Report 2010 - Italcementi Group

Report 2010 - Italcementi Group

Report 2010 - Italcementi Group

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>2010</strong> Annual <strong>Report</strong><br />

Presentation 6<br />

Consolidated Annual <strong>Report</strong> Directors’ report 28<br />

Corporate Governance Consolidated financial statements 68<br />

<strong>Italcementi</strong> S.p.A. financial statements 158<br />

At the end of March, the new 5,500 mt/day kiln line at the Yerraguntla plant began<br />

production; cement production began in the fourth quarter. <strong>Group</strong> domestic cement sales<br />

grew by 3.8%, while total cement and clinker sales were up 8.4%. Competitive pressures<br />

tightened considerably due to the start-up of new production capacity; after the drop that<br />

began in September 2009, average sales prices remained at a significantly lower average<br />

level than in 2009, despite the gradual rise reported in the last four months of the year.<br />

Operating results were sharply down on 2009 chiefly because of the fall in average sales<br />

prices and, in the last quarter, the rise in the cost of fuel and electricity, counterbalanced<br />

only in part by higher sales volumes and a favorable exchange-rate effect.<br />

Cement consumption is expected to continue growing in 2011 on <strong>Group</strong> markets, but<br />

competition will be fiercer due to new production capacity and the consequent pressure on<br />

average sales prices.<br />

Others<br />

In China, the economy continued to grow, although the trend slowed in the second half of<br />

<strong>2010</strong>. In a favorable scenario, our cement sales volumes rose by 11.2% (+9.4% for total<br />

cement and clinker sales), while sales prices were affected by the start-up of new<br />

competitor plants. Operating results decreased compared with 2009 due to the fall in prices<br />

and rise in fuel costs, countered only in part by the increase in sales volumes and a<br />

positive exchange-rate effect. In 2011 the market is expected to show further growth,<br />

thanks to new public investment in infrastructure, but competition will be more aggressive.<br />

In Kazakhstan, the rapid expansion of the construction sector in <strong>2010</strong> contributed to the<br />

strong increase in cement consumption compared with 2009 (+10.5%). Despite competition<br />

from imports, domestic cement sales volumes rose by 12.7% (+16.1% for overall cement<br />

and clinker sales) with a very positive trend in prices. Despite the unfavorable dynamic in<br />

operating expenses, especially for energy, a significant improvement was posted in<br />

operating results.<br />

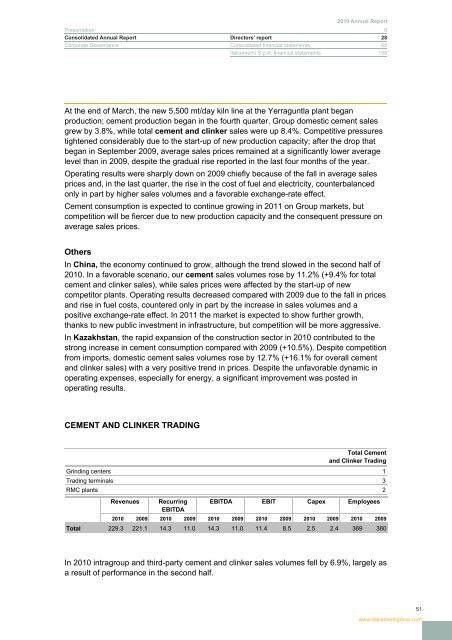

CEMENT AND CLINKER TRADING<br />

Total Cement<br />

and Clinker Trading<br />

Grinding centers 1<br />

Trading terminals 3<br />

RMC plants 2<br />

Revenues Recurring<br />

EBITDA<br />

EBITDA EBIT<br />

Capex Employees<br />

<strong>2010</strong> 2009 <strong>2010</strong> 2009 <strong>2010</strong> 2009 <strong>2010</strong> 2009 <strong>2010</strong> 2009 <strong>2010</strong> 2009<br />

Total 229.3 221.1 14.3 11.0 14.3 11.0 11.4 8.5 2.5 2.4 369 360<br />

In <strong>2010</strong> intragroup and third-party cement and clinker sales volumes fell by 6.9%, largely as<br />

a result of performance in the second half.<br />

51<br />

www.italcementigroup.com