- Page 1 and 2:

Registration Document 2011

- Page 3 and 4:

Registration Document 2011 This tra

- Page 5 and 6:

Key figures 1. Operating and market

- Page 7 and 8:

Sales Adjusted net income (Group sh

- Page 9 and 10:

Shareholder base Estimates as of No

- Page 11 and 12:

Business overview Business overview

- Page 13 and 14:

2. Upstream TOTAL’s Upstream segm

- Page 15 and 16:

As of December 31, 2009, TOTAL’s

- Page 17 and 18:

2.3. Presentation of production act

- Page 19 and 20:

Indonesia 1968 Myanmar 1992 Thailan

- Page 21 and 22:

United Kingdom 1962 Middle East U.A

- Page 23 and 24:

In Kenya, TOTAL acquired in Septemb

- Page 25 and 26:

In the United States, the Group’s

- Page 27 and 28:

The next two wells, which were expl

- Page 29 and 30:

is expected to be transported to Ru

- Page 31 and 32:

- In addition to Alwyn and the Cent

- Page 33 and 34:

2.6. Number of net oil and gas well

- Page 35 and 36:

Asia Yadana Yadana (Myanmar) Ban-I

- Page 37 and 38:

2.9.3. Marketing To unlock value fr

- Page 39 and 40:

As of January 2012, TOTAL owns 66%

- Page 41 and 42:

3. Downstream The Downstream segmen

- Page 43 and 44:

The heavy conversion process of thi

- Page 45 and 46:

In Northern, Central and Eastern Eu

- Page 47 and 48:

The oil markets had ended 2010 sign

- Page 49 and 50:

4.1. Base Chemicals The Base Chemic

- Page 51 and 52:

4.1.2. Fertilizers Through its Fren

- Page 53 and 54:

5. Investments 5.1. Major investmen

- Page 55 and 56:

7. Property, plant and equipment TO

- Page 57 and 58:

Finance Refining & Marketing Financ

- Page 59 and 60:

Crude Oil Trading Finance Trading &

- Page 61 and 62:

Management Report The Management re

- Page 63 and 64:

- a Refining & Chemicals segment, a

- Page 65 and 66:

1.2.4. Investments - divestments In

- Page 67 and 68:

1.6. TOTAL S.A. 2011 results Net in

- Page 69 and 70:

2.5. Anticipated sources of financi

- Page 71 and 72:

3.6. Environment Environmental issu

- Page 73 and 74:

Risk factors Risk factors 4 1. Fina

- Page 75 and 76:

Trading & Shipping : value-at-risk

- Page 77 and 78:

1.8. Sensitivity analysis on intere

- Page 79 and 80:

1.10. Liquidity risk TOTAL S.A. has

- Page 81 and 82:

Customer receivables are subject to

- Page 83 and 84:

2.2. Management and monitoring of i

- Page 85 and 86:

egions, causing substantial decline

- Page 87 and 88:

3.4. Activities in Cuba, Iran, Suda

- Page 89 and 90:

and service contracts. In 2011, TOT

- Page 91 and 92:

4.3. Insurance policy The Group has

- Page 93 and 94:

Corporate governance Corporate gove

- Page 95 and 96:

Chairman of the Nominating & Govern

- Page 97 and 98:

- Permanent representative of Colam

- Page 99 and 100:

du Territoire et de l’Action Rég

- Page 101 and 102:

- Director of Europalia Internation

- Page 103 and 104:

- monitoring the quality of the inf

- Page 105 and 106:

6. COMMITTEES OF THE BOARD OF DIREC

- Page 107 and 108:

1.5.2. Compensation Committee Rules

- Page 109 and 110:

The term of office of the members o

- Page 111 and 112:

- examination of ethical issues (co

- Page 113 and 114:

1.8. Director independence At its m

- Page 115 and 116:

With regard to counterparty risks,

- Page 117 and 118:

Variable compensation is determined

- Page 119 and 120:

3. General Management 3.1. Manageme

- Page 121 and 122:

4.4. Fees received by the statutory

- Page 123 and 124:

total gross compensation as Chairma

- Page 125 and 126:

