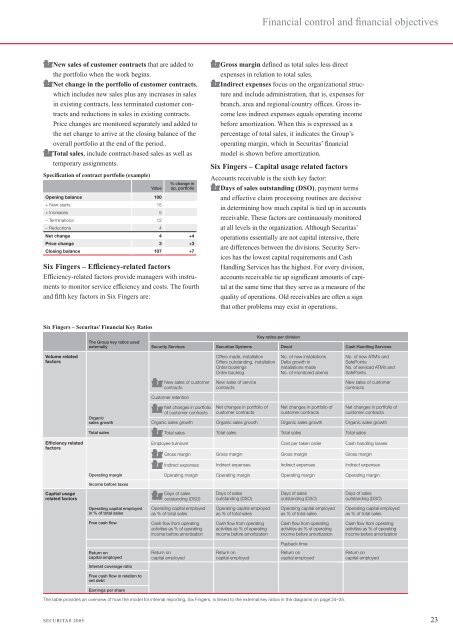

Six Fingers – <strong>Securitas</strong>’ Financial Key Ratios<br />

Volume related<br />

factors<br />

Effi ciency related<br />

factors<br />

Capital usage<br />

related factors<br />

The Group key ratios used<br />

externally<br />

Organic<br />

sales growth<br />

Total sales<br />

Financial control and fi nancial objectives<br />

Gross margin defi ned as total sales less direct<br />

expenses in relation to total sales.<br />

Indirect expenses focus on the organizational structure<br />

and include administration, that is, expenses for<br />

branch, area and regional/country offi ces. Gross income<br />

less indirect expenses equals operating income<br />

before amortization. When this is expressed as a<br />

percentage of total sales, it indicates the Group’s<br />

operating margin, which in <strong>Securitas</strong>’ fi nancial<br />

model is shown before amortization.<br />

Six Fingers – Capital usage related factors<br />

Accounts receivable is the sixth key factor:<br />

Days of sales outstanding (DSO), payment terms<br />

and effective claim processing routines are decisive<br />

in determining how much capital is tied up in accounts<br />

receivable. These factors are continuously monitored<br />

at all levels in the organization. Although <strong>Securitas</strong>’<br />

operations essentially are not capital intensive, there<br />

are differences between the divisions. Security Services<br />

has the lowest capital requirements and Cash<br />

Handling Services has the highest. For every division,<br />

accounts receivable tie up signifi cant amounts of capital<br />

at the same time that they serve as a measure of the<br />

quality of operations. Old receivables are often a sign<br />

that other problems may exist in operations.<br />

Security Services <strong>Securitas</strong> Systems<br />

Key ratios per division<br />

Direct Cash Handling Services<br />

New sales of customer<br />

contracts<br />

Customer retention<br />

Net changes in portfolio<br />

of customer contracts<br />

Offers made, installation<br />

Offers outstanding, installation<br />

Order bookings<br />

Order backlog<br />

New sales of service<br />

contracts<br />

Net changes in portfolio of<br />

customer contracts<br />

No. of new installations<br />

Delta growth in<br />

installations made<br />

No. of monitored alarms<br />

Net changes in portfolio of<br />

customer contracts<br />

No. of new ATM’s and<br />

SafePoints<br />

No. of serviced ATM’s and<br />

SafePoints<br />

New sales of customer<br />

contracts<br />

Net changes in portfolio of<br />

customer contracts<br />

Organic sales growth Organic sales growth Organic sales growth Organic sales growth<br />

Total sales Total sales Total sales Total sales<br />

Employee turnover Cost per taken order Cash handling losses<br />

Gross margin Gross margin Gross margin Gross margin<br />

Indirect expenses Indirect expenses Indirect expenses Indirect expenses<br />

Operating margin Operating margin Operating margin Operating margin Operating margin<br />

Income before taxes<br />

Operating capital employed<br />

in % of total sales<br />

Days of sales<br />

outstanding (DSO)<br />

Operating capital employed<br />

as % of total sales<br />

Free cash fl ow Cash fl ow from operating<br />

activities as % of operating<br />

income before amortization<br />

Return on<br />

capital employed<br />

Return on<br />

capital employed<br />

Days of sales<br />

outstanding (DSO)<br />

Operating capital employed<br />

as % of total sales<br />

Cash fl ow from operating<br />

activities as % of operating<br />

income before amortization<br />

Return on<br />

capital employed<br />

Days of sales<br />

outstanding (DSO)<br />

Operating capital employed<br />

as % of total sales<br />

Cash fl ow from operating<br />

activities as % of operating<br />

income before amortization<br />

Payback time<br />

Return on<br />

capital employed<br />

Interest coverage ratio<br />

Free cash fl ow in relation to<br />

net debt<br />

Earnings per share<br />

The table provides an overview of how the model for internal reporting, Six Fingers, is linked to the external key ratios in the diagrams on page 24–25.<br />

Days of sales<br />

outstanding (DSO)<br />

Operating capital employed<br />

as % of total sales<br />

Cash fl ow from operating<br />

activities as % of operating<br />

income before amortization<br />

Return on<br />

capital employed<br />

SECURITAS <strong>2005</strong> 23