Bahamas - FirstCaribbean International Bank

Bahamas - FirstCaribbean International Bank

Bahamas - FirstCaribbean International Bank

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Management’s Discussion and Analysis<br />

Of Operating Results and Financial Condition for the Fiscal Year Ended October 31, 2007<br />

Other Operating Income<br />

Other operating income consists of all revenues not classified as interest income.<br />

Revenues in this category increased $14.3 million, or 80% over the previous<br />

year. Driving the improved result was the significant improvement in financial<br />

performance of interest rate instruments. The losses for the current year were<br />

$5.5 million, compared to $13.7 million recorded for the previous year. Similarly,<br />

gains from investment securities were $4.5 million in fiscal 2007 compared to a<br />

loss of $0.180 million in the prior year. The improvement in operating income<br />

reflects a change in the <strong>Bank</strong>’s strategy to shift from interest-bearing assets to<br />

other types of investments such as mutual funds (outsourced portfolios), where<br />

financial performance is reflected in other operating income as opposed to NII.<br />

This shift in strategy explains the uneven rate of change in interest expenses<br />

relative to that of total interest income.<br />

Gains on foreign exchange transactions were $13.0 million, versus $13.2 million<br />

in the previous year.<br />

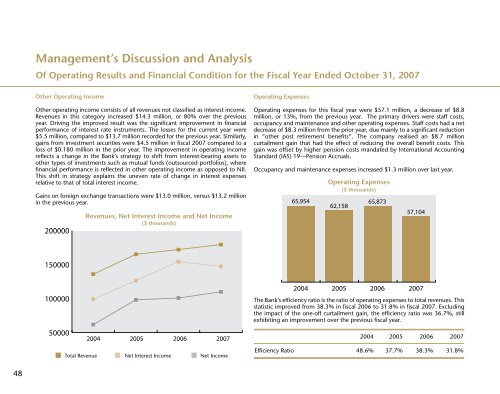

Operating Expenses<br />

Operating expenses for this fiscal year were $57.1 million, a decrease of $8.8<br />

million, or 13%, from the previous year. The primary drivers were staff costs,<br />

occupancy and maintenance and other operating expenses. Staff costs had a net<br />

decrease of $8.3 million from the prior year, due mainly to a significant reduction<br />

in “other post retirement benefits”. The company realised an $8.7 million<br />

curtailment gain that had the effect of reducing the overall benefit costs. This<br />

gain was offset by higher pension costs mandated by <strong>International</strong> Accounting<br />

Standard (IAS) 19—Pension Accruals.<br />

Occupancy and maintenance expenses increased $1.3 million over last year.<br />

Operating Expenses<br />

($ thousands)<br />

Revenues, Net Interest Income and Net Income<br />

($ thousands)<br />

The <strong>Bank</strong>’s efficiency ratio is the ratio of operating expenses to total revenues. This<br />

statistic improved from 38.3% in fiscal 2006 to 31.8% in fiscal 2007. Excluding<br />

the impact of the one-off curtailment gain, the efficiency ratio was 36.7%, still<br />

exhibiting an improvement over the previous fiscal year.<br />

2004 2005 2006 2007<br />

Total Revenue Net Interest Income Net Income<br />

Efficiency Ratio 48.6% 37.7% 38.3% 31.8%<br />

48