Bahamas - FirstCaribbean International Bank

Bahamas - FirstCaribbean International Bank

Bahamas - FirstCaribbean International Bank

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Management’s Discussion and Analysis<br />

Of Operating Results and Financial Condition for the Fiscal Year Ended October 31, 2007<br />

2004 2005 2006 2007<br />

Total provisions to total loans 2.7% 2.1% 2.0% 1.8%<br />

Specific provisions to non-performing loans 35.4% 34.6% 32.0% 22.9%<br />

Deposits<br />

Debt Securities in Issue<br />

As discussed in Note 14, on November 3, 2006, the <strong>Bank</strong> issued $20 million in<br />

redeemable floating rate bonds with maturity of November 3, 2011.<br />

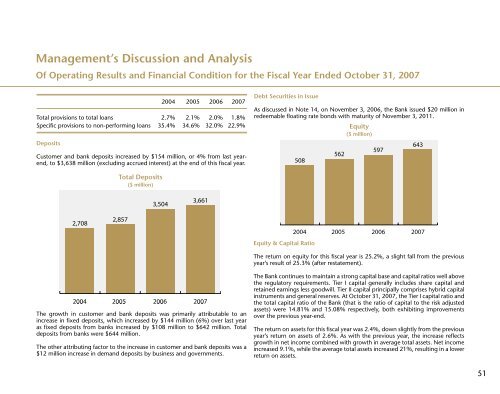

Equity<br />

($ million)<br />

Customer and bank deposits increased by $154 million, or 4% from last yearend,<br />

to $3,638 million (excluding accrued interest) at the end of this fiscal year.<br />

Total Deposits<br />

($ million)<br />

Equity & Capital Ratio<br />

The return on equity for this fiscal year is 25.2%, a slight fall from the previous<br />

year’s result of 25.3% (after restatement).<br />

The growth in customer and bank deposits was primarily attributable to an<br />

increase in fixed deposits, which increased by $144 million (6%) over last year<br />

as fixed deposits from banks increased by $108 million to $642 million. Total<br />

deposits from banks were $644 million.<br />

The other attributing factor to the increase in customer and bank deposits was a<br />

$12 million increase in demand deposits by business and governments.<br />

The <strong>Bank</strong> continues to maintain a strong capital base and capital ratios well above<br />

the regulatory requirements. Tier I capital generally includes share capital and<br />

retained earnings less goodwill. Tier II capital principally comprises hybrid capital<br />

instruments and general reserves. At October 31, 2007, the Tier I capital ratio and<br />

the total capital ratio of the <strong>Bank</strong> (that is the ratio of capital to the risk adjusted<br />

assets) were 14.81% and 15.08% respectively, both exhibiting improvements<br />

over the previous year-end.<br />

The return on assets for this fiscal year was 2.4%, down slightly from the previous<br />

year’s return on assets of 2.6%. As with the previous year, the increase reflects<br />

growth in net income combined with growth in average total assets. Net income<br />

increased 9.1%, while the average total assets increased 21%, resulting in a lower<br />

return on assets.<br />

51