Registration document 2011 - tota - Total.com

Registration document 2011 - tota - Total.com

Registration document 2011 - tota - Total.com

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

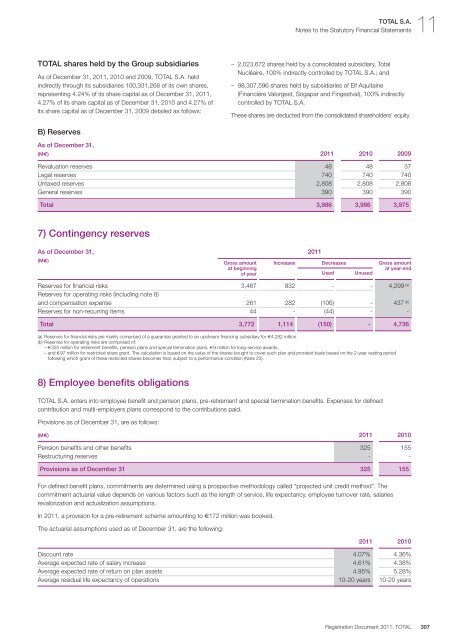

TOTAL shares held by the Group subsidiaries<br />

As of December 31, <strong>2011</strong>, 2010 and 2009, TOTAL S.A. held<br />

indirectly through its subsidiaries 100,331,268 of its own shares,<br />

representing 4.24% of its share capital as of December 31, <strong>2011</strong>,<br />

4.27% of its share capital as of December 31, 2010 and 4.27% of<br />

its share capital as of December 31, 2009 detailed as follows:<br />

B) Reserves<br />

As of December 31,<br />

(M€) <strong>2011</strong> 2010 2009<br />

Revaluation reserves 48 48 37<br />

Legal reserves 740 740 740<br />

Untaxed reserves 2,808 2,808 2,808<br />

General reserves 390 390 390<br />

<strong>Total</strong> 3,986 3,986 3,975<br />

7) Contingency reserves<br />

As of December 31,<br />

(M€)<br />

Reserves for financial risks 3,467 832 - - 4,299 (a)<br />

Reserves for operating risks (including note 8)<br />

and <strong>com</strong>pensation expense 261 282 (106) - 437 (b)<br />

Reserves for non-recurring items 44 - (44) - -<br />

<strong>Total</strong> 3,772 1,114 (150) - 4,736<br />

(a) Reserves for financial risks are mainly <strong>com</strong>prised of a guarantee granted to an upstream financing subsidiary for €4,282 million.<br />

(b) Reserves for operating risks are <strong>com</strong>prised of:<br />

– €325 million for retirement benefits, pension plans and special termination plans, €9 million for long-service awards,<br />

– and €97 million for restricted share grant. The calculation is based on the value of the shares bought to cover such plan and prorated basis based on the 2-year vesting period<br />

following which grant of these restricted shares be<strong>com</strong>es final, subject to a performance condition (Note 23).<br />

8) Employee benefits obligations<br />

TOTAL S.A. enters into employee benefit and pension plans, pre-retirement and special termination benefits. Expenses for defined<br />

contribution and multi-employers plans correspond to the contributions paid.<br />

Provisions as of December 31, are as follows:<br />

(M€) <strong>2011</strong> 2010<br />

Pension benefits and other benefits 325 155<br />

Restructuring reserves - -<br />

Provisions as of December 31 325 155<br />

For defined benefit plans, <strong>com</strong>mitments are determined using a prospective methodology called “projected unit credit method”. The<br />

<strong>com</strong>mitment actuarial value depends on various factors such as the length of service, life expectancy, employee turnover rate, salaries<br />

revalorization and actualization assumptions.<br />

In <strong>2011</strong>, a provision for a pre-retirement scheme amounting to €172 million was booked.<br />

The actuarial assumptions used as of December 31, are the following:<br />

Gross amount<br />

at beginning<br />

of year<br />

TOTAL S.A. 11<br />

Notes to the Statutory Financial Statements<br />

– 2,023,672 shares held by a consolidated subsidiary, <strong>Total</strong><br />

Nucléaire, 100% indirectly controlled by TOTAL S.A.; and<br />

– 98,307,596 shares held by subsidiaries of Elf Aquitaine<br />

(Financière Valorgest, Sogapar and Fingestval), 100% indirectly<br />

controlled by TOTAL S.A.<br />

These shares are deducted from the consolidated shareholders’ equity.<br />

<strong>2011</strong> 2010<br />

Discount rate 4.07% 4.36%<br />

Average expected rate of salary increase 4,61% 4.38%<br />

Average expected rate of return on plan assets 4.95% 5.28%<br />

Average residual life expectancy of operations 10-20 years 10-20 years<br />

<strong>2011</strong><br />

Increases Decreases Gross amount<br />

at year-end<br />

Used Unused<br />

<strong>Registration</strong> Document <strong>2011</strong>. TOTAL 307