Bahamas - FirstCaribbean International Bank

Bahamas - FirstCaribbean International Bank

Bahamas - FirstCaribbean International Bank

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Notes to the Consolidated Financial Statements<br />

October 31, 2007<br />

(expressed in thousands of Bahamian dollars)<br />

90<br />

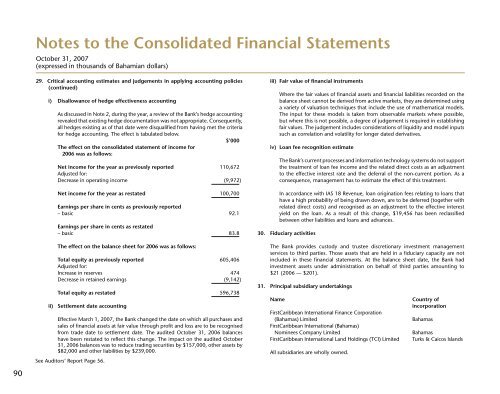

29. Critical accounting estimates and judgements in applying accounting policies<br />

(continued)<br />

i) Disallowance of hedge effectiveness accounting<br />

As discussed in Note 2, during the year, a review of the <strong>Bank</strong>’s hedge accounting<br />

revealed that existing hedge documentation was not appropriate. Consequently,<br />

all hedges existing as of that date were disqualified from having met the criteria<br />

for hedge accounting. The effect is tabulated below.<br />

$’000<br />

The effect on the consolidated statement of income for<br />

2006 was as follows:<br />

Net income for the year as previously reported 110,672<br />

Adjusted for:<br />

Decrease in operating income (9,972)<br />

Net income for the year as restated 100,700<br />

Earnings per share in cents as previously reported<br />

– basic 92.1<br />

Earnings per share in cents as restated<br />

– basic 83.8<br />

The effect on the balance sheet for 2006 was as follows:<br />

Total equity as previously reported 605,406<br />

Adjusted for:<br />

Increase in reserves 474<br />

Decrease in retained earnings (9,142)<br />

Total equity as restated 596,738<br />

ii) Settlement date accounting<br />

Effective March 1, 2007, the <strong>Bank</strong> changed the date on which all purchases and<br />

sales of financial assets at fair value through profit and loss are to be recognised<br />

from trade date to settlement date. The audited October 31, 2006 balances<br />

have been restated to reflect this change. The impact on the audited October<br />

31, 2006 balances was to reduce trading securities by $157,000, other assets by<br />

$82,000 and other liabilities by $239,000.<br />

See Auditors’ Report Page 56.<br />

iii) Fair value of financial instruments<br />

Where the fair values of financial assets and financial liabilities recorded on the<br />

balance sheet cannot be derived from active markets, they are determined using<br />

a variety of valuation techniques that include the use of mathematical models.<br />

The input for these models is taken from observable markets where possible,<br />

but where this is not possible, a degree of judgement is required in establishing<br />

fair values. The judgement includes considerations of liquidity and model inputs<br />

such as correlation and volatility for longer dated derivatives.<br />

iv) Loan fee recognition estimate<br />

The <strong>Bank</strong>’s current processes and information technology systems do not support<br />

the treatment of loan fee income and the related direct costs as an adjustment<br />

to the effective interest rate and the deferral of the non-current portion. As a<br />

consequence, management has to estimate the effect of this treatment.<br />

In accordance with IAS 18 Revenue, loan origination fees relating to loans that<br />

have a high probability of being drawn down, are to be deferred (together with<br />

related direct costs) and recognised as an adjustment to the effective interest<br />

yield on the loan. As a result of this change, $19,456 has been reclassified<br />

between other liabilities and loans and advances.<br />

30. Fiduciary activities<br />

The <strong>Bank</strong> provides custody and trustee discretionary investment management<br />

services to third parties. Those assets that are held in a fiduciary capacity are not<br />

included in these financial statements. At the balance sheet date, the <strong>Bank</strong> had<br />

investment assets under administration on behalf of third parties amounting to<br />

$21 (2006 — $201).<br />

31. Principal subsidiary undertakings<br />

Name<br />

<strong>FirstCaribbean</strong> <strong>International</strong> Finance Corporation<br />

(<strong>Bahamas</strong>) Limited<br />

<strong>FirstCaribbean</strong> <strong>International</strong> (<strong>Bahamas</strong>)<br />

Nominees Company Limited<br />

<strong>FirstCaribbean</strong> <strong>International</strong> Land Holdings (TCI) Limited<br />

All subsidiaries are wholly owned.<br />

Country of<br />

incorporation<br />

<strong>Bahamas</strong><br />

<strong>Bahamas</strong><br />

Turks & Caicos Islands