Report 2010 - Italcementi Group

Report 2010 - Italcementi Group

Report 2010 - Italcementi Group

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>2010</strong> Annual <strong>Report</strong><br />

Presentazione 6<br />

Consolidated Annual <strong>Report</strong> Directors’ report 27<br />

Corporate Governance Consolidated financial statements Financial statements 68<br />

<strong>Italcementi</strong> S.p.A. financial statements Notes 73<br />

Annexes 142<br />

<strong>Report</strong> of the Independent Auditors 151<br />

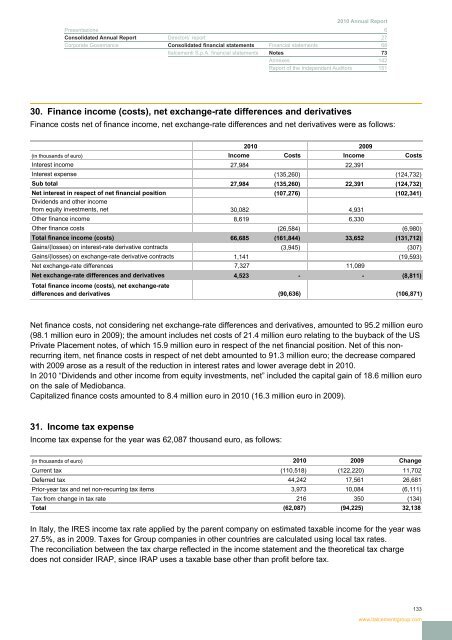

30. Finance income (costs), net exchange-rate differences and derivatives<br />

Finance costs net of finance income, net exchange-rate differences and net derivatives were as follows:<br />

<strong>2010</strong> 2009<br />

(in thousands of euro) Income Costs Income Costs<br />

Interest income 27,984 22,391<br />

Interest expense (135,260) (124,732)<br />

Sub total 27,984 (135,260) 22,391 (124,732)<br />

Net interest in respect of net financial position (107,276) (102,341)<br />

Dividends and other income<br />

from equity investments, net 30,082 4,931<br />

Other finance income 8,619 6,330<br />

Other finance costs (26,584) (6,980)<br />

Total finance income (costs) 66,685 (161,844) 33,652 (131,712)<br />

Gains/(losses) on interest-rate derivative contracts (3,945) (307)<br />

Gains/(losses) on exchange-rate derivative contracts 1,141 (19,593)<br />

Net exchange-rate differences 7,327 11,089<br />

Net exchange-rate differences and derivatives 4,523 - - (8,811)<br />

Total finance income (costs), net exchange-rate<br />

differences and derivatives (90,636) (106,871)<br />

Net finance costs, not considering net exchange-rate differences and derivatives, amounted to 95.2 million euro<br />

(98.1 million euro in 2009); the amount includes net costs of 21.4 million euro relating to the buyback of the US<br />

Private Placement notes, of which 15.9 million euro in respect of the net financial position. Net of this nonrecurring<br />

item, net finance costs in respect of net debt amounted to 91.3 million euro; the decrease compared<br />

with 2009 arose as a result of the reduction in interest rates and lower average debt in <strong>2010</strong>.<br />

In <strong>2010</strong> “Dividends and other income from equity investments, net” included the capital gain of 18.6 million euro<br />

on the sale of Mediobanca.<br />

Capitalized finance costs amounted to 8.4 million euro in <strong>2010</strong> (16.3 million euro in 2009).<br />

31. Income tax expense<br />

Income tax expense for the year was 62,087 thousand euro, as follows:<br />

(in thousands of euro) <strong>2010</strong> 2009 Change<br />

Current tax (110,518) (122,220) 11,702<br />

Deferred tax 44,242 17,561 26,681<br />

Prior-year tax and net non-recurring tax items 3,973 10,084 (6,111)<br />

Tax from change in tax rate 216 350 (134)<br />

Total (62,087) (94,225) 32,138<br />

In Italy, the IRES income tax rate applied by the parent company on estimated taxable income for the year was<br />

27.5%, as in 2009. Taxes for <strong>Group</strong> companies in other countries are calculated using local tax rates.<br />

The reconciliation between the tax charge reflected in the income statement and the theoretical tax charge<br />

does not consider IRAP, since IRAP uses a taxable base other than profit before tax.<br />

133<br />

www.italcementigroup.com