Report 2010 - Italcementi Group

Report 2010 - Italcementi Group

Report 2010 - Italcementi Group

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>2010</strong> Annual <strong>Report</strong><br />

Presentazione 6<br />

Consolidated Annual <strong>Report</strong> Directors’ report 27<br />

Corporate Governance Consolidated financial statements Financial statements 68<br />

<strong>Italcementi</strong> S.p.A. financial statements Notes 73<br />

Annexes 142<br />

<strong>Report</strong> of the Independent Auditors 151<br />

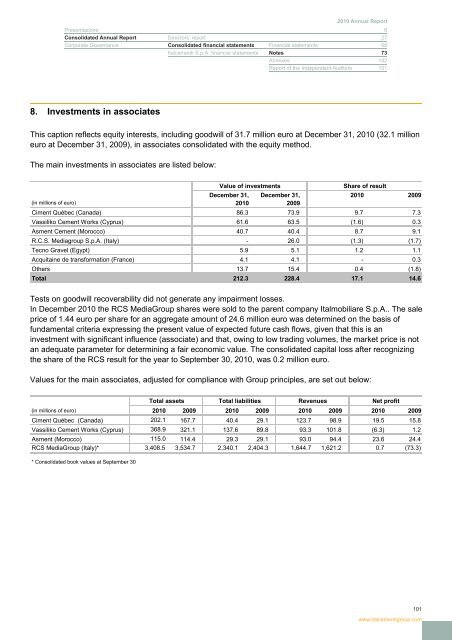

8. Investments in associates<br />

This caption reflects equity interests, including goodwill of 31.7 million euro at December 31, <strong>2010</strong> (32.1 million<br />

euro at December 31, 2009), in associates consolidated with the equity method.<br />

The main investments in associates are listed below:<br />

Value of investments<br />

Share of result<br />

December 31, December 31,<br />

<strong>2010</strong> 2009<br />

(in millions of euro)<br />

<strong>2010</strong><br />

2009<br />

Ciment Québec (Canada) 86.3 73.9 9.7 7.3<br />

Vassiliko Cement Works (Cyprus) 61.6 63.5 (1.6) 0.3<br />

Asment Cement (Morocco) 40.7 40.4 8.7 9.1<br />

R.C.S. Mediagroup S.p.A. (Italy) - 26.0 (1.3) (1.7)<br />

Tecno Gravel (Egypt) 5.9 5.1 1.2 1.1<br />

Acquitaine de transformation (France) 4.1 4.1 - 0.3<br />

Others 13.7 15.4 0.4 (1.8)<br />

Total 212.3 228.4 17.1 14.6<br />

Tests on goodwill recoverability did not generate any impairment losses.<br />

In December <strong>2010</strong> the RCS Media<strong>Group</strong> shares were sold to the parent company Italmobiliare S.p.A.. The sale<br />

price of 1.44 euro per share for an aggregate amount of 24.6 million euro was determined on the basis of<br />

fundamental criteria expressing the present value of expected future cash flows, given that this is an<br />

investment with significant influence (associate) and that, owing to low trading volumes, the market price is not<br />

an adequate parameter for determining a fair economic value. The consolidated capital loss after recognizing<br />

the share of the RCS result for the year to September 30, <strong>2010</strong>, was 0.2 million euro.<br />

Values for the main associates, adjusted for compliance with <strong>Group</strong> principles, are set out below:<br />

Total assets Total liabilities Revenues Net profit<br />

(in millions of euro) <strong>2010</strong> 2009 <strong>2010</strong> 2009 <strong>2010</strong> 2009 <strong>2010</strong> 2009<br />

Ciment Québec (Canada) 202.1 167.7 40.4 29.1 123.7 98.9 19.5 15.8<br />

Vassiliko Cement Works (Cyprus) 368.9 321.1 137.6 89.8 93.3 101.8 (6.3) 1.2<br />

Asment (Morocco) 115.0 114.4 29.3 29.1 93.0 94.4 23.6 24.4<br />

RCS Media<strong>Group</strong> (Italy)* 3,408.5 3,534.7 2,340.1 2,404.3 1,644.7 1,621.2 0.7 (73.3)<br />

* Consolidated book values at September 30<br />

101<br />

www.italcementigroup.com