Report 2010 - Italcementi Group

Report 2010 - Italcementi Group

Report 2010 - Italcementi Group

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

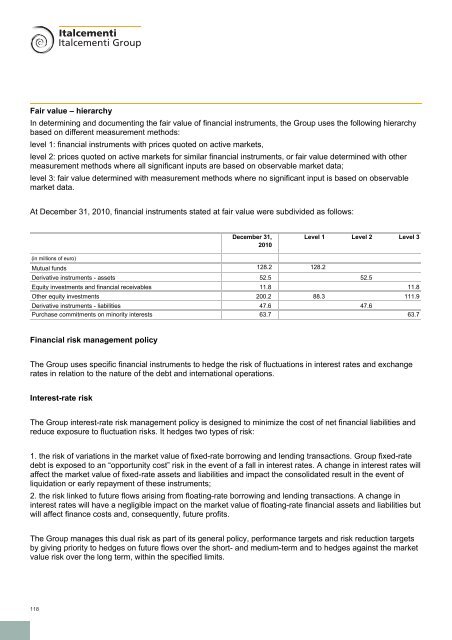

Fair value – hierarchy<br />

In determining and documenting the fair value of financial instruments, the <strong>Group</strong> uses the following hierarchy<br />

based on different measurement methods:<br />

level 1: financial instruments with prices quoted on active markets,<br />

level 2: prices quoted on active markets for similar financial instruments, or fair value determined with other<br />

measurement methods where all significant inputs are based on observable market data;<br />

level 3: fair value determined with measurement methods where no significant input is based on observable<br />

market data.<br />

At December 31, <strong>2010</strong>, financial instruments stated at fair value were subdivided as follows:<br />

December 31,<br />

<strong>2010</strong><br />

Level 1 Level 2 Level 3<br />

(in millions of euro)<br />

Mutual funds 128.2 128.2<br />

Derivative instruments - assets 52.5 52.5<br />

Equity investments and financial receivables 11.8 11.8<br />

Other equity investments 200.2 88.3 111.9<br />

Derivative instruments - liabilities 47.6 47.6<br />

Purchase commitments on minority interests 63.7 63.7<br />

Financial risk management policy<br />

The <strong>Group</strong> uses specific financial instruments to hedge the risk of fluctuations in interest rates and exchange<br />

rates in relation to the nature of the debt and international operations.<br />

Interest-rate risk<br />

The <strong>Group</strong> interest-rate risk management policy is designed to minimize the cost of net financial liabilities and<br />

reduce exposure to fluctuation risks. It hedges two types of risk:<br />

1. the risk of variations in the market value of fixed-rate borrowing and lending transactions. <strong>Group</strong> fixed-rate<br />

debt is exposed to an “opportunity cost” risk in the event of a fall in interest rates. A change in interest rates will<br />

affect the market value of fixed-rate assets and liabilities and impact the consolidated result in the event of<br />

liquidation or early repayment of these instruments;<br />

2. the risk linked to future flows arising from floating-rate borrowing and lending transactions. A change in<br />

interest rates will have a negligible impact on the market value of floating-rate financial assets and liabilities but<br />

will affect finance costs and, consequently, future profits.<br />

The <strong>Group</strong> manages this dual risk as part of its general policy, performance targets and risk reduction targets<br />

by giving priority to hedges on future flows over the short- and medium-term and to hedges against the market<br />

value risk over the long term, within the specified limits.<br />

118