Bahamas - FirstCaribbean International Bank

Bahamas - FirstCaribbean International Bank

Bahamas - FirstCaribbean International Bank

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

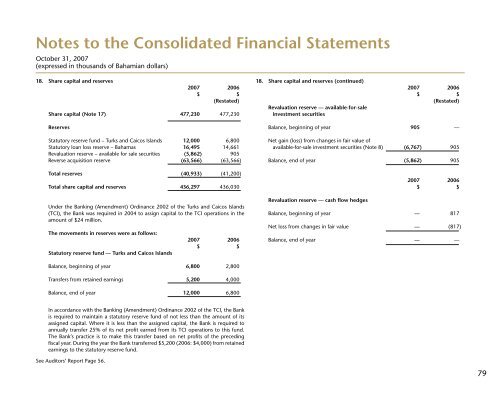

Notes to the Consolidated Financial Statements<br />

October 31, 2007<br />

(expressed in thousands of Bahamian dollars)<br />

18. Share capital and reserves<br />

2007 2006<br />

$ $<br />

(Restated)<br />

Share capital (Note 17) 477,230 477,230<br />

18. Share capital and reserves (continued)<br />

Revaluation reserve — available-for-sale<br />

investment securities<br />

2007 2006<br />

$ $<br />

(Restated)<br />

Reserves<br />

Statutory reserve fund – Turks and Caicos Islands 12,000 6,800<br />

Statutory loan loss reserve – <strong>Bahamas</strong> 16,495 14,661<br />

Revaluation reserve – available for sale securities (5,862) 905<br />

Reverse acquisition reserve (63,566) (63,566)<br />

Total reserves (40,933) (41,200)<br />

Total share capital and reserves 436,297 436,030<br />

Under the <strong>Bank</strong>ing (Amendment) Ordinance 2002 of the Turks and Caicos Islands<br />

(TCI), the <strong>Bank</strong> was required in 2004 to assign capital to the TCI operations in the<br />

amount of $24 million.<br />

The movements in reserves were as follows:<br />

Statutory reserve fund — Turks and Caicos Islands<br />

2007 2006<br />

$ $<br />

Balance, beginning of year 905 —<br />

Net gain (loss) from changes in fair value of<br />

available-for-sale investment securities (Note 8) (6,767) 905<br />

Balance, end of year (5,862) 905<br />

Revaluation reserve — cash flow hedges<br />

2007 2006<br />

$ $<br />

Balance, beginning of year — 817<br />

Net loss from changes in fair value — (817)<br />

Balance, end of year — —<br />

Balance, beginning of year 6,800 2,800<br />

Transfers from retained earnings 5,200 4,000<br />

Balance, end of year 12,000 6,800<br />

In accordance with the <strong>Bank</strong>ing (Amendment) Ordinance 2002 of the TCI, the <strong>Bank</strong><br />

is required to maintain a statutory reserve fund of not less than the amount of its<br />

assigned capital. Where it is less than the assigned capital, the <strong>Bank</strong> is required to<br />

annually transfer 25% of its net profit earned from its TCI operations to this fund.<br />

The <strong>Bank</strong>’s practice is to make this transfer based on net profits of the preceding<br />

fiscal year. During the year the <strong>Bank</strong> transferred $5,200 (2006: $4,000) from retained<br />

earnings to the statutory reserve fund.<br />

See Auditors’ Report Page 56.<br />

79