Registration document 2011 - tota - Total.com

Registration document 2011 - tota - Total.com

Registration document 2011 - tota - Total.com

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

9 Consolidated<br />

Financial Statements<br />

Notes to the Consolidated Financial Statements<br />

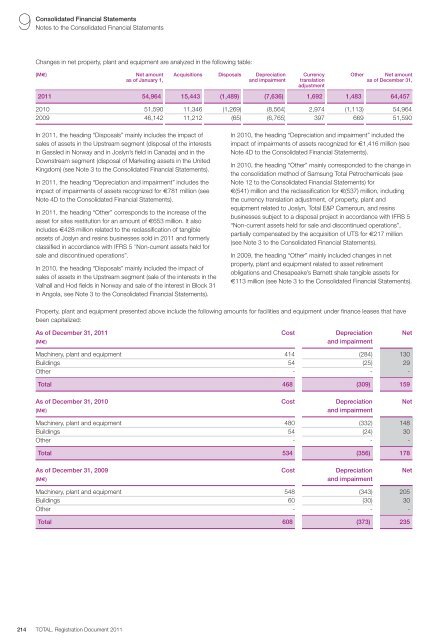

Changes in net property, plant and equipment are analyzed in the following table:<br />

(M€) Net amount<br />

as of January 1,<br />

<strong>2011</strong> 54,964 15,443 (1,489) (7,636) 1,692 1,483 64,457<br />

2010 51,590 11,346 (1,269) (8,564) 2,974 (1,113) 54,964<br />

2009 46,142 11,212 (65) (6,765) 397 669 51,590<br />

In <strong>2011</strong>, the heading “Disposals” mainly includes the impact of<br />

sales of assets in the Upstream segment (disposal of the interests<br />

in Gassled in Norway and in Joslyn’s field in Canada) and in the<br />

Downstream segment (disposal of Marketing assets in the United<br />

Kingdom) (see Note 3 to the Consolidated Financial Statements).<br />

In <strong>2011</strong>, the heading “Depreciation and impairment” includes the<br />

impact of impairments of assets recognized for €781 million (see<br />

Note 4D to the Consolidated Financial Statements).<br />

In <strong>2011</strong>, the heading “Other” corresponds to the increase of the<br />

asset for sites restitution for an amount of €653 million. It also<br />

includes €428 million related to the reclassification of tangible<br />

assets of Joslyn and resins businesses sold in <strong>2011</strong> and formerly<br />

classified in accordance with IFRS 5 "Non-current assets held for<br />

sale and discontinued operations”.<br />

In 2010, the heading “Disposals” mainly included the impact of<br />

sales of assets in the Upstream segment (sale of the interests in the<br />

Valhall and Hod fields in Norway and sale of the interest in Block 31<br />

in Angola, see Note 3 to the Consolidated Financial Statements).<br />

Acquisitions Disposals Depreciation<br />

and impairment<br />

Currency<br />

translation<br />

adjustment<br />

Other Net amount<br />

as of December 31,<br />

Property, plant and equipment presented above include the following amounts for facilities and equipment under finance leases that have<br />

been capitalized:<br />

As of December 31, <strong>2011</strong> Cost Depreciation Net<br />

(M€) and impairment<br />

Machinery, plant and equipment 414 (284) 130<br />

Buildings 54 (25) 29<br />

Other - - -<br />

<strong>Total</strong> 468 (309) 159<br />

As of December 31, 2010 Cost Depreciation Net<br />

(M€) and impairment<br />

Machinery, plant and equipment 480 (332) 148<br />

Buildings 54 (24) 30<br />

Other - - -<br />

<strong>Total</strong> 534 (356) 178<br />

As of December 31, 2009 Cost Depreciation Net<br />

(M€) and impairment<br />

Machinery, plant and equipment 548 (343) 205<br />

Buildings 60 (30) 30<br />

Other - - -<br />

<strong>Total</strong> 608 (373) 235<br />

214 TOTAL. <strong>Registration</strong> Document <strong>2011</strong><br />

In 2010, the heading “Depreciation and impairment” included the<br />

impact of impairments of assets recognized for €1,416 million (see<br />

Note 4D to the Consolidated Financial Statements).<br />

In 2010, the heading “Other” mainly corresponded to the change in<br />

the consolidation method of Samsung <strong>Total</strong> Petrochemicals (see<br />

Note 12 to the Consolidated Financial Statements) for<br />

€(541) million and the reclassification for €(537) million, including<br />

the currency translation adjustment, of property, plant and<br />

equipment related to Joslyn, <strong>Total</strong> E&P Cameroun, and resins<br />

businesses subject to a disposal project in accordance with IFRS 5<br />

“Non-current assets held for sale and discontinued operations”,<br />

partially <strong>com</strong>pensated by the acquisition of UTS for €217 million<br />

(see Note 3 to the Consolidated Financial Statements).<br />

In 2009, the heading “Other” mainly included changes in net<br />

property, plant and equipment related to asset retirement<br />

obligations and Chesapeake’s Barnett shale tangible assets for<br />

€113 million (see Note 3 to the Consolidated Financial Statements).