Bahamas - FirstCaribbean International Bank

Bahamas - FirstCaribbean International Bank

Bahamas - FirstCaribbean International Bank

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

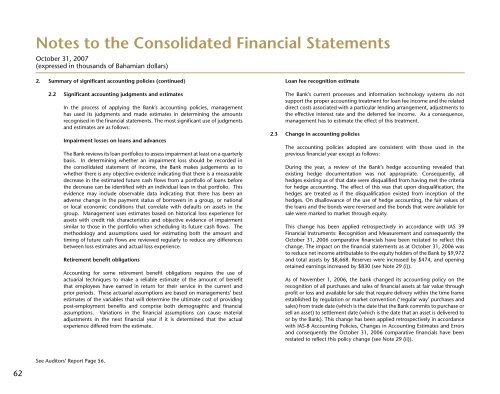

Notes to the Consolidated Financial Statements<br />

October 31, 2007<br />

(expressed in thousands of Bahamian dollars)<br />

2. Summary of significant accounting policies (continued)<br />

2.2 Significant accounting judgments and estimates<br />

In the process of applying the <strong>Bank</strong>’s accounting policies, management<br />

has used its judgments and made estimates in determining the amounts<br />

recognised in the financial statements. The most significant use of judgments<br />

and estimates are as follows:<br />

Impairment losses on loans and advances<br />

The <strong>Bank</strong> reviews its loan portfolios to assess impairment at least on a quarterly<br />

basis. In determining whether an impairment loss should be recorded in<br />

the consolidated statement of income, the <strong>Bank</strong> makes judgements as to<br />

whether there is any objective evidence indicating that there is a measurable<br />

decrease in the estimated future cash flows from a portfolio of loans before<br />

the decrease can be identified with an individual loan in that portfolio. This<br />

evidence may include observable data indicating that there has been an<br />

adverse change in the payment status of borrowers in a group, or national<br />

or local economic conditions that correlate with defaults on assets in the<br />

group. Management uses estimates based on historical loss experience for<br />

assets with credit risk characteristics and objective evidence of impairment<br />

similar to those in the portfolio when scheduling its future cash flows. The<br />

methodology and assumptions used for estimating both the amount and<br />

timing of future cash flows are reviewed regularly to reduce any differences<br />

between loss estimates and actual loss experience.<br />

Retirement benefit obligations<br />

Accounting for some retirement benefit obligations requires the use of<br />

actuarial techniques to make a reliable estimate of the amount of benefit<br />

that employees have earned in return for their service in the current and<br />

prior periods. These actuarial assumptions are based on managements’ best<br />

estimates of the variables that will determine the ultimate cost of providing<br />

post-employment benefits and comprise both demographic and financial<br />

assumptions. Variations in the financial assumptions can cause material<br />

adjustments in the next financial year if it is determined that the actual<br />

experience differed from the estimate.<br />

Loan fee recognition estimate<br />

The <strong>Bank</strong>’s current processes and information technology systems do not<br />

support the proper accounting treatment for loan fee income and the related<br />

direct costs associated with a particular lending arrangement, adjustments to<br />

the effective interest rate and the deferred fee income. As a consequence,<br />

management has to estimate the effect of this treatment.<br />

2.3 Change in accounting policies<br />

The accounting policies adopted are consistent with those used in the<br />

previous financial year except as follows:<br />

During the year, a review of the <strong>Bank</strong>’s hedge accounting revealed that<br />

existing hedge documentation was not appropriate. Consequently, all<br />

hedges existing as of that date were disqualified from having met the criteria<br />

for hedge accounting. The effect of this was that upon disqualification, the<br />

hedges are treated as if the disqualification existed from inception of the<br />

hedges. On disallowance of the use of hedge accounting, the fair values of<br />

the loans and the bonds were reversed and the bonds that were available for<br />

sale were marked to market through equity.<br />

This change has been applied retrospectively in accordance with IAS 39<br />

Financial Instruments: Recognition and Measurement and consequently the<br />

October 31, 2006 comparative financials have been restated to reflect this<br />

change. The impact on the financial statements as at October 31, 2006 was<br />

to reduce net income attributable to the equity holders of the <strong>Bank</strong> by $9,972<br />

and total assets by $8,668. Reserves were increased by $474, and opening<br />

retained earnings increased by $830 (see Note 29 (i)).<br />

As of November 1, 2006, the bank changed its accounting policy on the<br />

recognition of all purchases and sales of financial assets at fair value through<br />

profit or loss and available for sale that require delivery within the time frame<br />

established by regulation or market convention (‘regular way’ purchases and<br />

sales) from trade date (which is the date that the <strong>Bank</strong> commits to purchase or<br />

sell an asset) to settlement date (which is the date that an asset is delivered to<br />

or by the <strong>Bank</strong>). This change has been applied retrospectively in accordance<br />

with IAS-8 Accounting Policies, Changes in Accounting Estimates and Errors<br />

and consequently the October 31, 2006 comparative financials have been<br />

restated to reflect this policy change (see Note 29 (ii)).<br />

See Auditors’ Report Page 56.<br />

62