Assets 5 Property, plant and equipment and Investment property 5.1 Property, plant and equipment Land and buildings Quarries Technical plant, materials and equipment Other PPE and construction in progress Total (in thousands of euro) Net carrying amount at Dec.31, 09 899,050 372,495 2,304,317 817,131 4,392,993 Gross amount 1,935,866 596,590 6,894,249 1,158,988 10,585,693 Accumulated depreciation (1,036,816) (224,095) (4,589,932) (341,857) (6,192,700) Net carrying amount at Dec.31, 09 899,050 372,495 2,304,317 817,131 4,392,993 Additions 58,655 12,392 226,634 210,116 507,797 Change consolidation scope, Reclassifications, Other 94,729 (19,012) 357,129 (431,568) 1,278 Disposals (3,148) (95) (3,027) (2,069) (8,339) Depreciation and impairment losses (54,103) (12,550) (370,858) (27,631) (465,142) Currency translation differences 32,962 6,660 94,319 32,620 166,561 Net carrying amount at Dec.31, 10 1,028,145 359,890 2,608,514 598,599 4,595,148 Gross amount 2,170,392 565,302 7,624,901 965,037 11,325,632 Accumulated depreciation (1,142,247) (205,412) (5,016,387) (366,438) (6,730,484) Net carrying amount at Dec.31, 10 1,028,145 359,890 2,608,514 598,599 4,595,148 The main additions refer to the new production lines at the Ait Baha cement plant in Morocco and the Yerraguntla cement plant in India. Construction in progress at December 31, <strong>2010</strong>, was 511,629 thousand euro (720,271 thousand euro at December 31, 2009): the decrease for the year in the line “Change … other” related mainly to the reclassifications to the final categories of assets relating to the cement plant in Ait Baha, Morocco, and the Yerraguntla industrial site in India and the Martinsburg industrial site in North America. “Depreciation and impairment losses” include impairment of 5.2 million euro on property, plant and equipment (51.0 million euro at December 31, 2009) and refer mainly to industrial plants in Egypt and Saudi Arabia. The review of the useful lives of industrial assets in the cement sector produced a positive effect of 29.2 million euro in <strong>2010</strong>. Fixed assets held under finance leases and rental contracts were carried at a net amount of 27.7 million euro at December 31, <strong>2010</strong> (31.8 million euro at December 31, 2009). They consist largely of “plant and machinery” and “automobiles and aircraft”. Expenses included under “Property, plant and equipment” amounted to 58.7 million euro at December 31, 2009 (58.7 million euro at December 31, 2009). Fixed assets pledged as security for bank loans were carried at a net amount of 200 million euro at December 31, <strong>2010</strong> (213.3 million euro at December 31, 2009). The useful life adopted by the <strong>Group</strong> for the main asset categories is as follows: Civil and industrial buildings 10 – 33 years Plant and machinery 5 – 30 years Other property, plant and equipment 3 – 10 years The range between the above minimum and maximum limits indicates the presence of components with separate useful lives within each asset category. 96

