list of contributors - GALA

list of contributors - GALA

list of contributors - GALA

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

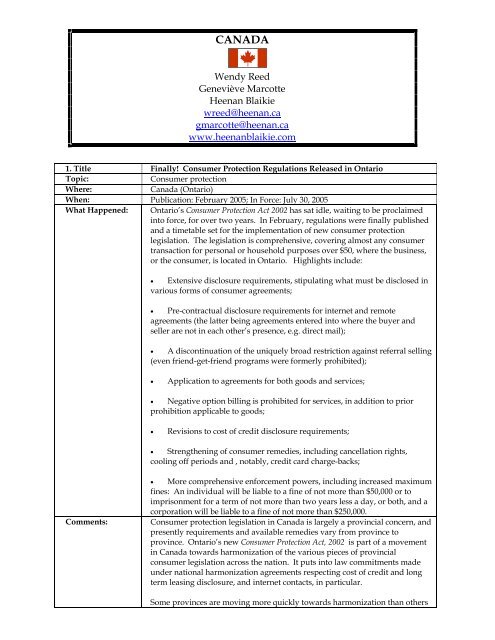

CANADA<br />

Wendy Reed<br />

Geneviève Marcotte<br />

Heenan Blaikie<br />

wreed@heenan.ca<br />

gmarcotte@heenan.ca<br />

www.heenanblaikie.com<br />

1. Title Finally! Consumer Protection Regulations Released in Ontario<br />

Topic: Consumer protection<br />

Where: Canada (Ontario)<br />

When: Publication: February 2005; In Force: July 30, 2005<br />

What Happened: Ontario’s Consumer Protection Act 2002 has sat idle, waiting to be proclaimed<br />

into force, for over two years. In February, regulations were finally published<br />

and a timetable set for the implementation <strong>of</strong> new consumer protection<br />

legislation. The legislation is comprehensive, covering almost any consumer<br />

transaction for personal or household purposes over $50, where the business,<br />

or the consumer, is located in Ontario. Highlights include:<br />

• Extensive disclosure requirements, stipulating what must be disclosed in<br />

various forms <strong>of</strong> consumer agreements;<br />

• Pre-contractual disclosure requirements for internet and remote<br />

agreements (the latter being agreements entered into where the buyer and<br />

seller are not in each other’s presence, e.g. direct mail);<br />

• A discontinuation <strong>of</strong> the uniquely broad restriction against referral selling<br />

(even friend-get-friend programs were formerly prohibited);<br />

• Application to agreements for both goods and services;<br />

• Negative option billing is prohibited for services, in addition to prior<br />

prohibition applicable to goods;<br />

• Revisions to cost <strong>of</strong> credit disclosure requirements;<br />

• Strengthening <strong>of</strong> consumer remedies, including cancellation rights,<br />

cooling <strong>of</strong>f periods and , notably, credit card charge-backs;<br />

• More comprehensive enforcement powers, including increased maximum<br />

fines: An individual will be liable to a fine <strong>of</strong> not more than $50,000 or to<br />

imprisonment for a term <strong>of</strong> not more than two years less a day, or both, and a<br />

corporation will be liable to a fine <strong>of</strong> not more than $250,000.<br />

Comments: Consumer protection legislation in Canada is largely a provincial concern, and<br />

presently requirements and available remedies vary from province to<br />

province. Ontario’s new Consumer Protection Act, 2002 is part <strong>of</strong> a movement<br />

in Canada towards harmonization <strong>of</strong> the various pieces <strong>of</strong> provincial<br />

consumer legislation across the nation. It puts into law commitments made<br />

under national harmonization agreements respecting cost <strong>of</strong> credit and long<br />

term leasing disclosure, and internet contacts, in particular.<br />

Some provinces are moving more quickly towards harmonization than others