Report 2010 - Italcementi Group

Report 2010 - Italcementi Group

Report 2010 - Italcementi Group

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>2010</strong> Annual <strong>Report</strong><br />

Presentazione 6<br />

Consolidated Annual <strong>Report</strong> Directors’ report 27<br />

Corporate Governance Consolidated financial statements Financial statements 68<br />

<strong>Italcementi</strong> S.p.A. financial statements Notes 73<br />

Annexes 142<br />

<strong>Report</strong> of the Independent Auditors 151<br />

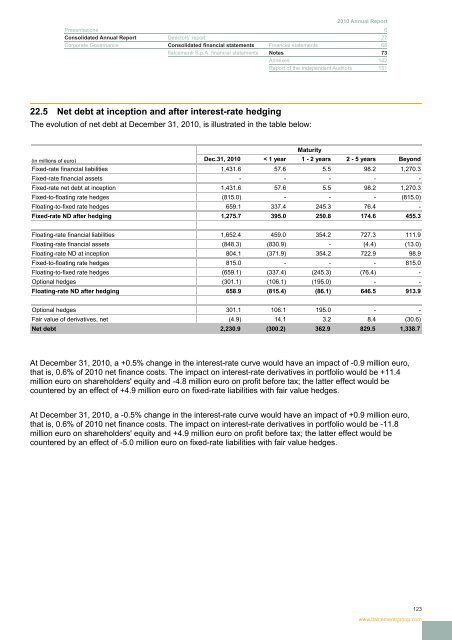

22.5 Net debt at inception and after interest-rate hedging<br />

The evolution of net debt at December 31, <strong>2010</strong>, is illustrated in the table below:<br />

Maturity<br />

(in millions of euro) Dec.31, <strong>2010</strong> < 1 year 1 - 2 years 2 - 5 years Beyond<br />

Fixed-rate financial liabilities 1,431.6 57.6 5.5 98.2 1,270.3<br />

Fixed-rate financial assets - - - - -<br />

Fixed-rate net debt at inception 1,431.6 57.6 5.5 98.2 1,270.3<br />

Fixed-to-floating rate hedges (815.0) - - - (815.0)<br />

Floating-to-fixed rate hedges 659.1 337.4 245.3 76.4 -<br />

Fixed-rate ND after hedging 1,275.7 395.0 250.8 174.6 455.3<br />

Floating-rate financial liabilities 1,652.4 459.0 354.2 727.3 111.9<br />

Floating-rate financial assets (848.3) (830.9) - (4.4) (13.0)<br />

Floating-rate ND at inception 804.1 (371.9) 354.2 722.9 98.9<br />

Fixed-to-floating rate hedges 815.0 - - - 815.0<br />

Floating-to-fixed rate hedges (659.1) (337.4) (245.3) (76.4) -<br />

Optional hedges (301.1) (106.1) (195.0) - -<br />

Floating-rate ND after hedging 658.9 (815.4) (86.1) 646.5 913.9<br />

Optional hedges 301.1 106.1 195.0 - -<br />

Fair value of derivatives, net (4.9) 14.1 3.2 8.4 (30.6)<br />

Net debt 2,230.9 (300.2) 362.9 829.5 1,338.7<br />

At December 31, <strong>2010</strong>, a +0.5% change in the interest-rate curve would have an impact of -0.9 million euro,<br />

that is, 0.6% of <strong>2010</strong> net finance costs. The impact on interest-rate derivatives in portfolio would be +11.4<br />

million euro on shareholders' equity and -4.8 million euro on profit before tax; the latter effect would be<br />

countered by an effect of +4.9 million euro on fixed-rate liabilities with fair value hedges.<br />

At December 31, <strong>2010</strong>, a -0.5% change in the interest-rate curve would have an impact of +0.9 million euro,<br />

that is, 0.6% of <strong>2010</strong> net finance costs. The impact on interest-rate derivatives in portfolio would be -11.8<br />

million euro on shareholders' equity and +4.9 million euro on profit before tax; the latter effect would be<br />

countered by an effect of -5.0 million euro on fixed-rate liabilities with fair value hedges.<br />

123<br />

www.italcementigroup.com