Bahamas - FirstCaribbean International Bank

Bahamas - FirstCaribbean International Bank

Bahamas - FirstCaribbean International Bank

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Notes to the Consolidated Financial Statements<br />

October 31, 2007<br />

(expressed in thousands of Bahamian dollars)<br />

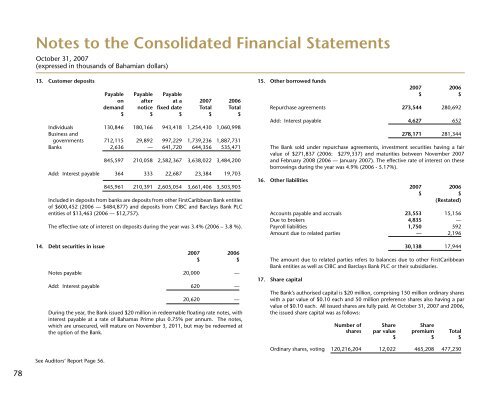

13. Customer deposits<br />

Payable Payable Payable<br />

on after at a 2007 2006<br />

demand notice fixed date Total Total<br />

$ $ $ $ $<br />

Individuals 130,846 180,166 943,418 1,254,430 1,060,998<br />

Business and<br />

governments 712,115 29,892 997,229 1,739,236 1,887,731<br />

<strong>Bank</strong>s 2,636 — 641,720 644,356 535,471<br />

845,597 210,058 2,582,367 3,638,022 3,484,200<br />

Add: Interest payable 364 333 22,687 23,384 19,703<br />

845,961 210,391 2,605,054 3,661,406 3,503,903<br />

Included in deposits from banks are deposits from other <strong>FirstCaribbean</strong> <strong>Bank</strong> entities<br />

of $600,452 (2006 — $484,877) and deposits from CIBC and Barclays <strong>Bank</strong> PLC<br />

entities of $13,463 (2006 — $12,757).<br />

The effective rate of interest on deposits during the year was 3.4% (2006 – 3.8 %).<br />

14. Debt securities in issue<br />

2007 2006<br />

$ $<br />

Notes payable 20,000 —<br />

Add: Interest payable 620 —<br />

20,620 —<br />

During the year, the <strong>Bank</strong> issued $20 million in redeemable floating rate notes, with<br />

interest payable at a rate of <strong>Bahamas</strong> Prime plus 0.75% per annum. The notes,<br />

which are unsecured, will mature on November 3, 2011, but may be redeemed at<br />

the option of the <strong>Bank</strong>.<br />

15. Other borrowed funds<br />

2007 2006<br />

$ $<br />

Repurchase agreements 273,544 280,692<br />

Add: Interest payable 4,627 652<br />

278,171 281,344<br />

The <strong>Bank</strong> sold under repurchase agreements, investment securities having a fair<br />

value of $271,837 (2006: $279,337) and maturities between November 2007<br />

and February 2008 (2006 — January 2007). The effective rate of interest on these<br />

borrowings during the year was 4.9% (2006 - 5.17%).<br />

16. Other liabilities<br />

2007 2006<br />

$ $<br />

(Restated)<br />

Accounts payable and accruals 23,553 15,156<br />

Due to brokers 4,835 —<br />

Payroll liabilities 1,750 592<br />

Amount due to related parties — 2,196<br />

30,138 17,944<br />

The amount due to related parties refers to balances due to other <strong>FirstCaribbean</strong><br />

<strong>Bank</strong> entities as well as CIBC and Barclays <strong>Bank</strong> PLC or their subsidiaries.<br />

17. Share capital<br />

The <strong>Bank</strong>’s authorised capital is $20 million, comprising 150 million ordinary shares<br />

with a par value of $0.10 each and 50 million preference shares also having a par<br />

value of $0.10 each. All issued shares are fully paid. At October 31, 2007 and 2006,<br />

the issued share capital was as follows:<br />

Number of Share Share<br />

shares par value premium Total<br />

$ $ $<br />

Ordinary shares, voting 120,216,204 12,022 465,208 477,230<br />

See Auditors’ Report Page 56.<br />

78