Bahamas - FirstCaribbean International Bank

Bahamas - FirstCaribbean International Bank

Bahamas - FirstCaribbean International Bank

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

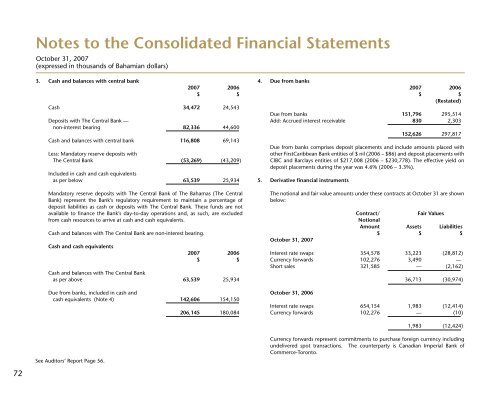

Notes to the Consolidated Financial Statements<br />

October 31, 2007<br />

(expressed in thousands of Bahamian dollars)<br />

3. Cash and balances with central bank<br />

2007 2006<br />

$ $<br />

Cash 34,472 24,543<br />

Deposits with The Central <strong>Bank</strong> —<br />

non-interest bearing 82,336 44,600<br />

Cash and balances with central bank 116,808 69,143<br />

Less: Mandatory reserve deposits with<br />

The Central <strong>Bank</strong> (53,269) (43,209)<br />

Included in cash and cash equivalents<br />

as per below 63,539 25,934<br />

Mandatory reserve deposits with The Central <strong>Bank</strong> of The <strong>Bahamas</strong> (The Central<br />

<strong>Bank</strong>) represent the <strong>Bank</strong>’s regulatory requirement to maintain a percentage of<br />

deposit liabilities as cash or deposits with The Central <strong>Bank</strong>. These funds are not<br />

available to finance the <strong>Bank</strong>’s day-to-day operations and, as such, are excluded<br />

from cash resources to arrive at cash and cash equivalents.<br />

Cash and balances with The Central <strong>Bank</strong> are non-interest bearing.<br />

Cash and cash equivalents<br />

2007 2006<br />

$ $<br />

Cash and balances with The Central <strong>Bank</strong><br />

as per above 63,539 25,934<br />

Due from banks, included in cash and<br />

cash equivalents (Note 4) 142,606 154,150<br />

206,145 180,084<br />

4. Due from banks<br />

2007 2006<br />

$ $<br />

(Restated)<br />

Due from banks 151,796 295,514<br />

Add: Accrued interest receivable 830 2,303<br />

152,626 297,817<br />

Due from banks comprises deposit placements and include amounts placed with<br />

other <strong>FirstCaribbean</strong> <strong>Bank</strong> entities of $ nil (2006 – $86) and deposit placements with<br />

CIBC and Barclays entities of $217,008 (2006 – $230,778). The effective yield on<br />

deposit placements during the year was 4.6% (2006 – 3.3%).<br />

5. Derivative financial instruments<br />

The notional and fair value amounts under these contracts at October 31 are shown<br />

below:<br />

October 31, 2007<br />

Contract/<br />

Fair Values<br />

Notional<br />

Amount Assets Liabilities<br />

$ $ $<br />

Interest rate swaps 354,578 33,223 (28,812)<br />

Currency forwards 102,276 3,490 —<br />

Short sales 321,585 — (2,162)<br />

October 31, 2006<br />

36,713 (30,974)<br />

Interest rate swaps 654,154 1,983 (12,414)<br />

Currency forwards 102,276 — (10)<br />

72<br />

See Auditors’ Report Page 56.<br />

1,983 (12,424)<br />

Currency forwards represent commitments to purchase foreign currency including<br />

undelivered spot transactions. The counterparty is Canadian Imperial <strong>Bank</strong> of<br />

Commerce-Toronto.