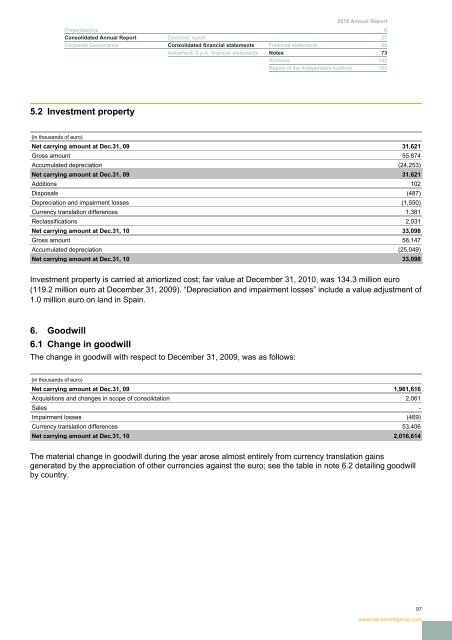

<strong>2010</strong> Annual <strong>Report</strong> Presentazione 6 Consolidated Annual <strong>Report</strong> Directors’ report 27 Corporate Governance Consolidated financial statements Financial statements 68 <strong>Italcementi</strong> S.p.A. financial statements Notes 73 Annexes 142 <strong>Report</strong> of the Independent Auditors 151 5.2 Investment property (in thousands of euro) Net carrying amount at Dec.31, 09 31,621 Gross amount 55,874 Accumulated depreciation (24,253) Net carrying amount at Dec.31, 09 31,621 Additions 102 Disposals (487) Depreciation and impairment losses (1,550) Currency translation differences 1,381 Reclassifications 2,031 Net carrying amount at Dec.31, 10 33,098 Gross amount 58,147 Accumulated depreciation (25,049) Net carrying amount at Dec.31, 10 33,098 Investment property is carried at amortized cost; fair value at December 31, <strong>2010</strong>, was 134.3 million euro (119.2 million euro at December 31, 2009). “Depreciation and impairment losses” include a value adjustment of 1.0 million euro on land in Spain. 6. Goodwill 6.1 Change in goodwill The change in goodwill with respect to December 31, 2009, was as follows: (in thousands of euro) Net carrying amount at Dec.31, 09 1,961,616 Acquisitions and changes in scope of consolidation 2,061 Sales - Impairment losses (469) Currency translation differences 53,406 Net carrying amount at Dec.31, 10 2,016,614 The material change in goodwill during the year arose almost entirely from currency translation gains generated by the appreciation of other currencies against the euro; see the table in note 6.2 detailing goodwill by country. 97 www.italcementigroup.com

- Page 1 and 2:

2010 Annual Report

- Page 3 and 4:

2010 Annual Report Italcementi S.p.

- Page 5 and 6:

In the past three financial years w

- Page 7 and 8:

2010 Annual Report Presentation Gen

- Page 9 and 10:

2010 Annual Report Presentation Gen

- Page 11 and 12:

2010 Annual Report Presentation Gen

- Page 13 and 14:

2010 Annual Report Presentation Gen

- Page 15 and 16:

2010 Annual Report Presentation Gen

- Page 17 and 18:

2010 Annual Report Presentation Gen

- Page 19 and 20:

2010 Annual Report Presentation Gen

- Page 21 and 22:

2010 Annual Report Presentation Gen

- Page 23 and 24:

2010 Annual Report Presentation Gen

- Page 25:

2010 Annual Report Presentation Gen

- Page 28 and 29:

Directors’ report Following the a

- Page 30 and 31:

Significant events for the year Sig

- Page 32 and 33:

Business and financial performance

- Page 34 and 35:

Fourth-quarter sales volumes and in

- Page 36 and 37:

Revenues and operating results Cont

- Page 38 and 39:

Total comprehensive income In 2010,

- Page 40 and 41:

Net debt breakdown (in millions of

- Page 42 and 43:

2010 to the Internal Control Commit

- Page 44 and 45:

