Bahamas - FirstCaribbean International Bank

Bahamas - FirstCaribbean International Bank

Bahamas - FirstCaribbean International Bank

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Notes to the Consolidated Financial Statements<br />

October 31, 2007<br />

(expressed in thousands of Bahamian dollars)<br />

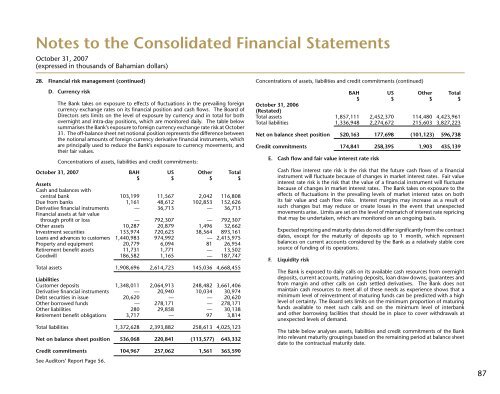

28. Financial risk management (continued)<br />

D. Currency risk<br />

The <strong>Bank</strong> takes on exposure to effects of fluctuations in the prevailing foreign<br />

currency exchange rates on its financial position and cash flows. The Board of<br />

Directors sets limits on the level of exposure by currency and in total for both<br />

overnight and intra-day positions, which are monitored daily. The table below<br />

summarises the <strong>Bank</strong>’s exposure to foreign currency exchange rate risk at October<br />

31. The off-balance sheet net notional position represents the difference between<br />

the notional amounts of foreign currency derivative financial instruments, which<br />

are principally used to reduce the <strong>Bank</strong>’s exposure to currency movements, and<br />

their fair values.<br />

Concentrations of assets, liabilities and credit commitments:<br />

October 31, 2007 BAH US Other Total<br />

$ $ $ $<br />

Assets<br />

Cash and balances with<br />

central bank 103,199 11,567 2,042 116,808<br />

Due from banks 1,161 48,612 102,853 152,626<br />

Derivative financial instruments — 36,713 — 36,713<br />

Financial assets at fair value<br />

through profit or loss — 792,307 — 792,307<br />

Other assets 10,287 20,879 1,496 32,662<br />

Investment securities 133,974 720,623 38,564 893,161<br />

Loans and advances to customers 1,440,983 974,992 — 2,415,975<br />

Property and equipment 20,779 6,094 81 26,954<br />

Retirement benefit assets 11,731 1,771 — 13,502<br />

Goodwill 186,582 1,165 — 187,747<br />

Total assets 1,908,696 2,614,723 145,036 4,668,455<br />

Liabilities<br />

Customer deposits 1,348,011 2,064,913 248,482 3,661,406<br />

Derivative financial instruments — 20,940 10,034 30,974<br />

Debt securities in issue 20,620 — — 20,620<br />

Other borrowed funds — 278,171 — 278,171<br />

Other liabilities 280 29,858 — 30,138<br />

Retirement benefit obligations 3,717 — 97 3,814<br />

Total liabilities 1,372,628 2,393,882 258,613 4,025,123<br />

Net on balance sheet position 536,068 220,841 (113,577) 643,332<br />

Credit commitments 104,967 257,062 1,561 363,590<br />

See Auditors’ Report Page 56.<br />

Concentrations of assets, liabilities and credit commitments (continued)<br />

BAH US Other Total<br />

$ $ $ $<br />

October 31, 2006<br />

(Restated)<br />

Total assets 1,857,111 2,452,370 114,480 4,423,961<br />

Total liabilities 1,336,948 2,274,672 215,603 3,827,223<br />

Net on balance sheet position 520,163 177,698 (101,123) 596,738<br />

Credit commitments 174,841 258,395 1,903 435,139<br />

E. Cash flow and fair value interest rate risk<br />

Cash flow interest rate risk is the risk that the future cash flows of a financial<br />

instrument will fluctuate because of changes in market interest rates. Fair value<br />

interest rate risk is the risk that the value of a financial instrument will fluctuate<br />

because of changes in market interest rates. The <strong>Bank</strong> takes on exposure to the<br />

effects of fluctuations in the prevailing levels of market interest rates on both<br />

its fair value and cash flow risks. Interest margins may increase as a result of<br />

such changes but may reduce or create losses in the event that unexpected<br />

movements arise. Limits are set on the level of mismatch of interest rate repricing<br />

that may be undertaken, which are monitored on an ongoing basis.<br />

Expected repricing and maturity dates do not differ significantly from the contract<br />

dates, except for the maturity of deposits up to 1 month, which represent<br />

balances on current accounts considered by the <strong>Bank</strong> as a relatively stable core<br />

source of funding of its operations.<br />

F. Liquidity risk<br />

The <strong>Bank</strong> is exposed to daily calls on its available cash resources from overnight<br />

deposits, current accounts, maturing deposits, loan draw downs, guarantees and<br />

from margin and other calls on cash settled derivatives. The <strong>Bank</strong> does not<br />

maintain cash resources to meet all of these needs as experience shows that a<br />

minimum level of reinvestment of maturing funds can be predicted with a high<br />

level of certainty. The Board sets limits on the minimum proportion of maturing<br />

funds available to meet such calls and on the minimum level of interbank<br />

and other borrowing facilities that should be in place to cover withdrawals at<br />

unexpected levels of demand.<br />

The table below analyses assets, liabilities and credit commitments of the <strong>Bank</strong><br />

into relevant maturity groupings based on the remaining period at balance sheet<br />

date to the contractual maturity date.<br />

87