Bahamas - FirstCaribbean International Bank

Bahamas - FirstCaribbean International Bank

Bahamas - FirstCaribbean International Bank

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

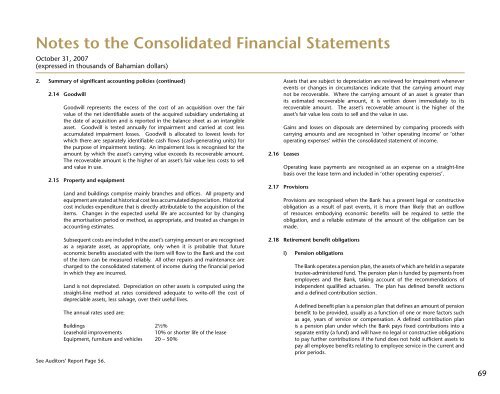

Notes to the Consolidated Financial Statements<br />

October 31, 2007<br />

(expressed in thousands of Bahamian dollars)<br />

2. Summary of significant accounting policies (continued)<br />

2.14 Goodwill<br />

Goodwill represents the excess of the cost of an acquisition over the fair<br />

value of the net identifiable assets of the acquired subsidiary undertaking at<br />

the date of acquisition and is reported in the balance sheet as an intangible<br />

asset. Goodwill is tested annually for impairment and carried at cost less<br />

accumulated impairment losses. Goodwill is allocated to lowest levels for<br />

which there are separately identifiable cash flows (cash-generating units) for<br />

the purpose of impairment testing. An impairment loss is recognised for the<br />

amount by which the asset’s carrying value exceeds its recoverable amount.<br />

The recoverable amount is the higher of an asset’s fair value less costs to sell<br />

and value in use.<br />

2.15 Property and equipment<br />

Land and buildings comprise mainly branches and offices. All property and<br />

equipment are stated at historical cost less accumulated depreciation. Historical<br />

cost includes expenditure that is directly attributable to the acquisition of the<br />

items. Changes in the expected useful life are accounted for by changing<br />

the amortisation period or method, as appropriate, and treated as changes in<br />

accounting estimates.<br />

Subsequent costs are included in the asset’s carrying amount or are recognised<br />

as a separate asset, as appropriate, only when it is probable that future<br />

economic benefits associated with the item will flow to the <strong>Bank</strong> and the cost<br />

of the item can be measured reliably. All other repairs and maintenance are<br />

charged to the consolidated statement of income during the financial period<br />

in which they are incurred.<br />

Land is not depreciated. Depreciation on other assets is computed using the<br />

straight-line method at rates considered adequate to write-off the cost of<br />

depreciable assets, less salvage, over their useful lives.<br />

The annual rates used are:<br />

Buildings 2½%<br />

Leasehold improvements<br />

10% or shorter life of the lease<br />

Equipment, furniture and vehicles 20 – 50%<br />

See Auditors’ Report Page 56.<br />

Assets that are subject to depreciation are reviewed for impairment whenever<br />

events or changes in circumstances indicate that the carrying amount may<br />

not be recoverable. Where the carrying amount of an asset is greater than<br />

its estimated recoverable amount, it is written down immediately to its<br />

recoverable amount. The asset’s recoverable amount is the higher of the<br />

asset’s fair value less costs to sell and the value in use.<br />

Gains and losses on disposals are determined by comparing proceeds with<br />

carrying amounts and are recognised in ‘other operating income’ or ‘other<br />

operating expenses’ within the consolidated statement of income.<br />

2.16 Leases<br />

Operating lease payments are recognised as an expense on a straight-line<br />

basis over the lease term and included in ‘other operating expenses’.<br />

2.17 Provisions<br />

Provisions are recognised when the <strong>Bank</strong> has a present legal or constructive<br />

obligation as a result of past events, it is more than likely that an outflow<br />

of resources embodying economic benefits will be required to settle the<br />

obligation, and a reliable estimate of the amount of the obligation can be<br />

made.<br />

2.18 Retirement benefit obligations<br />

i) Pension obligations<br />

The <strong>Bank</strong> operates a pension plan, the assets of which are held in a separate<br />

trustee-administered fund. The pension plan is funded by payments from<br />

employees and the <strong>Bank</strong>, taking account of the recommendations of<br />

independent qualified actuaries. The plan has defined benefit sections<br />

and a defined contribution section.<br />

A defined benefit plan is a pension plan that defines an amount of pension<br />

benefit to be provided, usually as a function of one or more factors such<br />

as age, years of service or compensation. A defined contribution plan<br />

is a pension plan under which the <strong>Bank</strong> pays fixed contributions into a<br />

separate entity (a fund) and will have no legal or constructive obligations<br />

to pay further contributions if the fund does not hold sufficient assets to<br />

pay all employee benefits relating to employee service in the current and<br />

prior periods.<br />

69