Report 2010 - Italcementi Group

Report 2010 - Italcementi Group

Report 2010 - Italcementi Group

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

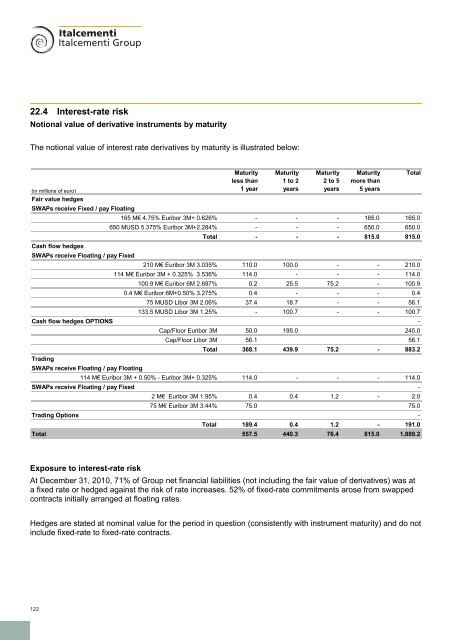

22.4 Interest-rate risk<br />

Notional value of derivative instruments by maturity<br />

The notional value of interest rate derivatives by maturity is illustrated below:<br />

Maturity Maturity Maturity Maturity Total<br />

less than 1 to 2 2 to 5 more than<br />

(in millions of euro)<br />

1 year years years 5 years<br />

Fair value hedges<br />

SWAPs receive Fixed / pay Floating<br />

165 M€ 4.75% Euribor 3M+ 0.626% - - - 165.0 165.0<br />

650 MUSD 5.375% Euribor 3M+2.284% - - - 650.0 650.0<br />

Total - - - 815.0 815.0<br />

Cash flow hedges<br />

SWAPs receive Floating / pay Fixed<br />

210 M€ Euribor 3M 3.035% 110.0 100.0 - - 210.0<br />

114 M€ Euribor 3M + 0.325% 3.536% 114.0 - - - 114.0<br />

100.9 M€ Euribor 6M 2.697% 0.2 25.5 75.2 - 100.9<br />

0.4 M€ Euribor 6M+0.50% 3.275% 0.4 - - - 0.4<br />

75 MUSD Libor 3M 2.06% 37.4 18.7 - - 56.1<br />

133.5 MUSD Libor 3M 1.25% - 100.7 - - 100.7<br />

Cash flow hedges OPTIONS -<br />

Cap/Floor Euribor 3M 50.0 195.0 245.0<br />

Cap/Floor Libor 3M 56.1 56.1<br />

Total 368.1 439.9 75.2 - 883.2<br />

Trading<br />

SWAPs receive Floating / pay Floating<br />

114 M€ Euribor 3M + 0.50% - Euribor 3M+ 0.325% 114.0 - - - 114.0<br />

SWAPs receive Floating / pay Fixed -<br />

2 M€ Euribor 3M 1.95% 0.4 0.4 1.2 - 2.0<br />

75 M€ Euribor 3M 3.44% 75.0 75.0<br />

Trading Options -<br />

Total 189.4 0.4 1.2 - 191.0<br />

Total 557.5 440.3 76.4 815.0 1,889.2<br />

Exposure to interest-rate risk<br />

At December 31, <strong>2010</strong>, 71% of <strong>Group</strong> net financial liabilities (not including the fair value of derivatives) was at<br />

a fixed rate or hedged against the risk of rate increases. 52% of fixed-rate commitments arose from swapped<br />

contracts initially arranged at floating rates.<br />

Hedges are stated at nominal value for the period in question (consistently with instrument maturity) and do not<br />

include fixed-rate to fixed-rate contracts.<br />

122