Bahamas - FirstCaribbean International Bank

Bahamas - FirstCaribbean International Bank

Bahamas - FirstCaribbean International Bank

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Notes to the Consolidated Financial Statements<br />

October 31, 2007<br />

(expressed in thousands of Bahamian dollars)<br />

82<br />

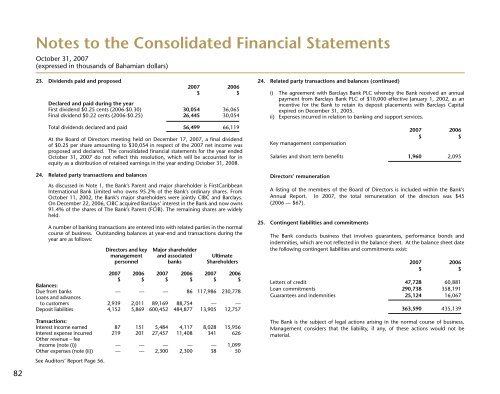

23. Dividends paid and proposed<br />

2007 2006<br />

$ $<br />

Declared and paid during the year<br />

First dividend $0.25 cents (2006-$0.30) 30,054 36,065<br />

Final dividend $0.22 cents (2006-$0.25) 26,445 30,054<br />

Total dividends declared and paid 56,499 66,119<br />

At the Board of Directors meeting held on December 17, 2007, a final dividend<br />

of $0.25 per share amounting to $30,054 in respect of the 2007 net income was<br />

proposed and declared. The consolidated financial statements for the year ended<br />

October 31, 2007 do not reflect this resolution, which will be accounted for in<br />

equity as a distribution of retained earnings in the year ending October 31, 2008.<br />

24. Related party transactions and balances<br />

As discussed in Note 1, the <strong>Bank</strong>’s Parent and major shareholder is <strong>FirstCaribbean</strong><br />

<strong>International</strong> <strong>Bank</strong> Limited who owns 95.2% of the <strong>Bank</strong>’s ordinary shares. From<br />

October 11, 2002, the <strong>Bank</strong>’s major shareholders were jointly CIBC and Barclays.<br />

On December 22, 2006, CIBC acquired Barclays’ interest in the <strong>Bank</strong> and now owns<br />

91.4% of the shares of The <strong>Bank</strong>’s Parent (FCIB). The remaining shares are widely<br />

held.<br />

A number of banking transactions are entered into with related parties in the normal<br />

course of business. Outstanding balances at year-end and transactions during the<br />

year are as follows:<br />

Directors and key Major shareholder<br />

management and associated Ultimate<br />

personnel banks Shareholders<br />

2007 2006 2007 2006 2007 2006<br />

$ $ $ $ $ $<br />

Balances:<br />

Due from banks — — — 86 117,986 230,778<br />

Loans and advances<br />

to customers 2,939 2,011 89,169 88,754 — —<br />

Deposit liabilities 4,152 5,869 600,452 484,877 13,905 12,757<br />

Transactions:<br />

Interest income earned 87 151 5,484 4,117 8,028 15,956<br />

Interest expense incurred 219 201 27,457 11,408 341 626<br />

Other revenue – fee<br />

income (note (i)) — — — — — 1,099<br />

Other expenses (note (ii)) — — 2,300 2,300 38 50<br />

See Auditors’ Report Page 56.<br />

24. Related party transactions and balances (continued)<br />

i) The agreement with Barclays <strong>Bank</strong> PLC whereby the <strong>Bank</strong> received an annual<br />

payment from Barclays <strong>Bank</strong> PLC of $10,000 effective January 1, 2002, as an<br />

incentive for the <strong>Bank</strong> to retain its deposit placements with Barclays Capital<br />

expired on December 31, 2005.<br />

ii) Expenses incurred in relation to banking and support services.<br />

Key management compensation<br />

2007 2006<br />

$ $<br />

Salaries and short term benefits 1,960 2,095<br />

Directors’ remuneration<br />

A listing of the members of the Board of Directors is included within the <strong>Bank</strong>’s<br />

Annual Report. In 2007, the total remuneration of the directors was $45<br />

(2006 — $67).<br />

25. Contingent liabilities and commitments<br />

The <strong>Bank</strong> conducts business that involves guarantees, performance bonds and<br />

indemnities, which are not reflected in the balance sheet. At the balance sheet date<br />

the following contingent liabilities and commitments exist:<br />

2007 2006<br />

$ $<br />

Letters of credit 47,728 60,881<br />

Loan commitments 290,738 358,191<br />

Guarantees and indemnities 25,124 16,067<br />

363,590 435,139<br />

The <strong>Bank</strong> is the subject of legal actions arising in the normal course of business.<br />

Management considers that the liability, if any, of these actions would not be<br />

material.