Report 2010 - Italcementi Group

Report 2010 - Italcementi Group

Report 2010 - Italcementi Group

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>2010</strong> Annual <strong>Report</strong><br />

Presentazione 6<br />

Consolidated Annual <strong>Report</strong> Directors’ report 27<br />

Corporate Governance Consolidated financial statements Financial statements 68<br />

<strong>Italcementi</strong> S.p.A. financial statements Notes 73<br />

Annexes 142<br />

<strong>Report</strong> of the Independent Auditors 151<br />

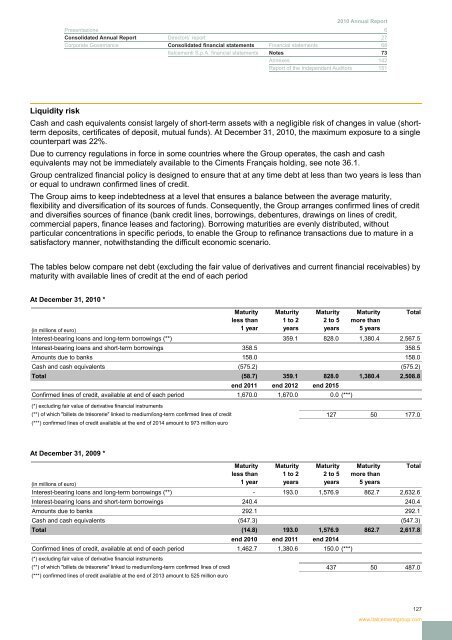

Liquidity risk<br />

Cash and cash equivalents consist largely of short-term assets with a negligible risk of changes in value (shortterm<br />

deposits, certificates of deposit, mutual funds). At December 31, <strong>2010</strong>, the maximum exposure to a single<br />

counterpart was 22%.<br />

Due to currency regulations in force in some countries where the <strong>Group</strong> operates, the cash and cash<br />

equivalents may not be immediately available to the Ciments Français holding, see note 36.1.<br />

<strong>Group</strong> centralized financial policy is designed to ensure that at any time debt at less than two years is less than<br />

or equal to undrawn confirmed lines of credit.<br />

The <strong>Group</strong> aims to keep indebtedness at a level that ensures a balance between the average maturity,<br />

flexibility and diversification of its sources of funds. Consequently, the <strong>Group</strong> arranges confirmed lines of credit<br />

and diversifies sources of finance (bank credit lines, borrowings, debentures, drawings on lines of credit,<br />

commercial papers, finance leases and factoring). Borrowing maturities are evenly distributed, without<br />

particular concentrations in specific periods, to enable the <strong>Group</strong> to refinance transactions due to mature in a<br />

satisfactory manner, notwithstanding the difficult economic scenario.<br />

The tables below compare net debt (excluding the fair value of derivatives and current financial receivables) by<br />

maturity with available lines of credit at the end of each period<br />

At December 31, <strong>2010</strong> *<br />

Maturity Maturity Maturity Maturity Total<br />

less than 1 to 2 2 to 5 more than<br />

(in millions of euro)<br />

1 year years years 5 years<br />

Interest-bearing loans and long-term borrowings (**) 359.1 828.0 1,380.4 2,567.5<br />

Interest-bearing loans and short-term borrowings 358.5 358.5<br />

Amounts due to banks 158.0 158.0<br />

Cash and cash equivalents (575.2) (575.2)<br />

Total (58.7) 359.1 828.0 1,380.4 2,508.8<br />

end 2011 end 2012 end 2015<br />

Confirmed lines of credit, available at end of each period 1,670.0 1,670.0 0.0 (***)<br />

(*) excluding fair value of derivative financial instruments<br />

(**) of which "billets de trésorerie" linked to medium/long-term confirmed lines of credit<br />

(***) confirmed lines of credit available at the end of 2014 amount to 973 million euro<br />

127 50 177.0<br />

At December 31, 2009 *<br />

Maturity Maturity Maturity Maturity Total<br />

less than 1 to 2 2 to 5 more than<br />

(in millions of euro)<br />

1 year years years 5 years<br />

Interest-bearing loans and long-term borrowings (**) - 193.0 1,576.9 862.7 2,632.6<br />

Interest-bearing loans and short-term borrowings 240.4 240.4<br />

Amounts due to banks 292.1 292.1<br />

Cash and cash equivalents (547.3) (547.3)<br />

Total (14.8) 193.0 1,576.9 862.7 2,617.8<br />

end <strong>2010</strong> end 2011 end 2014<br />

Confirmed lines of credit, available at end of each period 1,462.7 1,380.6 150.0 (***)<br />

(*) excluding fair value of derivative financial instruments<br />

(**) of which "billets de trésorerie" linked to medium/long-term confirmed lines of credi<br />

(***) confirmed lines of credit available at the end of 2013 amount to 525 million euro<br />

437 50 487.0<br />

127<br />

www.italcementigroup.com