Report 2010 - Italcementi Group

Report 2010 - Italcementi Group

Report 2010 - Italcementi Group

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>2010</strong> Annual <strong>Report</strong><br />

Presentazione 6<br />

Consolidated Annual <strong>Report</strong> Directors’ report 27<br />

Corporate Governance Consolidated financial statements Financial statements 68<br />

<strong>Italcementi</strong> S.p.A. financial statements Notes 73<br />

Annexes 142<br />

<strong>Report</strong> of the Independent Auditors 151<br />

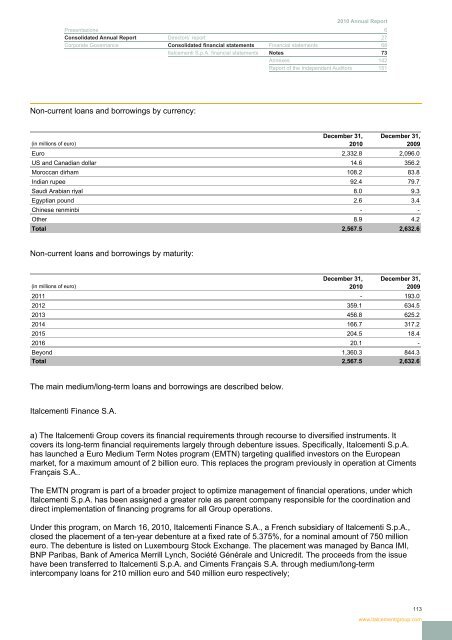

Non-current loans and borrowings by currency:<br />

(in millions of euro)<br />

December 31,<br />

<strong>2010</strong><br />

December 31,<br />

2009<br />

Euro 2,332.8 2,096.0<br />

US and Canadian dollar 14.6 356.2<br />

Moroccan dirham 108.2 83.8<br />

Indian rupee 92.4 79.7<br />

Saudi Arabian riyal 8.0 9.3<br />

Egyptian pound 2.6 3.4<br />

Chinese renminbi - -<br />

Other 8.9 4.2<br />

Total 2,567.5 2,632.6<br />

Non-current loans and borrowings by maturity:<br />

(in millions of euro)<br />

December 31,<br />

<strong>2010</strong><br />

December 31,<br />

2009<br />

2011 - 193.0<br />

2012 359.1 634.5<br />

2013 456.8 625.2<br />

2014 166.7 317.2<br />

2015 204.5 18.4<br />

2016 20.1 -<br />

Beyond 1,360.3 844.3<br />

Total 2,567.5 2,632.6<br />

The main medium/long-term loans and borrowings are described below.<br />

<strong>Italcementi</strong> Finance S.A.<br />

a) The <strong>Italcementi</strong> <strong>Group</strong> covers its financial requirements through recourse to diversified instruments. It<br />

covers its long-term financial requirements largely through debenture issues. Specifically, <strong>Italcementi</strong> S.p.A.<br />

has launched a Euro Medium Term Notes program (EMTN) targeting qualified investors on the European<br />

market, for a maximum amount of 2 billion euro. This replaces the program previously in operation at Ciments<br />

Français S.A..<br />

The EMTN program is part of a broader project to optimize management of financial operations, under which<br />

<strong>Italcementi</strong> S.p.A. has been assigned a greater role as parent company responsible for the coordination and<br />

direct implementation of financing programs for all <strong>Group</strong> operations.<br />

Under this program, on March 16, <strong>2010</strong>, <strong>Italcementi</strong> Finance S.A., a French subsidiary of <strong>Italcementi</strong> S.p.A.,<br />

closed the placement of a ten-year debenture at a fixed rate of 5.375%, for a nominal amount of 750 million<br />

euro. The debenture is listed on Luxembourg Stock Exchange. The placement was managed by Banca IMI,<br />

BNP Paribas, Bank of America Merrill Lynch, Société Générale and Unicredit. The proceeds from the issue<br />

have been transferred to <strong>Italcementi</strong> S.p.A. and Ciments Français S.A. through medium/long-term<br />

intercompany loans for 210 million euro and 540 million euro respectively;<br />

113<br />

www.italcementigroup.com