Bahamas - FirstCaribbean International Bank

Bahamas - FirstCaribbean International Bank

Bahamas - FirstCaribbean International Bank

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

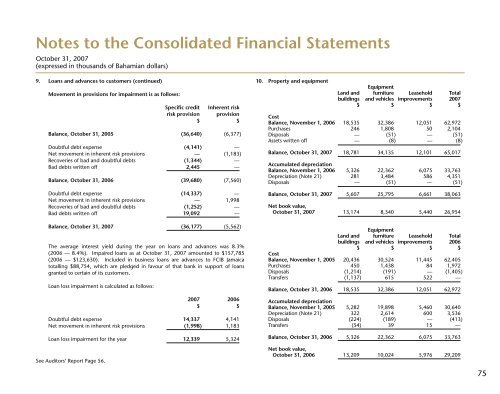

Notes to the Consolidated Financial Statements<br />

October 31, 2007<br />

(expressed in thousands of Bahamian dollars)<br />

9. Loans and advances to customers (continued)<br />

Movement in provisions for impairment is as follows:<br />

Specific credit Inherent risk<br />

risk provision provision<br />

$ $<br />

Balance, October 31, 2005 (36,640) (6,377)<br />

Doubtful debt expense (4,141) —<br />

Net movement in inherent risk provisions — (1,183)<br />

Recoveries of bad and doubtful debts (1,344) —<br />

Bad debts written off 2,445 —<br />

Balance, October 31, 2006 (39,680) (7,560)<br />

Doubtful debt expense (14,337) —<br />

Net movement in inherent risk provisions — 1,998<br />

Recoveries of bad and doubtful debts (1,252) —<br />

Bad debts written off 19,092 —<br />

Balance, October 31, 2007 (36,177) (5,562)<br />

The average interest yield during the year on loans and advances was 8.3%<br />

(2006 — 8.4%). Impaired loans as at October 31, 2007 amounted to $157,785<br />

(2006 — $123,630). Included in business loans are advances to FCIB Jamaica<br />

totalling $88,754, which are pledged in favour of that bank in support of loans<br />

granted to certain of its customers.<br />

Loan loss impairment is calculated as follows:<br />

2007 2006<br />

$ $<br />

Doubtful debt expense 14,337 4,141<br />

Net movement in inherent risk provisions (1,998) 1,183<br />

Loan loss impairment for the year 12,339 5,324<br />

See Auditors’ Report Page 56.<br />

10. Property and equipment<br />

Equipment<br />

Land and furniture Leasehold Total<br />

buildings and vehicles improvements 2007<br />

$ $ $ $<br />

Cost<br />

Balance, November 1, 2006 18,535 32,386 12,051 62,972<br />

Purchases 246 1,808 50 2,104<br />

Disposals — (51) — (51)<br />

Assets written off — (8) — (8)<br />

Balance, October 31, 2007 18,781 34,135 12,101 65,017<br />

Accumulated depreciation<br />

Balance, November 1, 2006 5,326 22,362 6,075 33,763<br />

Depreciation (Note 21) 281 3,484 586 4,351<br />

Disposals — (51) — (51)<br />

Balance, October 31, 2007 5,607 25,795 6,661 38,063<br />

Net book value,<br />

October 31, 2007 13,174 8,340 5,440 26,954<br />

Equipment<br />

Land and furniture Leasehold Total<br />

buildings and vehicles improvements 2006<br />

$ $ $ $<br />

Cost<br />

Balance, November 1, 2005 20,436 30,524 11,445 62,405<br />

Purchases 450 1,438 84 1,972<br />

Disposals (1,214) (191) — (1,405)<br />

Transfers (1,137) 615 522 —<br />

Balance, October 31, 2006 18,535 32,386 12,051 62,972<br />

Accumulated depreciation<br />

Balance, November 1, 2005 5,282 19,898 5,460 30,640<br />

Depreciation (Note 21) 322 2,614 600 3,536<br />

Disposals (224) (189) — (413)<br />

Transfers (54) 39 15 —<br />

Balance, October 31, 2006 5,326 22,362 6,075 33,763<br />

Net book value,<br />

October 31, 2006 13,209 10,024 5,976 29,209<br />

75