Report 2010 - Italcementi Group

Report 2010 - Italcementi Group

Report 2010 - Italcementi Group

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

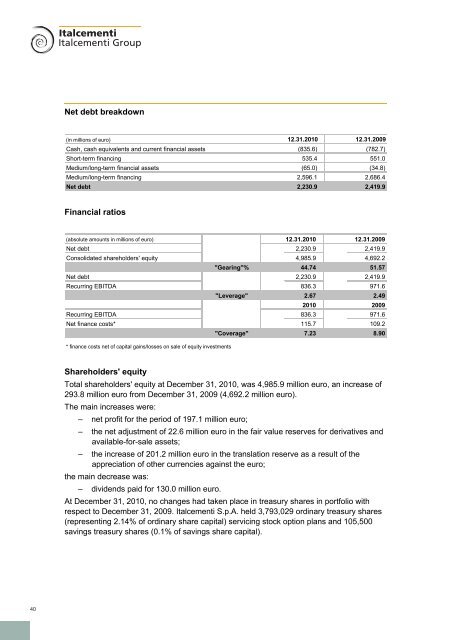

Net debt breakdown<br />

(in millions of euro) 12.31.<strong>2010</strong> 12.31.2009<br />

Cash, cash equivalents and current financial assets (835.6) (782.7)<br />

Short-term financing 535.4 551.0<br />

Medium/long-term financial assets (65.0) (34.8)<br />

Medium/long-term financing 2,596.1 2,686.4<br />

Net debt 2,230.9 2,419.9<br />

Financial ratios<br />

(absolute amounts in millions of euro)<br />

12.31.<strong>2010</strong><br />

12.31.2009<br />

Net debt 2,230.9 2,419.9<br />

Consolidated shareholders' equity 4,985.9 4,692.2<br />

"Gearing"%<br />

44.74<br />

51.57<br />

Net debt 2,230.9 2,419.9<br />

Recurring EBITDA 836.3 971.6<br />

"Leverage"<br />

2.67<br />

<strong>2010</strong><br />

2.49<br />

2009<br />

Recurring EBITDA 836.3 971.6<br />

Net finance costs* 115.7 109.2<br />

"Coverage" 7.23<br />

8.90<br />

* finance costs net of capital gains/losses on sale of equity investments<br />

Shareholders' equity<br />

Total shareholders' equity at December 31, <strong>2010</strong>, was 4,985.9 million euro, an increase of<br />

293.8 million euro from December 31, 2009 (4,692.2 million euro).<br />

The main increases were:<br />

– net profit for the period of 197.1 million euro;<br />

– the net adjustment of 22.6 million euro in the fair value reserves for derivatives and<br />

available-for-sale assets;<br />

– the increase of 201.2 million euro in the translation reserve as a result of the<br />

appreciation of other currencies against the euro;<br />

the main decrease was:<br />

– dividends paid for 130.0 million euro.<br />

At December 31, <strong>2010</strong>, no changes had taken place in treasury shares in portfolio with<br />

respect to December 31, 2009. <strong>Italcementi</strong> S.p.A. held 3,793,029 ordinary treasury shares<br />

(representing 2.14% of ordinary share capital) servicing stock option plans and 105,500<br />

savings treasury shares (0.1% of savings share capital).<br />

40