Registration document 2011 - tota - Total.com

Registration document 2011 - tota - Total.com

Registration document 2011 - tota - Total.com

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

11<br />

312<br />

TOTAL S.A.<br />

Notes to the Statutory Financial Statements<br />

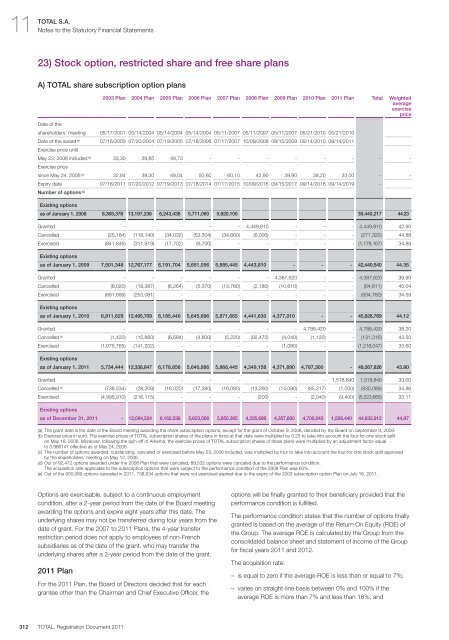

23) Stock option, restricted share and free share plans<br />

A) TOTAL share subscription option plans<br />

Date of the<br />

shareholders’ meeting 05/17/2001 05/14/2004 05/14/2004 05/14/2004 05/11/2007 05/11/2007 05/11/2007 05/21/2010 05/21/2010<br />

Date of the award (a) 07/16/2003 07/20/2004 07/19/2005 07/18/2006 07/17/2007 10/09/2008 09/15/2009 09/14/2010 09/14/<strong>2011</strong><br />

Exercise price until<br />

May 23, 2006 included (b) 33,30 39,85 49,73 - - - - - - - -<br />

Exercise price<br />

since May 24, 2006 (b) 32,84 39,30 49,04 50,60 60,10 42,90 39,90 38,20 33,00 - -<br />

Expiry date 07/16/<strong>2011</strong> 07/20/2012 07/19/2013 07/18/2014 07/17/2015 10/09/2016 09/15/2017 09/14/2018 09/14/2019 -<br />

Number of options (c)<br />

Existing options<br />

as of January 1, 2008 8,368,378 13,197,236 6,243,438 5,711,060 5,920,105 39,440,217 44.23<br />

Granted - - - - - 4,449,810 - - - 4,449,810 42.90<br />

Cancelled (25,184) (118,140) (34,032) (53,304) (34,660) (6,000) - - - (271,320) 44.88<br />

Exercised (841,846) (311,919) (17,702) (6,700) - - - - - (1,178,167) 34.89<br />

Existing options<br />

as of January 1, 2009 7,501,348 12,767,177 6,191,704 5,651,056 5,885,445 4,443,810 - - - 42,440,540 44.35<br />

Granted - - - - - - 4,387,620 - - 4,387,620 39.90<br />

Cancelled (8,020) (18,387) (6,264) (5,370) (13,780) (2,180) (10,610) - - (64,611) 45.04<br />

Exercised (681,699) (253,081) - - - - - - - (934,780) 34.59<br />

Existing options<br />

as of January 1, 2010 6,811,629 12,495,709 6,185,440 5,645,686 5,871,665 4,441,630 4,377,010 - - 45,828,769 44.12<br />

Granted - - - - - - - 4,788,420 - 4,788,420 38.20<br />

Cancelled (d) (1,420) (15,660) (6,584) (4,800) (5,220) (92,472) (4,040) (1,120) - (131,316) 43.50<br />

Exercised (1,075,765) (141,202) - - - - (1,080) - - (1,218,047) 33.60<br />

Existing options<br />

as of January 1, <strong>2011</strong> 5,734,444 12,338,847 6,178,856 5,640,886 5,866,445 4,349,158 4,371,890 4,787,300 - 49,267,826 43.80<br />

Granted - - - - - - - - 1,518,840 1,518,840 33.00<br />

Cancelled (e) (738,534) (28,208) (16,320) (17,380) (16,080) (13,260) (14,090) (85,217) (1,000) (930,089) 34.86<br />

Exercised (4,995,910) (216,115) - - - (200) - (2,040) (9,400) (5,223,665) 33.11<br />

Existing options<br />

as of December 31, <strong>2011</strong> - 12,094,524 6,162,536 5,623,506 5,850,365 4,335,698 4,357,800 4,700,043 1,508,440 44,632,912 44,87<br />

(a) The grant date is the date of the Board meeting awarding the share subscription options, except for the grant of October 9, 2008, decided by the Board on September 9, 2008.<br />

(b) Exercise price in euro. The exercise prices of TOTAL subscription shares of the plans in force at that date were multiplied by 0.25 to take into account the four-for-one stock split<br />

on May 18, 2006. Moreover, following the spin-off of Arkema, the exercise prices of TOTAL subscription shares of these plans were multiplied by an adjustment factor equal<br />

to 0.986147 effective as of May 24, 2006.<br />

(c) The number of options awarded, outstanding, canceled or exercised before May 23, 2006 included, was multiplied by four to take into account the four-for-one stock split approved<br />

by the shareholders’ meeting on May 12, 2006.<br />

(d) Out of 92,472 options awarded under the 2008 Plan that were canceled, 88,532 options were canceled due to the performance condition.<br />

The acquisition rate applicable to the subscription options that were subject to the performance condition of the 2008 Plan was 60%.<br />

(e) Out of the 930,089 options canceled in <strong>2011</strong>, 738,534 options that were not exercised expired due to the expiry of the 2003 subscription option Plan on July 16, <strong>2011</strong>.<br />

Options are exercisable, subject to a continuous employment<br />

condition, after a 2-year period from the date of the Board meeting<br />

awarding the options and expire eight years after this date. The<br />

underlying shares may not be transferred during four years from the<br />

date of grant. For the 2007 to <strong>2011</strong> Plans, the 4-year transfer<br />

restriction period does not apply to employees of non-French<br />

subsidiaries as of the date of the grant, who may transfer the<br />

underlying shares after a 2-year period from the date of the grant.<br />

<strong>2011</strong> Plan<br />

For the <strong>2011</strong> Plan, the Board of Directors decided that for each<br />

grantee other than the Chairman and Chief Executive Officer, the<br />

TOTAL. <strong>Registration</strong> Document <strong>2011</strong><br />

2003 Plan 2004 Plan 2005 Plan 2006 Plan 2007 Plan 2008 Plan 2009 Plan 2010 Plan <strong>2011</strong> Plan <strong>Total</strong> Weighted<br />

average<br />

exercise<br />

price<br />

options will be finally granted to their beneficiary provided that the<br />

performance condition is fulfilled.<br />

The performance condition states that the number of options finally<br />

granted is based on the average of the Return On Equity (ROE) of<br />

the Group. The average ROE is calculated by the Group from the<br />

consolidated balance sheet and statement of in<strong>com</strong>e of the Group<br />

for fiscal years <strong>2011</strong> and 2012.<br />

The acquisition rate:<br />

– is equal to zero if the average ROE is less than or equal to 7%;<br />

– varies on straight-line basis between 0% and 100% if the<br />

average ROE is more than 7% and less than 18%; and