Conformity risks The Group is subje

- Page 46 and 47: constraints imposed by the stringen

- Page 48 and 49: The construction sector reported a

- Page 50 and 51: ASIA Thailand India Others (1) Tota

- Page 52 and 53: The reduction arose essentially as

- Page 54 and 55: Turkey Work continued in 2010 to ob

- Page 56 and 57: variable amount. The fixed amount i

- Page 58 and 59: Information systems The three-year

- Page 60 and 61: Raw materials and alternative fuels

- Page 62 and 63: Engineering, technical assistance,

- Page 64 and 65: serves public companies and institu

- Page 66 and 67: Set Group Holding represents a sign

- Page 68 and 69: Financial statements Balance sheet

- Page 70 and 71: Statement of comprehensive income (

- Page 72 and 73: Consolidated cash flow statement No

- Page 74 and 75: 21. Deferred tax 22. Net debt 23. O

- Page 76 and 77: no longer generate goodwill, nor ga

- Page 78 and 79: Subsidiaries Subsidiaries are compa

- Page 80 and 81: 1.5. Translation of foreign currenc

- Page 82 and 83: 1.10. Intangible assets Intangible

- Page 84 and 85: deferred tax assets are reviewed at

- Page 86 and 87: Pending publication of a standard/i

- Page 88 and 89: 2. Exchange rates used to translate

- Page 90 and 91: 4. Operating segment disclosure The

- Page 92 and 93: Operating segments The table below

- Page 94 and 95: The table below sets out other segm

- Page 98 and 99: 6.2 Goodwill testing Goodwill acqui

- Page 100 and 101: “Concessions” are amortized ove

- Page 102 and 103: 9. Other equity investments This no

- Page 104 and 105: 12. Trade receivables (in thousands

- Page 106 and 107: 17. Dividends paid Dividends declar

- Page 108 and 109: The movements in defined benefit li

- Page 110 and 111: 20. Provisions Non-current and curr

- Page 112 and 113: 22.1 Loans and borrowings Loans and

- Page 114 and 115: ) in the third quarter of 2010, Ita

- Page 116 and 117: v) in the third quarter of 2010, Ci

- Page 118 and 119: Fair value - hierarchy In determini

- Page 120 and 121: In 2009 and 2010, in view of the su

- Page 122 and 123: 22.4 Interest-rate risk Notional va

- Page 124 and 125: 22.6 Exposure to exchange-rate risk

- Page 126 and 127: 22.8 Hedge Accounting The effects a

- Page 128 and 129: At December 31, 2010, the average m

- Page 130 and 131: 25. Goods and utilities expenses Go

- Page 132 and 133: The following table sets out the de

- Page 134 and 135: The reconciliation between the theo

- Page 136 and 137: 34. Transactions with related parti

- Page 138 and 139: 36. Cash flow statement 36.1. Cash

- Page 140 and 141: 38. Considerations to the Independe

- Page 142 and 143: Annex 1 The following table has bee

- Page 144 and 145: Company Registered office Share cap

- Page 146 and 147:

Company Registered office Share cap

- Page 148 and 149:

Company Registered office Share cap

- Page 150:

Representation form pursuant to art

- Page 154 and 155:

Financial statements Balance sheet

- Page 156 and 157:

Statement of comprehensive income (

- Page 158 and 159:

Cash flow statement 2010 2009 (euro

- Page 160 and 161:

Transactions with related parties o

- Page 164 and 165:

Summary of resolutions The Annual G

- Page 166 and 167:

Extraordinary session: 1) to amend

- Page 168 and 169:

Report on Corporate Governance and

- Page 170 and 171:

c) Significant shareholders as disc

- Page 172 and 173:

In the event of presentation of mor

- Page 174 and 175:

By resolution of June 20 th , 2007,

- Page 176 and 177:

d) Analysis of controls at process

- Page 178 and 179:

8) the various company functions, w

- Page 180 and 181:

knowledge of the company and its dy

- Page 182 and 183:

Emilio Zanetti * Unione di Banche I

- Page 184 and 185:

at their request, the Chief Executi

- Page 186 and 187:

The lists must be presented at the

- Page 188 and 189:

- for the simultaneous replacement

- Page 190 and 191:

Within the Board of Directors, the

- Page 192 and 193:

their level of agreement has been m

- Page 194 and 195:

The Board of Directors, with the as

- Page 196 and 197:

TABLE 2 BOARD OF STATUTORY AUDITORS

- Page 198 and 199:

Code of ethics The Code, approved f

- Page 200 and 201:

only if the unrelated shareholders

- Page 202 and 203:

EQUITY INVESTMENTS OF DIRECTORS, ST

- Page 204 and 205:

parent company, on a regular basis,

- Page 206 and 207:

Stock option plan for directors - 2

- Page 208 and 209:

Based on the opinion of the Committ

- Page 210 and 211:

g) Share capital increase; disposal

- Page 212 and 213:

Italcementi S.p.A. will have a pre-

- Page 214 and 215:

iii) approving for each assignee th

- Page 216 and 217:

216

- Page 218 and 219:

Annex 1 Highlights from the most re

- Page 220 and 221:

(in thousands of euro) Full name Po

- Page 222 and 223:

STOCK OPTIONS GRANTED TO DIRECTORS

- Page 224 and 225:

CIMENTS FRANÇAIS S.A. Options held

- Page 226 and 227:

Corporate bodies resulting from the

- Page 228:

italcementi S.p.A. Via G. Camozzi,