Bahamas - FirstCaribbean International Bank

Bahamas - FirstCaribbean International Bank

Bahamas - FirstCaribbean International Bank

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Management’s Discussion and Analysis<br />

Of Operating Results and Financial Condition for the Fiscal Year Ended October 31, 2007<br />

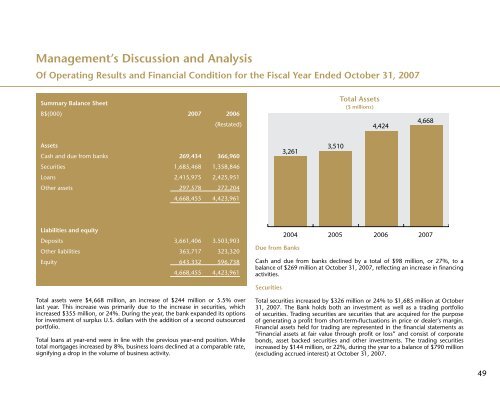

Summary Balance Sheet<br />

B$(000) 2007 2006<br />

(Restated)<br />

Total Assets<br />

($ millions)<br />

Assets<br />

Cash and due from banks 269,434 366,960<br />

Securities 1,685,468 1,358,846<br />

Loans 2,415,975 2,425,951<br />

Other assets 297,578 272,204<br />

4,668,455 4,423,961<br />

Liabilities and equity<br />

Deposits 3,661,406 3.503,903<br />

Other liabilities 363,717 323,320<br />

Equity 643,332 596,738<br />

4,668,455 4,423,961<br />

Due from <strong>Bank</strong>s<br />

Cash and due from banks declined by a total of $98 million, or 27%, to a<br />

balance of $269 million at October 31, 2007, reflecting an increase in financing<br />

activities.<br />

Securities<br />

Total assets were $4,668 million, an increase of $244 million or 5.5% over<br />

last year. This increase was primarily due to the increase in securities, which<br />

increased $355 million, or 24%. During the year, the bank expanded its options<br />

for investment of surplus U.S. dollars with the addition of a second outsourced<br />

portfolio.<br />

Total loans at year-end were in line with the previous year-end position. While<br />

total mortgages increased by 8%, business loans declined at a comparable rate,<br />

signifying a drop in the volume of business activity.<br />

Total securities increased by $326 million or 24% to $1,685 million at October<br />

31, 2007. The <strong>Bank</strong> holds both an investment as well as a trading portfolio<br />

of securities. Trading securities are securities that are acquired for the purpose<br />

of generating a profit from short-term-fluctuations in price or dealer’s margin.<br />

Financial assets held for trading are represented in the financial statements as<br />

“Financial assets at fair value through profit or loss” and consist of corporate<br />

bonds, asset backed securities and other investments. The trading securities<br />

increased by $144 million, or 22%, during the year to a balance of $790 million<br />

(excluding accrued interest) at October 31, 2007.<br />

49