Bahamas - FirstCaribbean International Bank

Bahamas - FirstCaribbean International Bank

Bahamas - FirstCaribbean International Bank

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

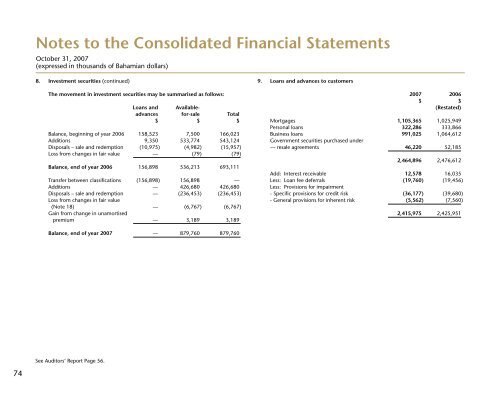

Notes to the Consolidated Financial Statements<br />

October 31, 2007<br />

(expressed in thousands of Bahamian dollars)<br />

8. Investment securities (continued)<br />

The movement in investment securities may be summarised as follows:<br />

Loans and Availableadvances<br />

for-sale Total<br />

$ $ $<br />

Balance, beginning of year 2006 158,523 7,500 166,023<br />

Additions 9,350 533,774 543,124<br />

Disposals – sale and redemption (10,975) (4,982) (15,957)<br />

Loss from changes in fair value — (79) (79)<br />

Balance, end of year 2006 156,898 536,213 693,111<br />

Transfer between classifications (156,898) 156,898 —<br />

Additions — 426,680 426,680<br />

Disposals – sale and redemption — (236,453) (236,453)<br />

Loss from changes in fair value<br />

(Note 18) — (6,767) (6,767)<br />

Gain from change in unamortised<br />

premium — 3,189 3,189<br />

9. Loans and advances to customers<br />

2007 2006<br />

$ $<br />

(Restated)<br />

Mortgages 1,105,365 1,025,949<br />

Personal loans 322,286 333,866<br />

Business loans 991,025 1,064,612<br />

Government securities purchased under<br />

— resale agreements 46,220 52,185<br />

2,464,896 2,476,612<br />

Add: Interest receivable 12,578 16,035<br />

Less: Loan fee deferrals (19,760) (19,456)<br />

Less: Provisions for impairment<br />

- Specific provisions for credit risk (36,177) (39,680)<br />

- General provisions for inherent risk (5,562) (7,560)<br />

2,415,975 2,425,951<br />

Balance, end of year 2007 — 879,760 879,760<br />

See Auditors’ Report Page 56.<br />

74