Bahamas - FirstCaribbean International Bank

Bahamas - FirstCaribbean International Bank

Bahamas - FirstCaribbean International Bank

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Notes to the Consolidated Financial Statements<br />

October 31, 2007<br />

(expressed in thousands of Bahamian dollars)<br />

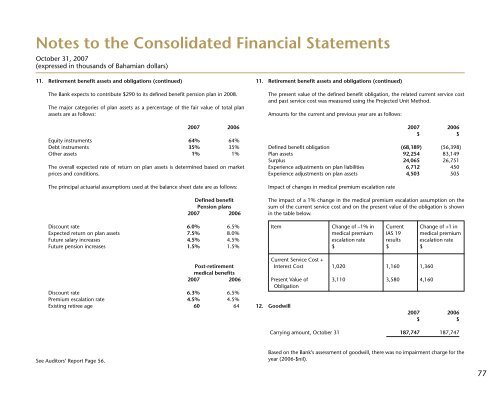

11. Retirement benefit assets and obligations (continued)<br />

The <strong>Bank</strong> expects to contribute $290 to its defined benefit pension plan in 2008.<br />

The major categories of plan assets as a percentage of the fair value of total plan<br />

assets are as follows:<br />

2007 2006<br />

Equity instruments 64% 64%<br />

Debt instruments 35% 35%<br />

Other assets 1% 1%<br />

The overall expected rate of return on plan assets is determined based on market<br />

prices and conditions.<br />

The principal actuarial assumptions used at the balance sheet date are as follows:<br />

Defined benefit<br />

Pension plans<br />

2007 2006<br />

Discount rate 6.0% 6.5%<br />

Expected return on plan assets 7.5% 8.0%<br />

Future salary increases 4.5% 4.5%<br />

Future pension increases 1.5% 1.5%<br />

Post-retirement<br />

medical benefits<br />

2007 2006<br />

Discount rate 6.3% 6.5%<br />

Premium escalation rate 4.5% 4.5%<br />

Existing retiree age 60 64<br />

11. Retirement benefit assets and obligations (continued)<br />

The present value of the defined benefit obligation, the related current service cost<br />

and past service cost was measured using the Projected Unit Method.<br />

Amounts for the current and previous year are as follows:<br />

2007 2006<br />

$ $<br />

Defined benefit obligation (68,189) (56,398)<br />

Plan assets 92,254 83,149<br />

Surplus 24,065 26,751<br />

Experience adjustments on plan liabilities 6,712 450<br />

Experience adjustments on plan assets 4,503 505<br />

Impact of changes in medical premium escalation rate<br />

The impact of a 1% change in the medical premium escalation assumption on the<br />

sum of the current service cost and on the present value of the obligation is shown<br />

in the table below.<br />

Item Change of –1% in Current Change of +1 in<br />

medical premium IAS 19 medical premium<br />

escalation rate results escalation rate<br />

$ $ $<br />

Current Service Cost +<br />

Interest Cost 1,020 1,160 1,360<br />

Present Value of 3,110 3,580 4,160<br />

Obligation<br />

12. Goodwill<br />

2007 2006<br />

$ $<br />

Carrying amount, October 31 187,747 187,747<br />

See Auditors’ Report Page 56.<br />

Based on the <strong>Bank</strong>’s assessment of goodwill, there was no impairment charge for the<br />

year (2006-$nil).<br />

77