Bahamas - FirstCaribbean International Bank

Bahamas - FirstCaribbean International Bank

Bahamas - FirstCaribbean International Bank

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Management’s Discussion and Analysis<br />

Of Operating Results and Financial Condition for the Fiscal Year Ended October 31, 2007<br />

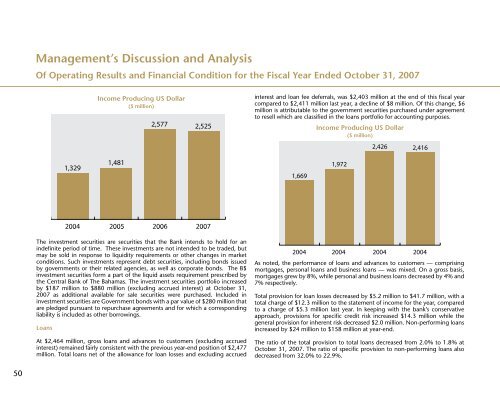

Income Producing US Dollar<br />

($ million)<br />

interest and loan fee deferrals, was $2,403 million at the end of this fiscal year<br />

compared to $2,411 million last year, a decline of $8 million. Of this change, $6<br />

million is attributable to the government securities purchased under agreement<br />

to resell which are classified in the loans portfolio for accounting purposes.<br />

Income Producing US Dollar<br />

($ million)<br />

The investment securities are securities that the <strong>Bank</strong> intends to hold for an<br />

indefinite period of time. These investments are not intended to be traded, but<br />

may be sold in response to liquidity requirements or other changes in market<br />

conditions. Such investments represent debt securities, including bonds issued<br />

by governments or their related agencies, as well as corporate bonds. The B$<br />

investment securities form a part of the liquid assets requirement prescribed by<br />

the Central <strong>Bank</strong> of The <strong>Bahamas</strong>. The investment securities portfolio increased<br />

by $187 million to $880 million (excluding accrued interest) at October 31,<br />

2007 as additional available for sale securities were purchased. Included in<br />

investment securities are Government bonds with a par value of $280 million that<br />

are pledged pursuant to repurchase agreements and for which a corresponding<br />

liability is included as other borrowings.<br />

Loans<br />

At $2,464 million, gross loans and advances to customers (excluding accrued<br />

interest) remained fairly consistent with the previous year-end position of $2,477<br />

million. Total loans net of the allowance for loan losses and excluding accrued<br />

As noted, the performance of loans and advances to customers — comprising<br />

mortgages, personal loans and business loans — was mixed. On a gross basis,<br />

mortgages grew by 8%, while personal and business loans decreased by 4% and<br />

7% respectively.<br />

Total provision for loan losses decreased by $5.2 million to $41.7 million, with a<br />

total charge of $12.3 million to the statement of income for the year, compared<br />

to a charge of $5.3 million last year. In keeping with the bank’s conservative<br />

approach, provisions for specific credit risk increased $14.3 million while the<br />

general provision for inherent risk decreased $2.0 million. Non-performing loans<br />

increased by $24 million to $158 million at year-end.<br />

The ratio of the total provision to total loans decreased from 2.0% to 1.8% at<br />

October 31, 2007. The ratio of specific provision to non-performing loans also<br />

decreased from 32.0% to 22.9%.<br />

50