Bahamas - FirstCaribbean International Bank

Bahamas - FirstCaribbean International Bank

Bahamas - FirstCaribbean International Bank

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

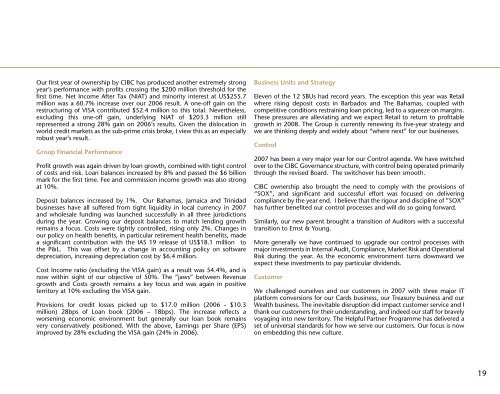

Our first year of ownership by CIBC has produced another extremely strong<br />

year’s performance with profits crossing the $200 million threshold for the<br />

first time. Net Income After Tax (NIAT) and minority interest at US$255.7<br />

million was a 60.7% increase over our 2006 result. A one-off gain on the<br />

restructuring of VISA contributed $52.4 million to this total. Nevertheless,<br />

excluding this one-off gain, underlying NIAT of $203.3 million still<br />

represented a strong 28% gain on 2006’s results. Given the dislocation in<br />

world credit markets as the sub-prime crisis broke, I view this as an especially<br />

robust year’s result.<br />

Group Financial Performance<br />

Profit growth was again driven by loan growth, combined with tight control<br />

of costs and risk. Loan balances increased by 8% and passed the $6 billion<br />

mark for the first time. Fee and commission income growth was also strong<br />

at 10%.<br />

Deposit balances increased by 1%. Our <strong>Bahamas</strong>, Jamaica and Trinidad<br />

businesses have all suffered from tight liquidity in local currency in 2007<br />

and wholesale funding was launched successfully in all three jurisdictions<br />

during the year. Growing our deposit balances to match lending growth<br />

remains a focus. Costs were tightly controlled, rising only 2%. Changes in<br />

our policy on health benefits, in particular retirement health benefits, made<br />

a significant contribution with the IAS 19 release of US$18.1 million to<br />

the P&L. This was offset by a change in accounting policy on software<br />

depreciation, increasing depreciation cost by $6.4 million.<br />

Cost Income ratio (excluding the VISA gain) as a result was 54.4%, and is<br />

now within sight of our objective of 50%. The “jaws” between Revenue<br />

growth and Costs growth remains a key focus and was again in positive<br />

territory at 10% excluding the VISA gain.<br />

Provisions for credit losses picked up to $17.0 million (2006 - $10.3<br />

million) 28bps of Loan book (2006 – 18bps). The increase reflects a<br />

worsening economic environment but generally our loan book remains<br />

very conservatively positioned. With the above, Earnings per Share (EPS)<br />

improved by 28% excluding the VISA gain (24% in 2006).<br />

Business Units and Strategy<br />

Eleven of the 12 SBUs had record years. The exception this year was Retail<br />

where rising deposit costs in Barbados and The <strong>Bahamas</strong>, coupled with<br />

competitive conditions restraining loan pricing, led to a squeeze on margins.<br />

These pressures are alleviating and we expect Retail to return to profitable<br />

growth in 2008. The Group is currently renewing its five-year strategy and<br />

we are thinking deeply and widely about “where next” for our businesses.<br />

Control<br />

2007 has been a very major year for our Control agenda. We have switched<br />

over to the CIBC Governance structure, with control being operated primarily<br />

through the revised Board. The switchover has been smooth.<br />

CIBC ownership also brought the need to comply with the provisions of<br />

“SOX”, and significant and successful effort was focused on delivering<br />

compliance by the year end. I believe that the rigour and discipline of ”SOX”<br />

has further benefited our control processes and will do so going forward.<br />

Similarly, our new parent brought a transition of Auditors with a successful<br />

transition to Ernst & Young.<br />

More generally we have continued to upgrade our control processes with<br />

major investments in Internal Audit, Compliance, Market Risk and Operational<br />

Risk during the year. As the economic environment turns downward we<br />

expect these investments to pay particular dividends.<br />

Customer<br />

We challenged ourselves and our customers in 2007 with three major IT<br />

platform conversions for our Cards business, our Treasury business and our<br />

Wealth business. The inevitable disruption did impact customer service and I<br />

thank our customers for their understanding, and indeed our staff for bravely<br />

voyaging into new territory. The Helpful Partner Programme has delivered a<br />

set of universal standards for how we serve our customers. Our focus is now<br />

on embedding this new culture.<br />

19