Registration document 2011 - tota - Total.com

Registration document 2011 - tota - Total.com

Registration document 2011 - tota - Total.com

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

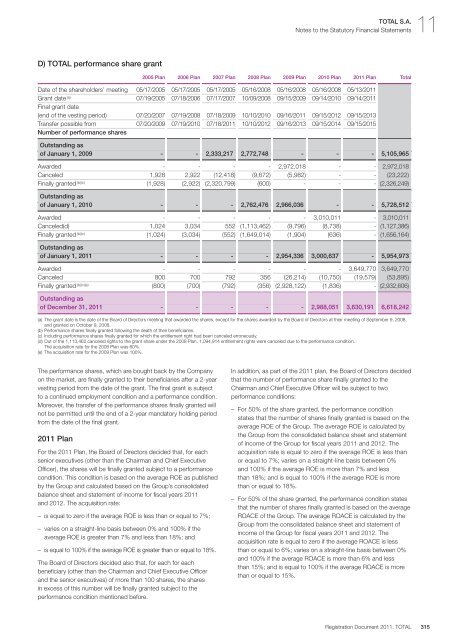

D) TOTAL performance share grant<br />

The performance shares, which are bought back by the Company<br />

on the market, are finally granted to their beneficiaries after a 2-year<br />

vesting period from the date of the grant. The final grant is subject<br />

to a continued employment condition and a performance condition.<br />

Moreover, the transfer of the performance shares finally granted will<br />

not be permitted until the end of a 2-year mandatory holding period<br />

from the date of the final grant.<br />

<strong>2011</strong> Plan<br />

For the <strong>2011</strong> Plan, the Board of Directors decided that, for each<br />

senior executives (other than the Chairman and Chief Executive<br />

Officer), the shares will be finally granted subject to a performance<br />

condition. This condition is based on the average ROE as published<br />

by the Group and calculated based on the Group’s consolidated<br />

balance sheet and statement of in<strong>com</strong>e for fiscal years <strong>2011</strong><br />

and 2012. The acquisition rate:<br />

– is equal to zero if the average ROE is less than or equal to 7%;<br />

– varies on a straight-line basis between 0% and 100% if the<br />

average ROE is greater than 7% and less than 18%; and<br />

– is equal to 100% if the average ROE is greater than or equal to 18%.<br />

The Board of Directors decided also that, for each for each<br />

beneficiary (other than the Chairman and Chief Executive Officer<br />

and the senior executives) of more than 100 shares, the shares<br />

in excess of this number will be finally granted subject to the<br />

performance condition mentioned before.<br />

TOTAL S.A. 11<br />

Notes to the Statutory Financial Statements<br />

2005 Plan 2006 Plan 2007 Plan 2008 Plan 2009 Plan 2010 Plan <strong>2011</strong> Plan <strong>Total</strong><br />

Date of the shareholders’ meeting 05/17/2005 05/17/2005 05/17/2005 05/16/2008 05/16/2008 05/16/2008 05/13/<strong>2011</strong><br />

Grant date (a) 07/19/2005 07/18/2006 07/17/2007 10/09/2008 09/15/2009 09/14/2010 09/14/<strong>2011</strong><br />

Final grant date<br />

(end of the vesting period) 07/20/2007 07/19/2008 07/18/2009 10/10/2010 09/16/<strong>2011</strong> 09/15/2012 09/15/2013<br />

Transfer possible from 07/20/2009 07/19/2010 07/18/<strong>2011</strong> 10/10/2012 09/16/2013 09/15/2014 09/15/2015<br />

Number of performance shares<br />

Outstanding as<br />

of January 1, 2009 - - 2,333,217 2,772,748 - - - 5,105,965<br />

Awarded - - - - 2,972,018 - - 2,972,018<br />

Canceled 1,928 2,922 (12,418) (9,672) (5,982) - - (23,222)<br />

Finally granted (b)(c) (1,928) (2,922) (2,320,799) (600) - - - (2,326,249)<br />

Outstanding as<br />

of January 1, 2010 - - - 2,762,476 2,966,036 - - 5,728,512<br />

Awarded - - - - - 3,010,011 - 3,010,011<br />

Canceled(d) 1,024 3,034 552 (1,113,462) (9,796) (8,738) - (1,127,386)<br />

Finally granted (b)(c) (1,024) (3,034) (552) (1,649,014) (1,904) (636) - (1,656,164)<br />

Outstanding as<br />

of January 1, <strong>2011</strong> - - - - 2,954,336 3,000,637 - 5,954,973<br />

Awarded - - - - - - 3,649,770 3,649,770<br />

Canceled 800 700 792 356 (26,214) (10,750) (19,579) (53,895)<br />

Finally granted (b)(c)(e) (800) (700) (792) (356) (2,928,122) (1,836) - (2,932,606)<br />

Outstanding as<br />

of December 31, <strong>2011</strong> - - - - - 2,988,051 3,630,191 6,618,242<br />

(a) The grant date is the date of the Board of Directors meeting that awarded the shares, except for the shares awarded by the Board of Directors at their meeting of September 9, 2008,<br />

and granted on October 9, 2008.<br />

(b) Performance shares finally granted following the death of their beneficiaries.<br />

(c) Including performance shares finally granted for which the entitlement right had been canceled erroneously.<br />

(d) Out of the 1,113,462 canceled rights to the grant share under the 2008 Plan, 1,094,914 entitlement rights were canceled due to the performance condition.<br />

The acquisition rate for the 2008 Plan was 60%.<br />

(e) The acquisition rate for the 2009 Plan was 100%.<br />

In addition, as part of the <strong>2011</strong> plan, the Board of Directors decided<br />

that the number of performance share finally granted to the<br />

Chairman and Chief Executive Officer will be subject to two<br />

performance conditions:<br />

– For 50% of the share granted, the performance condition<br />

states that the number of shares finally granted is based on the<br />

average ROE of the Group. The average ROE is calculated by<br />

the Group from the consolidated balance sheet and statement<br />

of in<strong>com</strong>e of the Group for fiscal years <strong>2011</strong> and 2012. The<br />

acquisition rate is equal to zero if the average ROE is less than<br />

or equal to 7%; varies on a straight-line basis between 0%<br />

and 100% if the average ROE is more than 7% and less<br />

than 18%; and is equal to 100% if the average ROE is more<br />

than or equal to 18%.<br />

– For 50% of the share granted, the performance condition states<br />

that the number of shares finally granted is based on the average<br />

ROACE of the Group. The average ROACE is calculated by the<br />

Group from the consolidated balance sheet and statement of<br />

in<strong>com</strong>e of the Group for fiscal years <strong>2011</strong> and 2012. The<br />

acquisition rate is equal to zero if the average ROACE is less<br />

than or equal to 6%; varies on a straight-line basis between 0%<br />

and 100% if the average ROACE is more than 6% and less<br />

than 15%; and is equal to 100% if the average ROACE is more<br />

than or equal to 15%.<br />

<strong>Registration</strong> Document <strong>2011</strong>. TOTAL 315