Bahamas - FirstCaribbean International Bank

Bahamas - FirstCaribbean International Bank

Bahamas - FirstCaribbean International Bank

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

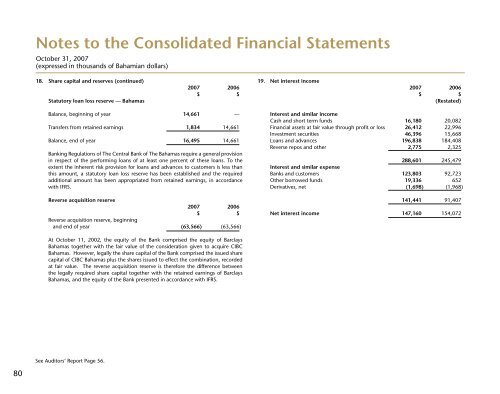

Notes to the Consolidated Financial Statements<br />

October 31, 2007<br />

(expressed in thousands of Bahamian dollars)<br />

18. Share capital and reserves (continued)<br />

Statutory loan loss reserve — <strong>Bahamas</strong><br />

2007 2006<br />

$ $<br />

19. Net interest income<br />

2007 2006<br />

$ $<br />

(Restated)<br />

Balance, beginning of year 14,661 —<br />

Transfers from retained earnings 1,834 14,661<br />

Balance, end of year 16,495 14,661<br />

<strong>Bank</strong>ing Regulations of The Central <strong>Bank</strong> of The <strong>Bahamas</strong> require a general provision<br />

in respect of the performing loans of at least one percent of these loans. To the<br />

extent the inherent risk provision for loans and advances to customers is less than<br />

this amount, a statutory loan loss reserve has been established and the required<br />

additional amount has been appropriated from retained earnings, in accordance<br />

with IFRS.<br />

Reverse acquisition reserve<br />

2007 2006<br />

$ $<br />

Reverse acquisition reserve, beginning<br />

and end of year (63,566) (63,566)<br />

Interest and similar income<br />

Cash and short term funds 16,180 20,082<br />

Financial assets at fair value through profit or loss 26,412 22,996<br />

Investment securities 46,396 15,668<br />

Loans and advances 196,838 184,408<br />

Reverse repos and other 2,775 2,325<br />

288,601 245,479<br />

Interest and similar expense<br />

<strong>Bank</strong>s and customers 123,803 92,723<br />

Other borrowed funds 19,336 652<br />

Derivatives, net (1,698) (1,968)<br />

141,441 91,407<br />

Net interest income 147,160 154,072<br />

At October 11, 2002, the equity of the <strong>Bank</strong> comprised the equity of Barclays<br />

<strong>Bahamas</strong> together with the fair value of the consideration given to acquire CIBC<br />

<strong>Bahamas</strong>. However, legally the share capital of the <strong>Bank</strong> comprised the issued share<br />

capital of CIBC <strong>Bahamas</strong> plus the shares issued to effect the combination, recorded<br />

at fair value. The reverse acquisition reserve is therefore the difference between<br />

the legally required share capital together with the retained earnings of Barclays<br />

<strong>Bahamas</strong>, and the equity of the <strong>Bank</strong> presented in accordance with IFRS.<br />

See Auditors’ Report Page 56.<br />

80