Registration document 2011 - tota - Total.com

Registration document 2011 - tota - Total.com

Registration document 2011 - tota - Total.com

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

9 Consolidated<br />

Financial Statements<br />

Notes to the Consolidated Financial Statements<br />

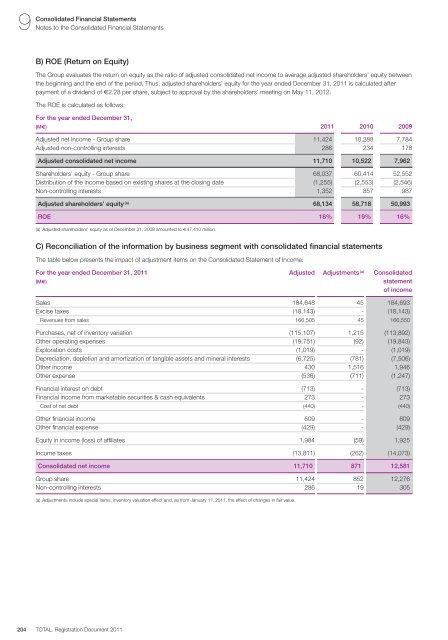

B) ROE (Return on Equity)<br />

The Group evaluates the return on equity as the ratio of adjusted consolidated net in<strong>com</strong>e to average adjusted shareholders’ equity between<br />

the beginning and the end of the period. Thus, adjusted shareholders’ equity for the year ended December 31, <strong>2011</strong> is calculated after<br />

payment of a dividend of €2.28 per share, subject to approval by the shareholders’ meeting on May 11, 2012.<br />

The ROE is calculated as follows:<br />

For the year ended December 31,<br />

(M€) <strong>2011</strong> 2010 2009<br />

Adjusted net in<strong>com</strong>e - Group share 11,424 10,288 7,784<br />

Adjusted non-controlling interests 286 234 178<br />

Adjusted consolidated net in<strong>com</strong>e 11,710 10,522 7,962<br />

Shareholders' equity - Group share 68,037 60,414 52,552<br />

Distribution of the in<strong>com</strong>e based on existing shares at the closing date (1,255) (2,553) (2,546)<br />

Non-controlling interests 1,352 857 987<br />

Adjusted shareholders' equity (a) 68,134 58,718 50,993<br />

ROE 18% 19% 16%<br />

(a) Adjusted shareholders' equity as of December 31, 2008 amounted to €47,410 million.<br />

C) Reconciliation of the information by business segment with consolidated financial statements<br />

The table below presents the impact of adjustment items on the Consolidated Statement of In<strong>com</strong>e:<br />

For the year ended December 31, <strong>2011</strong> Adjusted Adjustments (a) Consolidated<br />

(M€) statement<br />

of in<strong>com</strong>e<br />

Sales 184,648 45 184,693<br />

Excise taxes (18,143) - (18,143)<br />

Revenues from sales 166,505 45 166,550<br />

Purchases, net of inventory variation (115,107) 1,215 (113,892)<br />

Other operating expenses (19,751) (92) (19,843)<br />

Exploration costs (1,019) - (1,019)<br />

Depreciation, depletion and amortization of tangible assets and mineral interests (6,725) (781) (7,506)<br />

Other in<strong>com</strong>e 430 1,516 1,946<br />

Other expense (536) (711) (1,247)<br />

Financial interest on debt (713) - (713)<br />

Financial in<strong>com</strong>e from marketable securities & cash equivalents 273 - 273<br />

Cost of net debt (440) - (440)<br />

Other financial in<strong>com</strong>e 609 - 609<br />

Other financial expense (429) - (429)<br />

Equity in in<strong>com</strong>e (loss) of affiliates 1,984 (59) 1,925<br />

In<strong>com</strong>e taxes (13,811) (262) (14,073)<br />

Consolidated net in<strong>com</strong>e 11,710 871 12,581<br />

Group share 11,424 852 12,276<br />

Non-controlling interests 286 19 305<br />

(a) Adjustments include special items, inventory valuation effect and, as from January 1 st , <strong>2011</strong>, the effect of changes in fair value.<br />

204 TOTAL. <strong>Registration</strong> Document <strong>2011</strong>