Bahamas - FirstCaribbean International Bank

Bahamas - FirstCaribbean International Bank

Bahamas - FirstCaribbean International Bank

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

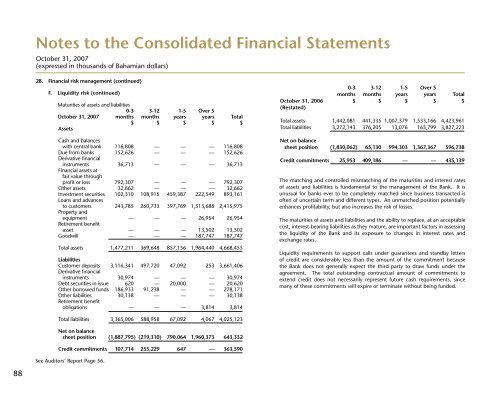

Notes to the Consolidated Financial Statements<br />

October 31, 2007<br />

(expressed in thousands of Bahamian dollars)<br />

28. Financial risk management (continued)<br />

F. Liquidity risk (continued)<br />

Maturities of assets and liabilities<br />

0-3 3-12 1-5 Over 5<br />

October 31, 2007 months months years years Total<br />

$ $ $ $ $<br />

Assets<br />

Cash and balances<br />

with central bank 116,808 — — — 116,808<br />

Due from banks 152,626 — — — 152,626<br />

Derivative financial<br />

instruments 36,713 — — — 36,713<br />

Financial assets at<br />

fair value through<br />

profit or loss 792,307 — — — 792,307<br />

Other assets 32,662 — — — 32,662<br />

Investment securities 102,310 108,915 459,387 222,549 893,161<br />

Loans and advances<br />

to customers 243,785 260,733 397,769 1,513,688 2,415,975<br />

Property and<br />

equipment — — — 26,954 26,954<br />

Retirement benefit<br />

asset — — — 13,502 13,502<br />

Goodwill — — — 187,747 187,747<br />

Total assets 1,477,211 369,648 857,156 1,964,440 4,668,455<br />

Liabilities<br />

Customer deposits 3,116,341 497,720 47,092 253 3,661,406<br />

Derivative financial<br />

instruments 30,974 — — — 30,974<br />

Debt securities in issue 620 — 20,000 — 20,620<br />

Other borrowed funds 186,933 91,238 — — 278,171<br />

Other liabilities 30,138 — — — 30,138<br />

Retirement benefit<br />

obligations — — — 3,814 3,814<br />

0-3 3-12 1-5 Over 5<br />

months months years years Total<br />

October 31, 2006 $ $ $ $ $<br />

(Restated)<br />

Total assets 1,442,081 441,335 1,007,379 1,533,166 4,423,961<br />

Total liabilities 3,272,143 376,205 13,076 165,799 3,827,223<br />

Net on balance<br />

sheet position (1,830,062) 65,130 994,303 1,367,367 596,738<br />

Credit commitments 25,953 409,186 — — 435,139<br />

The matching and controlled mismatching of the maturities and interest rates<br />

of assets and liabilities is fundamental to the management of the <strong>Bank</strong>. It is<br />

unusual for banks ever to be completely matched since business transacted is<br />

often of uncertain term and different types. An unmatched position potentially<br />

enhances profitability, but also increases the risk of losses.<br />

The maturities of assets and liabilities and the ability to replace, at an acceptable<br />

cost, interest-bearing liabilities as they mature, are important factors in assessing<br />

the liquidity of the <strong>Bank</strong> and its exposure to changes in interest rates and<br />

exchange rates.<br />

Liquidity requirements to support calls under guarantees and standby letters<br />

of credit are considerably less than the amount of the commitment because<br />

the <strong>Bank</strong> does not generally expect the third party to draw funds under the<br />

agreement. The total outstanding contractual amount of commitments to<br />

extend credit does not necessarily represent future cash requirements, since<br />

many of these commitments will expire or terminate without being funded.<br />

Total liabilities 3,365,006 588,958 67,092 4,067 4,025,123<br />

Net on balance<br />

sheet position (1,887,795) (219,310) 790,064 1,960,373 643,332<br />

Credit commitments 107,714 255,229 647 — 363,590<br />

See Auditors’ Report Page 56.<br />

88