Report 2010 - Italcementi Group

Report 2010 - Italcementi Group

Report 2010 - Italcementi Group

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

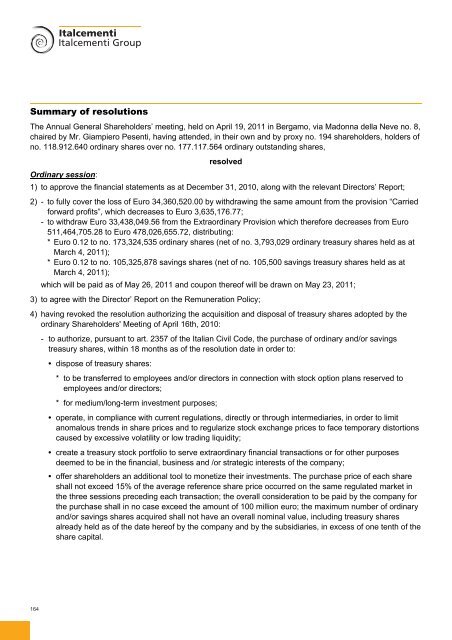

Summary of resolutions<br />

The Annual General Shareholders’ meeting, held on April 19, 2011 in Bergamo, via Madonna della Neve no. 8,<br />

chaired by Mr. Giampiero Pesenti, having attended, in their own and by proxy no. 194 shareholders, holders of<br />

no. 118.912.640 ordinary shares over no. 177.117.564 ordinary outstanding shares,<br />

resolved<br />

Ordinary session:<br />

1) to approve the financial statements as at December 31, <strong>2010</strong>, along with the relevant Directors’ <strong>Report</strong>;<br />

2) - to fully cover the loss of Euro 34,360,520.00 by withdrawing the same amount from the provision “Carried<br />

forward profits”, which decreases to Euro 3,635,176.77;<br />

- to withdraw Euro 33,438,049.56 from the Extraordinary Provision which therefore decreases from Euro<br />

511,464,705.28 to Euro 478,026,655.72, distributing:<br />

* Euro 0.12 to no. 173,324,535 ordinary shares (net of no. 3,793,029 ordinary treasury shares held as at<br />

March 4, 2011);<br />

* Euro 0.12 to no. 105,325,878 savings shares (net of no. 105,500 savings treasury shares held as at<br />

March 4, 2011);<br />

which will be paid as of May 26, 2011 and coupon thereof will be drawn on May 23, 2011;<br />

3) to agree with the Director’ <strong>Report</strong> on the Remuneration Policy;<br />

4) having revoked the resolution authorizing the acquisition and disposal of treasury shares adopted by the<br />

ordinary Shareholders' Meeting of April 16th, <strong>2010</strong>:<br />

- to authorize, pursuant to art. 2357 of the Italian Civil Code, the purchase of ordinary and/or savings<br />

treasury shares, within 18 months as of the resolution date in order to:<br />

• dispose of treasury shares:<br />

* to be transferred to employees and/or directors in connection with stock option plans reserved to<br />

employees and/or directors;<br />

* for medium/long-term investment purposes;<br />

• operate, in compliance with current regulations, directly or through intermediaries, in order to limit<br />

anomalous trends in share prices and to regularize stock exchange prices to face temporary distortions<br />

caused by excessive volatility or low trading liquidity;<br />

• create a treasury stock portfolio to serve extraordinary financial transactions or for other purposes<br />

deemed to be in the financial, business and /or strategic interests of the company;<br />

• offer shareholders an additional tool to monetize their investments. The purchase price of each share<br />

shall not exceed 15% of the average reference share price occurred on the same regulated market in<br />

the three sessions preceding each transaction; the overall consideration to be paid by the company for<br />

the purchase shall in no case exceed the amount of 100 million euro; the maximum number of ordinary<br />

and/or savings shares acquired shall not have an overall nominal value, including treasury shares<br />

already held as of the date hereof by the company and by the subsidiaries, in excess of one tenth of the<br />

share capital.<br />

164