Chairman and Chief Executive Office

- Page 127 and 128:

The acquisition rate: - is equal to

- Page 129 and 130:

5.7.3. Directors’ fees and other

- Page 131 and 132:

5.8. TOTAL stock option grants Corp

- Page 133 and 134:

If all the outstanding stock option

- Page 135 and 136:

Corporate governance 5 Compensation

- Page 137 and 138:

The grant of these performance shar

- Page 139 and 140:

6. Employees, share ownership 6.1.

- Page 141 and 142:

6.3.1. Summary of transactions in t

- Page 143 and 144:

TOTAL and its shareholders TOTAL an

- Page 145 and 146:

1.2. Share performance TOTAL share

- Page 147 and 148:

1.2.7. TOTAL share price over the p

- Page 149 and 150:

2.2. Dividend payment BNP Paribas S

- Page 151 and 152:

the Board of Directors decided on J

- Page 153 and 154:

- delivered to the holders of secur

- Page 155 and 156:

4.4. Major shareholders 4.4.1. Chan

- Page 157 and 158:

4.6. Shares held by members of the

- Page 159 and 160:

However, there are certain exceptio

- Page 161 and 162:

6.4. Registered shareholding TOTAL

- Page 163 and 164:

Financial information Financial inf

- Page 165 and 166:

4. Dividend policy The Company’s

- Page 167 and 168:

criminal chamber of the Court of Ap

- Page 169 and 170:

In October 2010, the Prosecutor’s

- Page 171 and 172:

General information General informa

- Page 173 and 174:

delegations of authority granted by

- Page 175 and 176: 1.4. Potential share capital as of

- Page 177 and 178: 2.3. Provisions of the by-laws gove

- Page 179 and 180: 2.6. Shareholders’ meetings 2.6.1

- Page 181 and 182: In 2011, TOTAL’s holdings in Sano

- Page 183 and 184: Consolidated Financial Statements T

- Page 185 and 186: 2. Consolidated statement of income

- Page 187 and 188: 4. Consolidated balance sheet TOTAL

- Page 189 and 190: 6. Consolidated statement of change

- Page 191 and 192: Non-monetary contributions by ventu

- Page 193 and 194: Intangible assets are carried at co

- Page 195 and 196: when market data are not directly a

- Page 197 and 198: - In June 2011, the IASB issued rev

- Page 199 and 200: Since the acquisition date, sales a

- Page 201 and 202: 4) Business segment information Fin

- Page 203 and 204: For the year ended December 31, 201

- Page 205 and 206: For the year ended December 31, 201

- Page 207 and 208: For the year ended December 31, 200

- Page 209 and 210: For the year ended December 31, 201

- Page 211 and 212: Adjustments to net income, Group sh

- Page 213 and 214: 7) Other income and other expense F

- Page 215 and 216: The net deferred tax variation in t

- Page 217 and 218: 11) Property, plant and equipment C

- Page 219 and 220: 12) Equity affiliates: investments

- Page 221 and 222: In Group share, the main financial

- Page 223 and 224: 15) Inventories As of December 31,

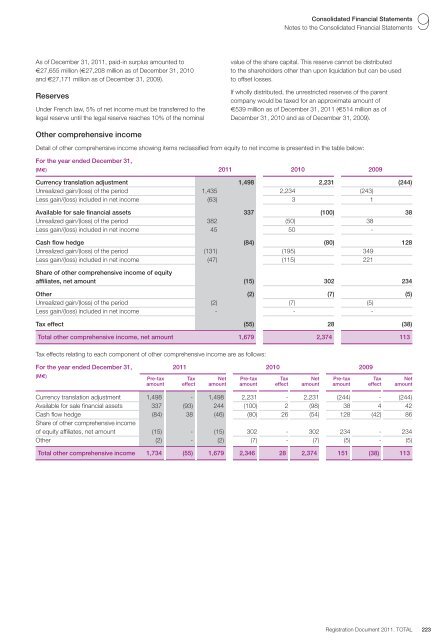

- Page 225: 17) Shareholders’ equity Number o

- Page 229 and 230: The experience actuarial (gains) lo

- Page 231 and 232: 19) Provisions and other non-curren

- Page 233 and 234: 20) Financial debt and related fina

- Page 235 and 236: Bonds after fair value hedge (M€)

