Report 2010 - Italcementi Group

Report 2010 - Italcementi Group

Report 2010 - Italcementi Group

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

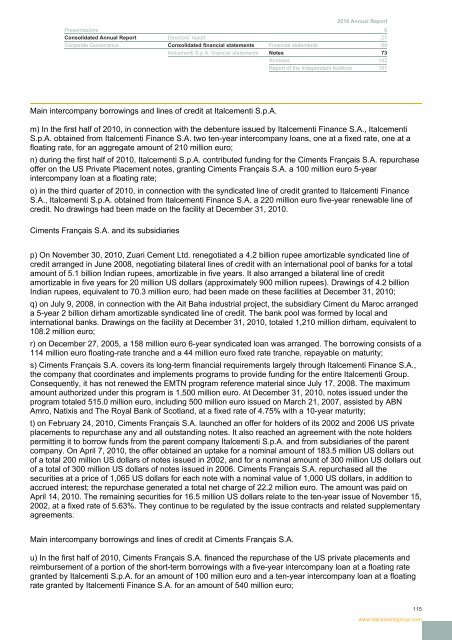

<strong>2010</strong> Annual <strong>Report</strong><br />

Presentazione 6<br />

Consolidated Annual <strong>Report</strong> Directors’ report 27<br />

Corporate Governance Consolidated financial statements Financial statements 68<br />

<strong>Italcementi</strong> S.p.A. financial statements Notes 73<br />

Annexes 142<br />

<strong>Report</strong> of the Independent Auditors 151<br />

Main intercompany borrowings and lines of credit at <strong>Italcementi</strong> S.p.A.<br />

m) In the first half of <strong>2010</strong>, in connection with the debenture issued by <strong>Italcementi</strong> Finance S.A., <strong>Italcementi</strong><br />

S.p.A. obtained from <strong>Italcementi</strong> Finance S.A. two ten-year intercompany loans, one at a fixed rate, one at a<br />

floating rate, for an aggregate amount of 210 million euro;<br />

n) during the first half of <strong>2010</strong>, <strong>Italcementi</strong> S.p.A. contributed funding for the Ciments Français S.A. repurchase<br />

offer on the US Private Placement notes, granting Ciments Français S.A. a 100 million euro 5-year<br />

intercompany loan at a floating rate;<br />

o) in the third quarter of <strong>2010</strong>, in connection with the syndicated line of credit granted to <strong>Italcementi</strong> Finance<br />

S.A., <strong>Italcementi</strong> S.p.A. obtained from <strong>Italcementi</strong> Finance S.A. a 220 million euro five-year renewable line of<br />

credit. No drawings had been made on the facility at December 31, <strong>2010</strong>.<br />

Ciments Français S.A. and its subsidiaries<br />

p) On November 30, <strong>2010</strong>, Zuari Cement Ltd. renegotiated a 4.2 billion rupee amortizable syndicated line of<br />

credit arranged in June 2008, negotiating bilateral lines of credit with an international pool of banks for a total<br />

amount of 5.1 billion Indian rupees, amortizable in five years. It also arranged a bilateral line of credit<br />

amortizable in five years for 20 million US dollars (approximately 900 million rupees). Drawings of 4.2 billion<br />

Indian rupees, equivalent to 70.3 million euro, had been made on these facilities at December 31, <strong>2010</strong>;<br />

q) on July 9, 2008, in connection with the Ait Baha industrial project, the subsidiary Ciment du Maroc arranged<br />

a 5-year 2 billion dirham amortizable syndicated line of credit. The bank pool was formed by local and<br />

international banks. Drawings on the facility at December 31, <strong>2010</strong>, totaled 1,210 million dirham, equivalent to<br />

108.2 million euro;<br />

r) on December 27, 2005, a 158 million euro 6-year syndicated loan was arranged. The borrowing consists of a<br />

114 million euro floating-rate tranche and a 44 million euro fixed rate tranche, repayable on maturity;<br />

s) Ciments Français S.A. covers its long-term financial requirements largely through <strong>Italcementi</strong> Finance S.A.,<br />

the company that coordinates and implements programs to provide funding for the entire <strong>Italcementi</strong> <strong>Group</strong>.<br />

Consequently, it has not renewed the EMTN program reference material since July 17, 2008. The maximum<br />

amount authorized under this program is 1,500 million euro. At December 31, <strong>2010</strong>, notes issued under the<br />

program totaled 515.0 million euro, including 500 million euro issued on March 21, 2007, assisted by ABN<br />

Amro, Natixis and The Royal Bank of Scotland, at a fixed rate of 4.75% with a 10-year maturity;<br />

t) on February 24, <strong>2010</strong>, Ciments Français S.A. launched an offer for holders of its 2002 and 2006 US private<br />

placements to repurchase any and all outstanding notes. It also reached an agreement with the note holders<br />

permitting it to borrow funds from the parent company <strong>Italcementi</strong> S.p.A. and from subsidiaries of the parent<br />

company. On April 7, <strong>2010</strong>, the offer obtained an uptake for a nominal amount of 183.5 million US dollars out<br />

of a total 200 million US dollars of notes issued in 2002, and for a nominal amount of 300 million US dollars out<br />

of a total of 300 million US dollars of notes issued in 2006. Ciments Français S.A. repurchased all the<br />

securities at a price of 1,065 US dollars for each note with a nominal value of 1,000 US dollars, in addition to<br />

accrued interest; the repurchase generated a total net charge of 22.2 million euro. The amount was paid on<br />

April 14, <strong>2010</strong>. The remaining securities for 16.5 million US dollars relate to the ten-year issue of November 15,<br />

2002, at a fixed rate of 5.63%. They continue to be regulated by the issue contracts and related supplementary<br />

agreements.<br />

Main intercompany borrowings and lines of credit at Ciments Français S.A.<br />

u) In the first half of <strong>2010</strong>, Ciments Français S.A. financed the repurchase of the US private placements and<br />

reimbursement of a portion of the short-term borrowings with a five-year intercompany loan at a floating rate<br />

granted by <strong>Italcementi</strong> S.p.A. for an amount of 100 million euro and a ten-year intercompany loan at a floating<br />

rate granted by <strong>Italcementi</strong> Finance S.A. for an amount of 540 million euro;<br />

115<br />

www.italcementigroup.com