Bahamas - FirstCaribbean International Bank

Bahamas - FirstCaribbean International Bank

Bahamas - FirstCaribbean International Bank

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

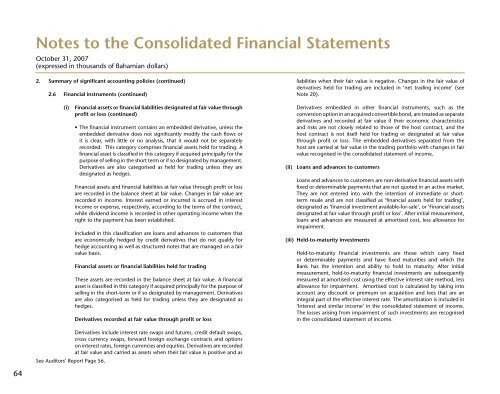

Notes to the Consolidated Financial Statements<br />

October 31, 2007<br />

(expressed in thousands of Bahamian dollars)<br />

2. Summary of significant accounting policies (continued)<br />

2.6 Financial instruments (continued)<br />

liabilities when their fair value is negative. Changes in the fair value of<br />

derivatives held for trading are included in ‘net trading income’ (see<br />

Note 20).<br />

(i)<br />

Financial assets or financial liabilities designated at fair value through<br />

profit or loss (continued)<br />

• The financial instrument contains an embedded derivative, unless the<br />

embedded derivative does not significantly modify the cash flows or<br />

it is clear, with little or no analysis, that it would not be separately<br />

recorded. This category comprises financial assets held for trading. A<br />

financial asset is classified in this category if acquired principally for the<br />

purpose of selling in the short term or if so designated by management.<br />

Derivatives are also categorised as held for trading unless they are<br />

designated as hedges.<br />

Financial assets and financial liabilities at fair value through profit or loss<br />

are recorded in the balance sheet at fair value. Changes in fair value are<br />

recorded in income. Interest earned or incurred is accrued in interest<br />

income or expense, respectively, according to the terms of the contract,<br />

while dividend income is recorded in other operating income when the<br />

right to the payment has been established.<br />

Included in this classification are loans and advances to customers that<br />

are economically hedged by credit derivatives that do not qualify for<br />

hedge accounting as well as structured notes that are managed on a fair<br />

value basis.<br />

Financial assets or financial liabilities held for trading<br />

These assets are recorded in the balance sheet at fair value. A financial<br />

asset is classified in this category if acquired principally for the purpose of<br />

selling in the short-term or if so designated by management. Derivatives<br />

are also categorised as held for trading unless they are designated as<br />

hedges.<br />

Derivatives recorded at fair value through profit or loss<br />

Derivatives embedded in other financial instruments, such as the<br />

conversion option in an acquired convertible bond, are treated as separate<br />

derivatives and recorded at fair value if their economic characteristics<br />

and risks are not closely related to those of the host contract, and the<br />

host contract is not itself held for trading or designated at fair value<br />

through profit or loss. The embedded derivatives separated from the<br />

host are carried at fair value in the trading portfolio with changes in fair<br />

value recognised in the consolidated statement of income.<br />

(ii) Loans and advances to customers<br />

Loans and advances to customers are non-derivative financial assets with<br />

fixed or determinable payments that are not quoted in an active market.<br />

They are not entered into with the intention of immediate or shortterm<br />

resale and are not classified as ‘financial assets held for trading’,<br />

designated as ‘financial investment available-for-sale’, or ‘Financial assets<br />

designated at fair value through profit or loss’. After initial measurement,<br />

loans and advances are measured at amortised cost, less allowance for<br />

impairment.<br />

(iii) Held-to-maturity investments<br />

Held-to-maturity financial investments are those which carry fixed<br />

or determinable payments and have fixed maturities and which the<br />

<strong>Bank</strong> has the intention and ability to hold to maturity. After initial<br />

measurement, held-to-maturity financial investments are subsequently<br />

measured at amortised cost using the effective interest rate method, less<br />

allowance for impairment. Amortised cost is calculated by taking into<br />

account any discount or premium on acquisition and fees that are an<br />

integral part of the effective interest rate. The amortisation is included in<br />

‘Interest and similar income’ in the consolidated statement of income.<br />

The losses arising from impairment of such investments are recognised<br />

in the consolidated statement of income.<br />

64<br />

Derivatives include interest rate swaps and futures, credit default swaps,<br />

cross currency swaps, forward foreign exchange contracts and options<br />

on interest rates, foreign currencies and equities. Derivatives are recorded<br />

at fair value and carried as assets when their fair value is positive and as<br />

See Auditors’ Report Page 56.