Report 2010 - Italcementi Group

Report 2010 - Italcementi Group

Report 2010 - Italcementi Group

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

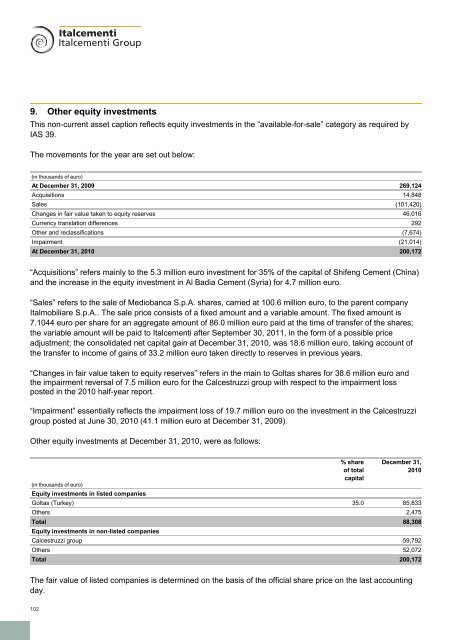

9. Other equity investments<br />

This non-current asset caption reflects equity investments in the “available-for-sale” category as required by<br />

IAS 39.<br />

The movements for the year are set out below:<br />

(in thousands of euro)<br />

At December 31, 2009 269,124<br />

Acquisitions 14,848<br />

Sales (101,420)<br />

Changes in fair value taken to equity reserves 46,016<br />

Currency translation differences 292<br />

Other and reclassifications (7,674)<br />

Impairment (21,014)<br />

At December 31, <strong>2010</strong> 200,172<br />

“Acquisitions” refers mainly to the 5.3 million euro investment for 35% of the capital of Shifeng Cement (China)<br />

and the increase in the equity investment in Al Badia Cement (Syria) for 4.7 million euro.<br />

“Sales” refers to the sale of Mediobanca S.p.A. shares, carried at 100.6 million euro, to the parent company<br />

Italmobiliare S.p.A.. The sale price consists of a fixed amount and a variable amount. The fixed amount is<br />

7.1044 euro per share for an aggregate amount of 86.0 million euro paid at the time of transfer of the shares;<br />

the variable amount will be paid to <strong>Italcementi</strong> after September 30, 2011, in the form of a possible price<br />

adjustment; the consolidated net capital gain at December 31, <strong>2010</strong>, was 18.6 million euro, taking account of<br />

the transfer to income of gains of 33.2 million euro taken directly to reserves in previous years.<br />

“Changes in fair value taken to equity reserves” refers in the main to Goltas shares for 38.6 million euro and<br />

the impairment reversal of 7.5 million euro for the Calcestruzzi group with respect to the impairment loss<br />

posted in the <strong>2010</strong> half-year report.<br />

“Impairment” essentially reflects the impairment loss of 19.7 million euro on the investment in the Calcestruzzi<br />

group posted at June 30, <strong>2010</strong> (41.1 million euro at December 31, 2009).<br />

Other equity investments at December 31, <strong>2010</strong>, were as follows:<br />

% share<br />

of total<br />

December 31,<br />

<strong>2010</strong><br />

capital<br />

(in thousands of euro)<br />

Equity investments in listed companies<br />

Goltas (Turkey) 35.0 85,833<br />

Others 2,475<br />

Total 88,308<br />

Equity investments in non-listed companies<br />

Calcestruzzi group 59,792<br />

Others 52,072<br />

Total 200,172<br />

The fair value of listed companies is determined on the basis of the official share price on the last accounting<br />

day.<br />

102