Bahamas - FirstCaribbean International Bank

Bahamas - FirstCaribbean International Bank

Bahamas - FirstCaribbean International Bank

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Notes to the Consolidated Financial Statements<br />

October 31, 2007<br />

(expressed in thousands of Bahamian dollars)<br />

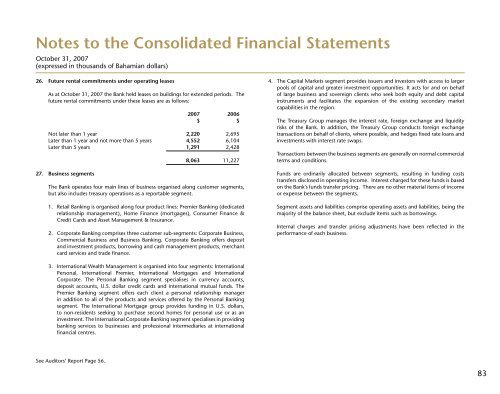

26. Future rental commitments under operating leases<br />

As at October 31, 2007 the <strong>Bank</strong> held leases on buildings for extended periods. The<br />

future rental commitments under these leases are as follows:<br />

2007 2006<br />

$ $<br />

Not later than 1 year 2,220 2,695<br />

Later than 1 year and not more than 5 years 4,552 6,104<br />

Later than 5 years 1,291 2,428<br />

27. Business segments<br />

8,063 11,227<br />

The <strong>Bank</strong> operates four main lines of business organised along customer segments,<br />

but also includes treasury operations as a reportable segment.<br />

1. Retail <strong>Bank</strong>ing is organised along four product lines: Premier <strong>Bank</strong>ing (dedicated<br />

relationship management), Home Finance (mortgages), Consumer Finance &<br />

Credit Cards and Asset Management & Insurance.<br />

2. Corporate <strong>Bank</strong>ing comprises three customer sub-segments: Corporate Business,<br />

Commercial Business and Business <strong>Bank</strong>ing. Corporate <strong>Bank</strong>ing offers deposit<br />

and investment products, borrowing and cash management products, merchant<br />

card services and trade finance.<br />

4. The Capital Markets segment provides issuers and investors with access to larger<br />

pools of capital and greater investment opportunities. It acts for and on behalf<br />

of large business and sovereign clients who seek both equity and debt capital<br />

instruments and facilitates the expansion of the existing secondary market<br />

capabilities in the region.<br />

The Treasury Group manages the interest rate, foreign exchange and liquidity<br />

risks of the <strong>Bank</strong>. In addition, the Treasury Group conducts foreign exchange<br />

transactions on behalf of clients, where possible, and hedges fixed rate loans and<br />

investments with interest rate swaps.<br />

Transactions between the business segments are generally on normal commercial<br />

terms and conditions.<br />

Funds are ordinarily allocated between segments, resulting in funding costs<br />

transfers disclosed in operating income. Interest charged for these funds is based<br />

on the <strong>Bank</strong>’s funds transfer pricing. There are no other material items of income<br />

or expense between the segments.<br />

Segment assets and liabilities comprise operating assets and liabilities, being the<br />

majority of the balance sheet, but exclude items such as borrowings.<br />

Internal charges and transfer pricing adjustments have been reflected in the<br />

performance of each business.<br />

3. <strong>International</strong> Wealth Management is organised into four segments: <strong>International</strong><br />

Personal, <strong>International</strong> Premier, <strong>International</strong> Mortgages and <strong>International</strong><br />

Corporate. The Personal <strong>Bank</strong>ing segment specialises in currency accounts,<br />

deposit accounts, U.S. dollar credit cards and international mutual funds. The<br />

Premier <strong>Bank</strong>ing segment offers each client a personal relationship manager<br />

in addition to all of the products and services offered by the Personal <strong>Bank</strong>ing<br />

segment. The <strong>International</strong> Mortgage group provides funding in U.S. dollars,<br />

to non-residents seeking to purchase second homes for personal use or as an<br />

investment. The <strong>International</strong> Corporate <strong>Bank</strong>ing segment specialises in providing<br />

banking services to businesses and professional intermediaries at international<br />

financial centres.<br />

See Auditors’ Report Page 56.<br />

83