Bahamas - FirstCaribbean International Bank

Bahamas - FirstCaribbean International Bank

Bahamas - FirstCaribbean International Bank

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Management’s Discussion and Analysis<br />

Of Operating Results and Financial Condition for the Fiscal Year Ended October 31, 2007<br />

Restatement of Financial Statements<br />

The financial statements reflect the restatement of 2006 comparative numbers<br />

(and 2005 where applicable) to reflect the following: 1. The impact of the<br />

change in accounting policy from trade date to settlement date accounting for<br />

all purchases and sales of financial assets through profit and loss; 2. A change<br />

in the <strong>Bank</strong>’s hedge accounting treatment; and 3. A change in accounting<br />

treatment and classification of certain fee income deemed to be a part of the<br />

effective interest rate of the underlying financial instruments – primarily loans –<br />

from operating income to interest income.<br />

million, an increase of $43.1 million, or 17.6%, over last year. As discussed in<br />

Note 19 to the financial statements, interest and similar income is generated<br />

primarily from loans and advances and investment securities, which accounted<br />

for over 82% of total interest income in both reporting years. Interest income<br />

from loans and advances to customers increased $12.4 million, or 6.7%. Interest<br />

income from investment securities increased $30.7 million, or 196%. Interest<br />

income from the trading portfolios increased by $3.4 million, or 14.9%.<br />

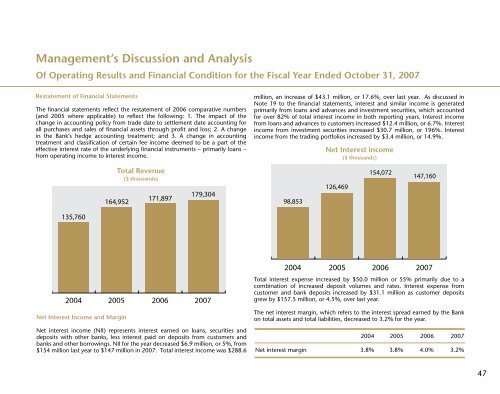

Net Interest income<br />

($ thousands)<br />

Total Revenue<br />

($ thousands)<br />

Total interest expense increased by $50.0 million or 55% primarily due to a<br />

combination of increased deposit volumes and rates. Interest expense from<br />

customer and bank deposits increased by $31.1 million as customer deposits<br />

grew by $157.5 million, or 4.5%, over last year.<br />

Net Interest Income and Margin<br />

Net interest income (NII) represents interest earned on loans, securities and<br />

deposits with other banks, less interest paid on deposits from customers and<br />

banks and other borrowings. NII for the year decreased $6.9 million, or 5%, from<br />

$154 million last year to $147 million in 2007. Total interest income was $288.6<br />

The net interest margin, which refers to the interest spread earned by the <strong>Bank</strong><br />

on total assets and total liabilities, decreased to 3.2% for the year.<br />

2004 2005 2006 2007<br />

Net interest margin 3.8% 3.8% 4.0% 3.2%<br />

47