Bahamas - FirstCaribbean International Bank

Bahamas - FirstCaribbean International Bank

Bahamas - FirstCaribbean International Bank

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Notes to the Consolidated Financial Statements<br />

October 31, 2007<br />

(expressed in thousands of Bahamian dollars)<br />

76<br />

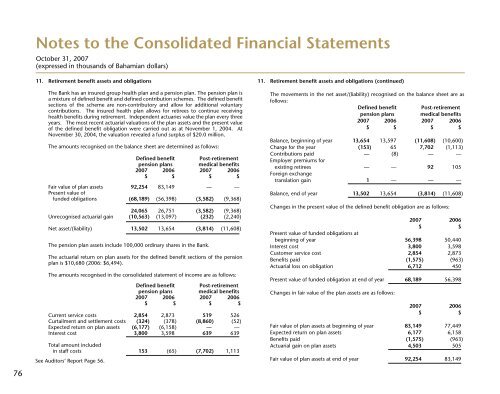

11. Retirement benefit assets and obligations<br />

The <strong>Bank</strong> has an insured group health plan and a pension plan. The pension plan is<br />

a mixture of defined benefit and defined contribution schemes. The defined benefit<br />

sections of the scheme are non-contributory and allow for additional voluntary<br />

contributions. The insured health plan allows for retirees to continue receiving<br />

health benefits during retirement. Independent actuaries value the plan every three<br />

years. The most recent actuarial valuations of the plan assets and the present value<br />

of the defined benefit obligation were carried out as at November 1, 2004. At<br />

November 30, 2004, the valuation revealed a fund surplus of $20.0 million.<br />

The amounts recognised on the balance sheet are determined as follows:<br />

Defined benefit Post-retirement<br />

pension plans medical benefits<br />

2007 2006 2007 2006<br />

$ $ $ $<br />

Fair value of plan assets 92,254 83,149 — —<br />

Present value of<br />

funded obligations (68,189) (56,398) (3,582) (9,368)<br />

24,065 26,751 (3,582) (9,368)<br />

Unrecognised actuarial gain (10,563) (13,097) (232) (2,240)<br />

Net asset/(liability) 13,502 13,654 (3,814) (11,608)<br />

The pension plan assets include 100,000 ordinary shares in the <strong>Bank</strong>.<br />

The actuarial return on plan assets for the defined benefit sections of the pension<br />

plan is $10,680 (2006: $6,494).<br />

The amounts recognised in the consolidated statement of income are as follows:<br />

Defined benefit Post-retirement<br />

pension plans medical benefits<br />

2007 2006 2007 2006<br />

$ $ $ $<br />

Current service costs 2,854 2,873 519 526<br />

Curtailment and settlement costs (324) (378) (8,860) (52)<br />

Expected return on plan assets (6,177) (6,158) — —<br />

Interest cost 3,800 3,598 639 639<br />

Total amount included<br />

in staff costs 153 (65) (7,702) 1,113<br />

See Auditors’ Report Page 56.<br />

11. Retirement benefit assets and obligations (continued)<br />

The movements in the net asset/(liability) recognised on the balance sheet are as<br />

follows:<br />

Defined benefit Post-retirement<br />

pension plans medical benefits<br />

2007 2006 2007 2006<br />

$ $ $ $<br />

Balance, beginning of year 13,654 13,597 (11,608) (10,600)<br />

Charge for the year (153) 65 7,702 (1,113)<br />

Contributions paid — (8) — —<br />

Employer premiums for<br />

existing retirees — — 92 105<br />

Foreign exchange<br />

translation gain 1 — — —<br />

Balance, end of year 13,502 13,654 (3,814) (11,608)<br />

Changes in the present value of the defined benefit obligation are as follows:<br />

2007 2006<br />

$ $<br />

Present value of funded obligations at<br />

beginning of year 56,398 50,440<br />

Interest cost 3,800 3,598<br />

Customer service cost 2,854 2,873<br />

Benefits paid (1,575) (963)<br />

Actuarial loss on obligation 6,712 450<br />

Present value of funded obligation at end of year 68,189 56,398<br />

Changes in fair value of the plan assets are as follows:<br />

2007 2006<br />

$ $<br />

Fair value of plan assets at beginning of year 83,149 77,449<br />

Expected return on plan assets 6,177 6,158<br />

Benefits paid (1,575) (963)<br />

Actuarial gain on plan assets 4,503 505<br />

Fair value of plan assets at end of year 92,254 83,149