Bahamas - FirstCaribbean International Bank

Bahamas - FirstCaribbean International Bank

Bahamas - FirstCaribbean International Bank

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

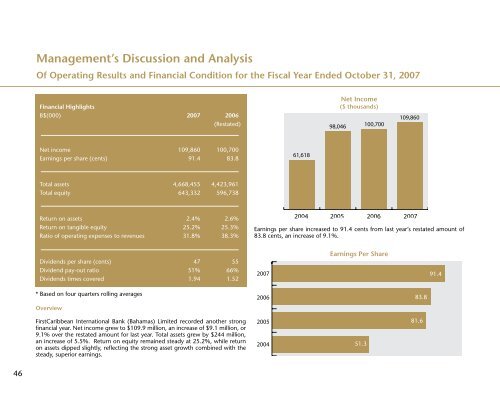

Management’s Discussion and Analysis<br />

Of Operating Results and Financial Condition for the Fiscal Year Ended October 31, 2007<br />

Financial Highlights<br />

B$(000) 2007 2006<br />

(Restated)<br />

Net Income<br />

($ thousands)<br />

Net income 109,860 100,700<br />

Earnings per share (cents) 91.4 83.8<br />

Total assets 4,668,455 4,423,961<br />

Total equity 643,332 596,738<br />

Return on assets 2.4% 2.6%<br />

Return on tangible equity 25.2% 25.3%<br />

Ratio of operating expenses to revenues 31.8% 38.3%<br />

Earnings per share increased to 91.4 cents from last year’s restated amount of<br />

83.8 cents, an increase of 9.1%.<br />

Dividends per share (cents) 47 55<br />

Dividend pay-out ratio 51% 66%<br />

Dividends times covered 1.94 1.52<br />

Earnings Per Share<br />

91.4<br />

* Based on four quarters rolling averages<br />

Overview<br />

<strong>FirstCaribbean</strong> <strong>International</strong> <strong>Bank</strong> (<strong>Bahamas</strong>) Limited recorded another strong<br />

financial year. Net income grew to $109.9 million, an increase of $9.1 million, or<br />

9.1% over the restated amount for last year. Total assets grew by $244 million,<br />

an increase of 5.5%. Return on equity remained steady at 25.2%, while return<br />

on assets dipped slightly, reflecting the strong asset growth combined with the<br />

steady, superior earnings.<br />

51.3<br />

83.8<br />

81.6<br />

46