Registration document 2011 - tota - Total.com

Registration document 2011 - tota - Total.com

Registration document 2011 - tota - Total.com

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

9 Consolidated<br />

Financial Statements<br />

Notes to the Consolidated Financial Statements<br />

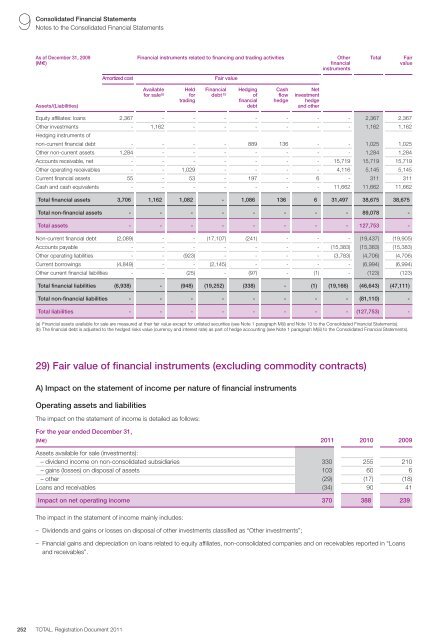

As of December 31, 2009<br />

(M€)<br />

Assets/(Liabilities)<br />

Equity affiliates: loans 2,367 - - - - - - - 2,367 2,367<br />

Other investments - 1,162 - - - - - - 1,162 1,162<br />

Hedging instruments of<br />

non-current financial debt - - - - 889 136 - - 1,025 1,025<br />

Other non-current assets 1,284 - - - - - - - 1,284 1,284<br />

Accounts receivable, net - - - - - - - 15,719 15,719 15,719<br />

Other operating receivables - - 1,029 - - - - 4,116 5,145 5,145<br />

Current financial assets 55 - 53 - 197 - 6 - 311 311<br />

Cash and cash equivalents - - - - - - - 11,662 11,662 11,662<br />

<strong>Total</strong> financial assets 3,706 1,162 1,082 - 1,086 136 6 31,497 38,675 38,675<br />

<strong>Total</strong> non-financial assets - - - - - - - - 89,078 -<br />

<strong>Total</strong> assets - - - - - - - - 127,753 -<br />

Non-current financial debt (2,089) - - (17,107) (241) - - - (19,437) (19,905)<br />

Accounts payable - - - - - - - (15,383) (15,383) (15,383)<br />

Other operating liabilities - - (923) - - - - (3,783) (4,706) (4,706)<br />

Current borrowings (4,849) - - (2,145) - - - - (6,994) (6,994)<br />

Other current financial liabilities - - (25) - (97) - (1) - (123) (123)<br />

<strong>Total</strong> financial liabilities (6,938) - (948) (19,252) (338) - (1) (19,166) (46,643) (47,111)<br />

<strong>Total</strong> non-financial liabilities - - - - - - - - (81,110) -<br />

<strong>Total</strong> liabilities - - - - - - - - (127,753) -<br />

(a) Financial assets available for sale are measured at their fair value except for unlisted securities (see Note 1 paragraph M(ii) and Note 13 to the Consolidated Financial Statements).<br />

(b) The financial debt is adjusted to the hedged risks value (currency and interest rate) as part of hedge accounting (see Note 1 paragraph M(iii) to the Consolidated Financial Statements).<br />

29) Fair value of financial instruments (excluding <strong>com</strong>modity contracts)<br />

A) Impact on the statement of in<strong>com</strong>e per nature of financial instruments<br />

Operating assets and liabilities<br />

The impact on the statement of in<strong>com</strong>e is detailed as follows:<br />

For the year ended December 31,<br />

(M€) <strong>2011</strong> 2010 2009<br />

Assets available for sale (investments):<br />

– dividend in<strong>com</strong>e on non-consolidated subsidiaries 330 255 210<br />

– gains (losses) on disposal of assets 103 60 6<br />

– other (29) (17) (18)<br />

Loans and receivables (34) 90 41<br />

Impact on net operating in<strong>com</strong>e 370 388 239<br />

The impact in the statement of in<strong>com</strong>e mainly includes:<br />

Financial instruments related to financing and trading activities Other<br />

financial<br />

instruments<br />

Amortized cost Fair value<br />

Available<br />

for sale (a)<br />

Held<br />

for<br />

trading<br />

Financial<br />

debt (b)<br />

Hedging<br />

of<br />

financial<br />

debt<br />

– Dividends and gains or losses on disposal of other investments classified as “Other investments”;<br />

<strong>Total</strong> Fair<br />

value<br />

– Financial gains and depreciation on loans related to equity affiliates, non-consolidated <strong>com</strong>panies and on receivables reported in “Loans<br />

and receivables”.<br />

252 TOTAL. <strong>Registration</strong> Document <strong>2011</strong><br />

Cash<br />

flow<br />

hedge<br />

Net<br />

investment<br />

hedge<br />

and other