- Page 237 and 238: Bonds after cash flow hedge and fix

- Page 239 and 240: C) Net-debt-to-equity ratio For its

- Page 241 and 242: 23) Commitments and contingencies A

- Page 243 and 244: guarantees. As of December 31, 2011

- Page 245 and 246: 25) Share-based payments A) TOTAL s

- Page 247 and 248: condition. This condition states th

- Page 249 and 250: - varies on a straight-line basis b

- Page 251 and 252: The following table summarizes SunP

- Page 253 and 254: 27) Statement of cash flows A) Cash

- Page 255 and 256: As of December 31, 2010 (M€) Asse

- Page 257 and 258: Assets and liabilities from financi

- Page 259 and 260: As of December 31, 2010 (M€) Asse

- Page 261 and 262: D) Fair value hierarchy The fair va

- Page 263 and 264: As of December 31, 2009 Consolidate

- Page 265 and 266: As part of its gas, power and coal

- Page 267 and 268: As a result of this policy, the imp

- Page 269 and 270: The following table sets forth fina

- Page 271 and 272: its assets (as calculated under the

- Page 273 and 274: e paid to those affected by the pol

- Page 275 and 276: 33) Other information Research and

- Page 277 and 278:

The business segments are identifie

- Page 279 and 280:

Supplemental oil and gas informatio

- Page 281 and 282:

1.3. Proved undeveloped reserves As

- Page 283 and 284:

(in million barrels of oil equivale

- Page 285 and 286:

Supplemental oil and gas informatio

- Page 287 and 288:

1.4.4. Changes in gas reserves Supp

- Page 289 and 290:

1.5. Results of operations for oil

- Page 291 and 292:

1.6. Cost incurred The following ta

- Page 293 and 294:

The standardized measure of discoun

- Page 295 and 296:

1.9. Changes in the standardized me

- Page 297 and 298:

2011 Natural gas production availab

- Page 299 and 300:

TOTAL S.A. The statutory Financial

- Page 301 and 302:

To be eligible for this supplementa

- Page 303 and 304:

3. Statutory Financial Statements o

- Page 305 and 306:

3.3. Statement of cash flow For the

- Page 307 and 308:

4. Notes to the Statutory Financial

- Page 309 and 310:

4) Other non-current assets A) Chan

- Page 311 and 312:

TOTAL shares held by the Group subs

- Page 313 and 314:

11) Translation adjustment The appl

- Page 315 and 316:

21) Commitments As of December 31 (

- Page 317 and 318:

- is equal to 100% if the average R

- Page 319 and 320:

D) TOTAL performance share grant Th

- Page 321 and 322:

24) Others Compensation for the adm

- Page 323 and 324:

5.2. Five-year financial data Share

- Page 325 and 326:

6. Consolidated financial informati

- Page 327 and 328:

Corporate social responsibility Cor

- Page 329 and 330:

TOTAL also hired 3,321 employees on

- Page 331 and 332:

1.5. Equal opportunity From recruit

- Page 333 and 334:

2.1. Occupational health and safety

- Page 335 and 336:

TOTAL particularly monitors hazardo

- Page 337 and 338:

The Group has therefore taken proac

- Page 339 and 340:

Social and economic development of

- Page 341 and 342:

commitment for TOTAL, adopting a pr

- Page 343 and 344:

4.3. TOTAL and new energies Althoug

- Page 345 and 346:

The selected sites and subsidiaries

- Page 347 and 348:

Assurance Opinion Completeness of d

- Page 349 and 350:

Glossary A Acreage Areas in which m

- Page 351 and 352:

MTO/OCP MTO (Methanols to Olefins)

- Page 353 and 354:

Cross reference lists Registration

- Page 355 and 356:

17. Employees 17.1. Number of emplo

- Page 357 and 358:

Registration Document concordance t

- Page 359 and 360:

PEFC/10-31-2043 This brochure is pr