Report 2010 - Italcementi Group

Report 2010 - Italcementi Group

Report 2010 - Italcementi Group

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>2010</strong> Annual <strong>Report</strong><br />

Presentazione 6<br />

Consolidated Annual <strong>Report</strong> Directors’ report 27<br />

Corporate Governance Consolidated financial statements Financial statements 68<br />

<strong>Italcementi</strong> S.p.A. financial statements Notes 73<br />

Annexes 142<br />

<strong>Report</strong> of the Independent Auditors 151<br />

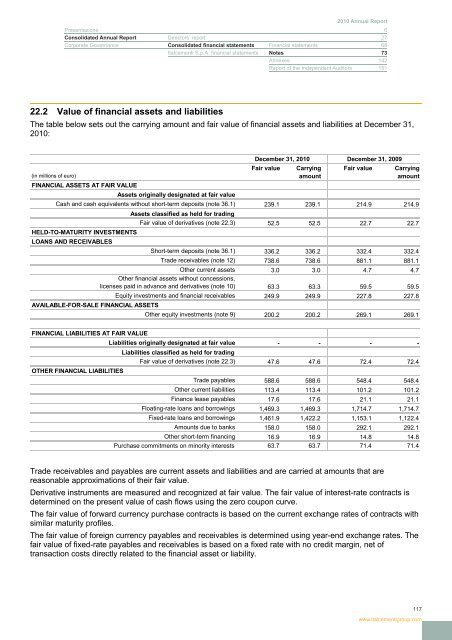

22.2 Value of financial assets and liabilities<br />

The table below sets out the carrying amount and fair value of financial assets and liabilities at December 31,<br />

<strong>2010</strong>:<br />

December 31, <strong>2010</strong> December 31, 2009<br />

Fair value Carrying Fair value Carrying<br />

(in millions of euro)<br />

amount<br />

amount<br />

FINANCIAL ASSETS AT FAIR VALUE<br />

Assets originally designated at fair value<br />

Cash and cash equivalents without short-term deposits (note 36.1) 239.1 239.1 214.9 214.9<br />

Assets classified as held for trading<br />

Fair value of derivatives (note 22.3) 52.5 52.5 22.7 22.7<br />

HELD-TO-MATURITY INVESTMENTS<br />

LOANS AND RECEIVABLES<br />

Short-term deposits (note 36.1) 336.2 336.2 332.4 332.4<br />

Trade receivables (note 12) 738.6 738.6 881.1 881.1<br />

Other current assets 3.0 3.0 4.7 4.7<br />

Other financial assets without concessions,<br />

licenses paid in advance and derivatives (note 10) 63.3 63.3 59.5 59.5<br />

Equity investments and financial receivables 249.9 249.9 227.8 227.8<br />

AVAILABLE-FOR-SALE FINANCIAL ASSETS<br />

Other equity investments (note 9) 200.2 200.2 269.1 269.1<br />

FINANCIAL LIABILITIES AT FAIR VALUE<br />

Liabilities originally designated at fair value - - - -<br />

Liabilities classified as held for trading<br />

Fair value of derivatives (note 22.3) 47.6 47.6 72.4 72.4<br />

OTHER FINANCIAL LIABILITIES<br />

Trade payables 588.6 588.6 548.4 548.4<br />

Other current liabilities 113.4 113.4 101.2 101.2<br />

Finance lease payables 17.6 17.6 21.1 21.1<br />

Floating-rate loans and borrowings 1,469.3 1,469.3 1,714.7 1,714.7<br />

Fixed-rate loans and borrowings 1,461.9 1,422.2 1,153.1 1,122.4<br />

Amounts due to banks 158.0 158.0 292.1 292.1<br />

Other short-term financing 16.9 16.9 14.8 14.8<br />

Purchase commitments on minority interests 63.7 63.7 71.4 71.4<br />

Trade receivables and payables are current assets and liabilities and are carried at amounts that are<br />

reasonable approximations of their fair value.<br />

Derivative instruments are measured and recognized at fair value. The fair value of interest-rate contracts is<br />

determined on the present value of cash flows using the zero coupon curve.<br />

The fair value of forward currency purchase contracts is based on the current exchange rates of contracts with<br />

similar maturity profiles.<br />

The fair value of foreign currency payables and receivables is determined using year-end exchange rates. The<br />

fair value of fixed-rate payables and receivables is based on a fixed rate with no credit margin, net of<br />

transaction costs directly related to the financial asset or liability.<br />

117<br />

www.italcementigroup.com