Registration document 2011 - tota - Total.com

Registration document 2011 - tota - Total.com

Registration document 2011 - tota - Total.com

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

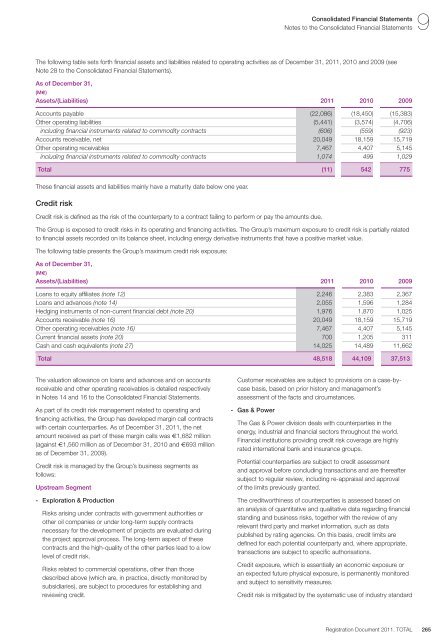

The following table sets forth financial assets and liabilities related to operating activities as of December 31, <strong>2011</strong>, 2010 and 2009 (see<br />

Note 28 to the Consolidated Financial Statements).<br />

As of December 31,<br />

(M€)<br />

Assets/(Liabilities) <strong>2011</strong> 2010 2009<br />

Accounts payable (22,086) (18,450) (15,383)<br />

Other operating liabilities (5,441) (3,574) (4,706)<br />

including financial instruments related to <strong>com</strong>modity contracts (606) (559) (923)<br />

Accounts receivable, net 20,049 18,159 15,719<br />

Other operating receivables 7,467 4,407 5,145<br />

including financial instruments related to <strong>com</strong>modity contracts 1,074 499 1,029<br />

<strong>Total</strong> (11) 542 775<br />

These financial assets and liabilities mainly have a maturity date below one year.<br />

Credit risk<br />

Credit risk is defined as the risk of the counterparty to a contract failing to perform or pay the amounts due.<br />

The Group is exposed to credit risks in its operating and financing activities. The Group’s maximum exposure to credit risk is partially related<br />

to financial assets recorded on its balance sheet, including energy derivative instruments that have a positive market value.<br />

The following table presents the Group’s maximum credit risk exposure:<br />

The valuation allowance on loans and advances and on accounts<br />

receivable and other operating receivables is detailed respectively<br />

in Notes 14 and 16 to the Consolidated Financial Statements.<br />

As part of its credit risk management related to operating and<br />

financing activities, the Group has developed margin call contracts<br />

with certain counterparties. As of December 31, <strong>2011</strong>, the net<br />

amount received as part of these margin calls was €1,682 million<br />

(against €1,560 million as of December 31, 2010 and €693 million<br />

as of December 31, 2009).<br />

Credit risk is managed by the Group’s business segments as<br />

follows:<br />

Upstream Segment<br />

- Exploration & Production<br />

Risks arising under contracts with government authorities or<br />

other oil <strong>com</strong>panies or under long-term supply contracts<br />

necessary for the development of projects are evaluated during<br />

the project approval process. The long-term aspect of these<br />

contracts and the high-quality of the other parties lead to a low<br />

level of credit risk.<br />

Risks related to <strong>com</strong>mercial operations, other than those<br />

described above (which are, in practice, directly monitored by<br />

subsidiaries), are subject to procedures for establishing and<br />

reviewing credit.<br />

Customer receivables are subject to provisions on a case-bycase<br />

basis, based on prior history and management’s<br />

assessment of the facts and circumstances.<br />

- Gas & Power<br />

Consolidated Financial Statements 9<br />

Notes to the Consolidated Financial Statements<br />

As of December 31,<br />

(M€)<br />

Assets/(Liabilities) <strong>2011</strong> 2010 2009<br />

Loans to equity affiliates (note 12) 2,246 2,383 2,367<br />

Loans and advances (note 14) 2,055 1,596 1,284<br />

Hedging instruments of non-current financial debt (note 20) 1,976 1,870 1,025<br />

Accounts receivable (note 16) 20,049 18,159 15,719<br />

Other operating receivables (note 16) 7,467 4,407 5,145<br />

Current financial assets (note 20) 700 1,205 311<br />

Cash and cash equivalents (note 27) 14,025 14,489 11,662<br />

<strong>Total</strong> 48,518 44,109 37,513<br />

The Gas & Power division deals with counterparties in the<br />

energy, industrial and financial sectors throughout the world.<br />

Financial institutions providing credit risk coverage are highly<br />

rated international bank and insurance groups.<br />

Potential counterparties are subject to credit assessment<br />

and approval before concluding transactions and are thereafter<br />

subject to regular review, including re-appraisal and approval<br />

of the limits previously granted.<br />

The creditworthiness of counterparties is assessed based on<br />

an analysis of quantitative and qualitative data regarding financial<br />

standing and business risks, together with the review of any<br />

relevant third party and market information, such as data<br />

published by rating agencies. On this basis, credit limits are<br />

defined for each potential counterparty and, where appropriate,<br />

transactions are subject to specific authorisations.<br />

Credit exposure, which is essentially an economic exposure or<br />

an expected future physical exposure, is permanently monitored<br />

and subject to sensitivity measures.<br />

Credit risk is mitigated by the systematic use of industry standard<br />

<strong>Registration</strong> Document <strong>2011</strong>. TOTAL<br />

265